Advertisement

Mortgage Applications Up, Homeowner Valuation Sharpens

More people were taking out mortgage applications as existing homeowners displayed a sharper awareness of their properties’ value, according to the latest housing market data.

For the week ending Sept. 6, the Mortgage Bankers Association’s Market Composite Index recorded a week-over-week increase of two percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index dropped nine percent compared with the previous week.

The seasonally adjusted Purchase Index increased five percent from one week earlier, but the unadjusted index fell by eight percent–although the latter was nine percent higher than the same week one year ago. The Refinance Index increased 0.4 percent from the previous week and was 169 percent higher than the same week one year ago, while the refinance share of mortgage activity decreased to 60 percent of total applications from 60.4 percent the previous week.

Among the federal programs, the FHA share of total applications decreased to 9.3 percent from 10.2 percent the week prior while the VA share of total applications increased to 11.9 percent from 11.3 percent and the USDA share of total applications decreased to 0.5 percent from 0.6 percent.

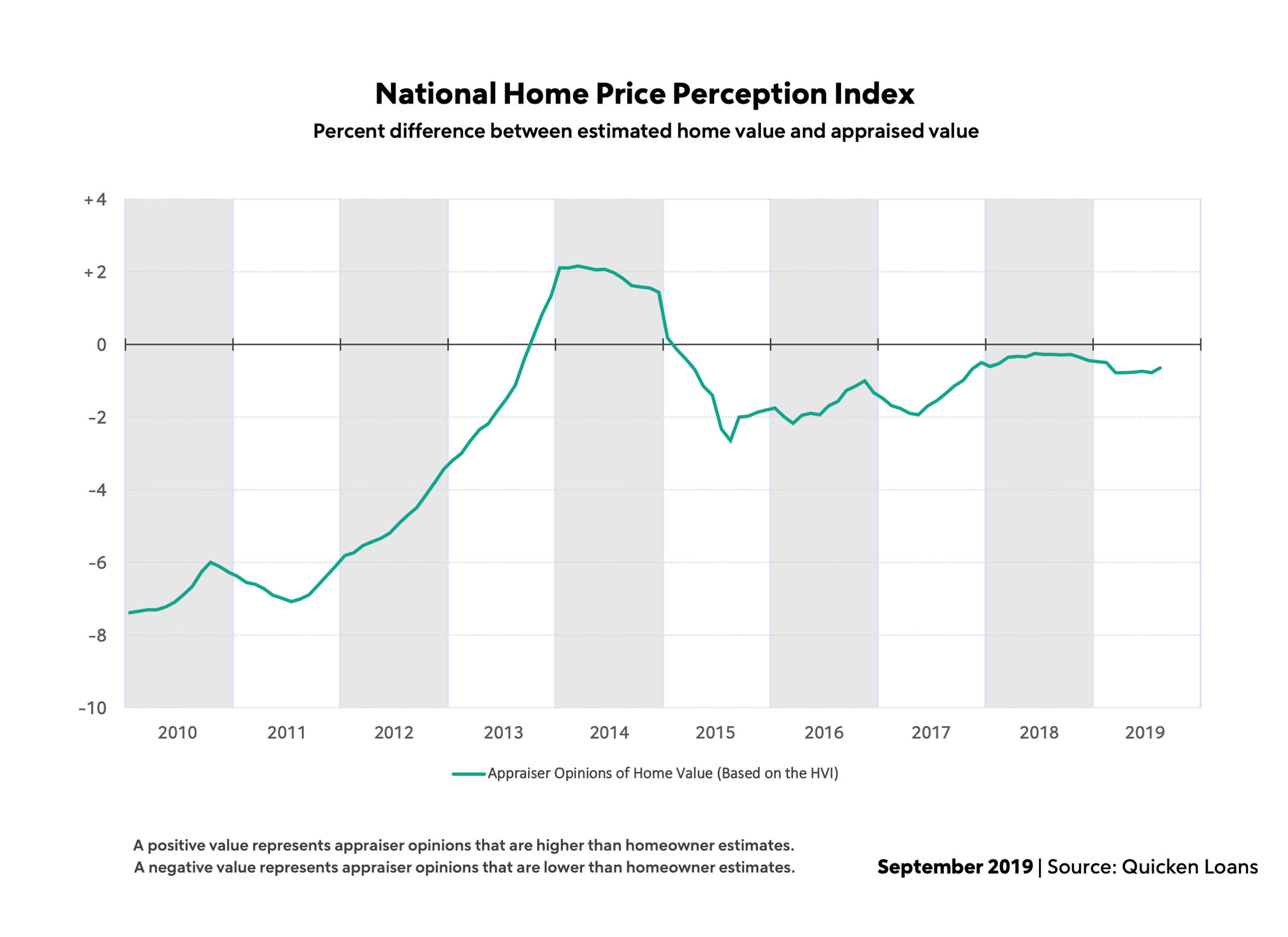

In other data news, Quicken Loans’s latest Home Price Perception Index reported the average home appraisal in August was only 0.64 percent lower than what the owner expected. Among the major metro markets, the average appraisal value was strongest in Boston at 2.05 percent higher than expected, while Chicago lagged with the average appraisal 1.77 percent lower than the homeowner’s estimate. The Quicken Loans Home Value Index, which tracks home value fluctuation based on appraisals, showed 0.95 percent growth from July to August and a 4.64 percent year-over-year increase.

“Homeowner perceptions have remained in a relatively tight band, with less than a percent gap between expectations and actual appraisal values, for the last two years,” said Bill Banfield, Quicken Loans executive vice president of capital markets. “This is a good sign that homeowners have kept their finger on the pulse of their local housing market as home values continued to rise. This is a great news for those who haven’t already tapped their growing home equity. Based on the report, they are likely to have a good estimate of their home’s value and, as a result, have a smooth process when it comes time for the appraisal in the mortgage process.”

About the author