Advertisement

Redfin: Property Bidding Wars at Eight-Year Low

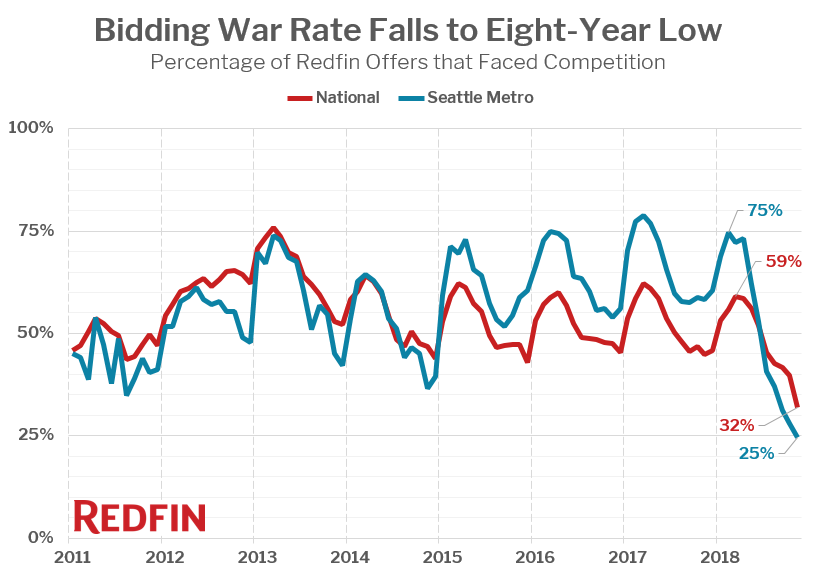

For most homebuyers, purchasing a property no longer involves diving into a bidding war.

According to new data from Redfin, 32 percent of offers written by the brokerage’s agents on behalf of their home-buying customers faced one or more competing bids in November, down from 45 percent one year earlier. This is the lowest level recorded since Refin began tracking data on offer competitions in 2011.

One of the most dramatic examples of the disappearance of bidding wars was Seattle. During the spring, Redfin reported that three out of four offers in Seattle faced competition—but as of last month, only about one of every five offers in the Seattle area faced competition, the lowest rate of Redfin's largest markets.

Philadelphia was the only metro area tracked by Redfin where buyers faced significantly more competition last month compared to November 2017. Philadelphia was also one of the markets where the housing inventory is shrinking and homes are selling faster and at higher prices.

About the author