Advertisement

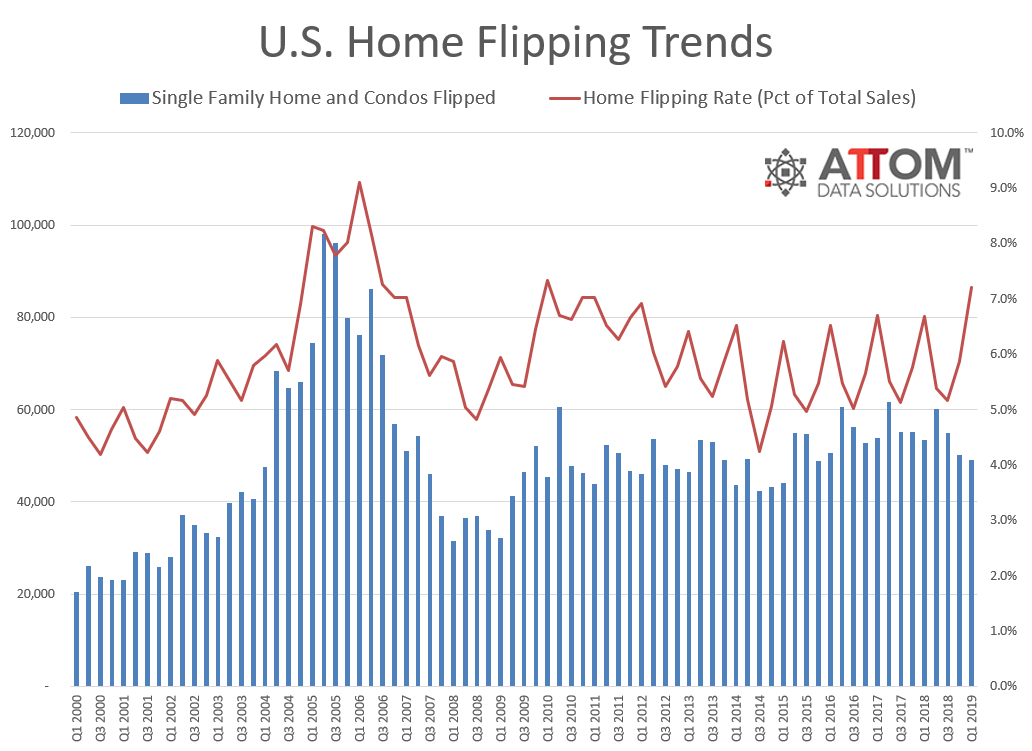

Q1 Home Flipping Rate Hits Nine-Year High

The first quarter of this year saw 49,059 single-family homes and condos flipped, according to statistics from ATTOM Data Solutions. This marks a two percent decline from the previous quarter and an eight percent drop from a year ago to a three-year low. However, the first quarter’s flipping volume represented 7.2 percent of all home sales during the quarter, up from 5.9 percent in the previous quarter and up from 6.7 percent a year ago, marking the highest home flipping rate recorded since the first quarter of 2010.

Homes flipped during the first quarter sold at an average gross profit of $60,000, down from an average gross flipping profit of $62,000 in the previous quarter and down from $68,000 in the first quarter of 2018. This marked the lowest average gross flipping profit since the first quarter of 2016. The average gross flipping profit of $60,000 in the first quarter reflected an average 38.7 percent return on investment (ROI) compared to the original acquisition price, down from a 42.5 percent average gross flipping ROI in the previous quarter and down from an average gross flipping ROI of 48.6 percent in one year earlier. This marked the lowest level since the third quarter of 2011.

The total dollar volume of financed home flip purchases was $6.4 billion for homes flipped in the first quarter, up 35 percent from $4.7 billion one year earlier to the highest level since the second quarter of 2007. Eighty-five of 138 metropolitan statistical analyzed in the report (62 percent) posted a year-over-year increase in their home flipping rate in the first quarter, most notably Columbus, Ga. (up 83 percent), Raleigh, N.C. (up 73 percent) and Charlotte, N.C. (up 65 percent).

“With interest rates dropping and home price increases starting to ease, investors may be getting out while the getting is good, before the market softens further,” said Todd Teta, chief product officer at ATTOM Data Solutions. “While the home flipping rate is increasing, gross profits and ROI are starting to weaken and the number of investors that are flipping is down 11 percent from last year. Therefore, if investors are seeing profit margins drop, they may be acting now and selling before price increases drop even more.”

About the author