Advertisement

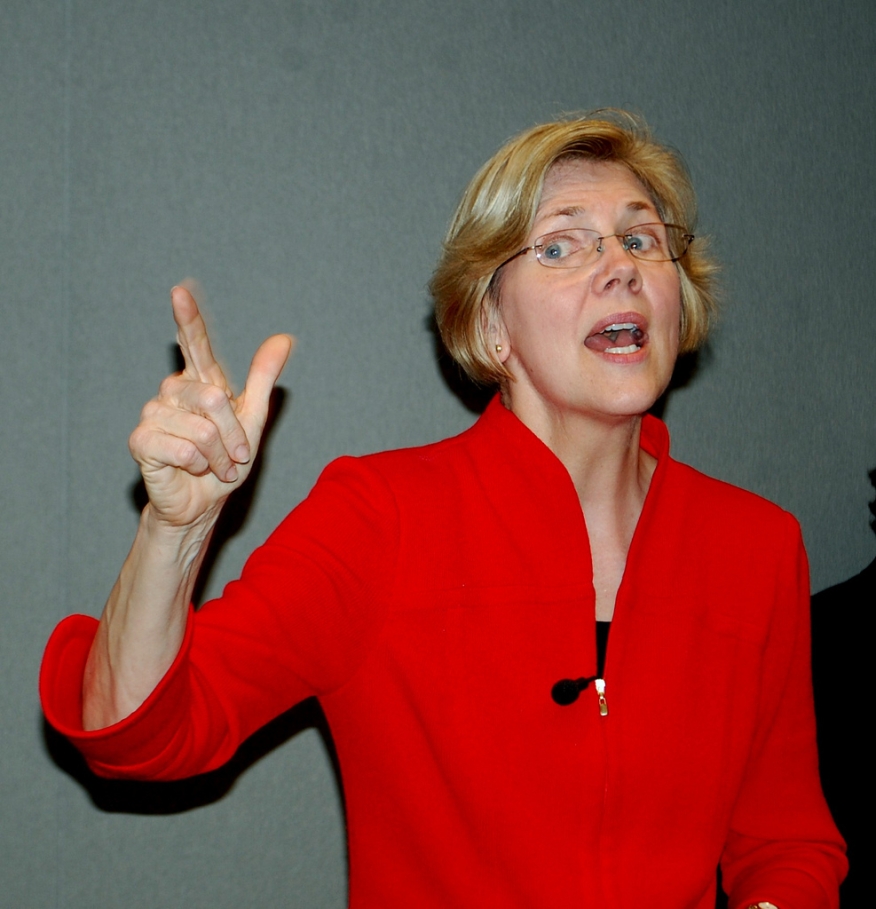

Study: Warren Student Loan Erasure Plan Could Speed Down Payment Savings Time

The presidential campaign proposal by Sen. Elizabeth Warren (D-MA) to cancel up to $50,000 of student loan debt per person would enable the typical first-time homebuyer to save for a down payment three years faster, according to an analysis by Redfin.

Redfin based its findings on a scenario with a typical potential first-time homebuyer between 24 and 44 years old earning the national average salary of $65,879 and carrying an average of $17,938 in student debt. If this individual spent 10 percent of his or her income ($549 per month) on debt repayment at the average 5.8 percent interest rate, it would take three years to pay off the student debt. If this person saved 10 percent of their income toward a 20 percent down payment on the national median-priced home ($308,000), it would take a total of 12.3 years to both pay off the student loans and save enough money for the full 20 percent down payment ($61,600), assuming home price and income did not change.

But if the Warren plan became law, Redfin determined the cancellation of up to $50,000 in student loan debt would alter the time required to save for a down payment would shrink to 9.4 years. In some markets, the savings time would be faster: Detroit’s first-time buyers with cancelled student loan debt could accumulate down payment funds in 4.2 years instead of the current 7.4 years needed for the average-priced $130,000 home.

"The idea of taking on a mortgage when you're still paying off tens of thousands of dollars in student loans is a non-starter for many people," said Redfin Chief Economist Daryl Fairweather. "If student debt were eliminated, college grads would be able to start building wealth through homeownership, laying down roots and contributing to their communities years earlier in their lives. An influx of young, educated homeowners could have positive impacts on neighborhoods and society at large."

About the author