Advertisement

Senior Housing Wealth Reaches Record $7.17T

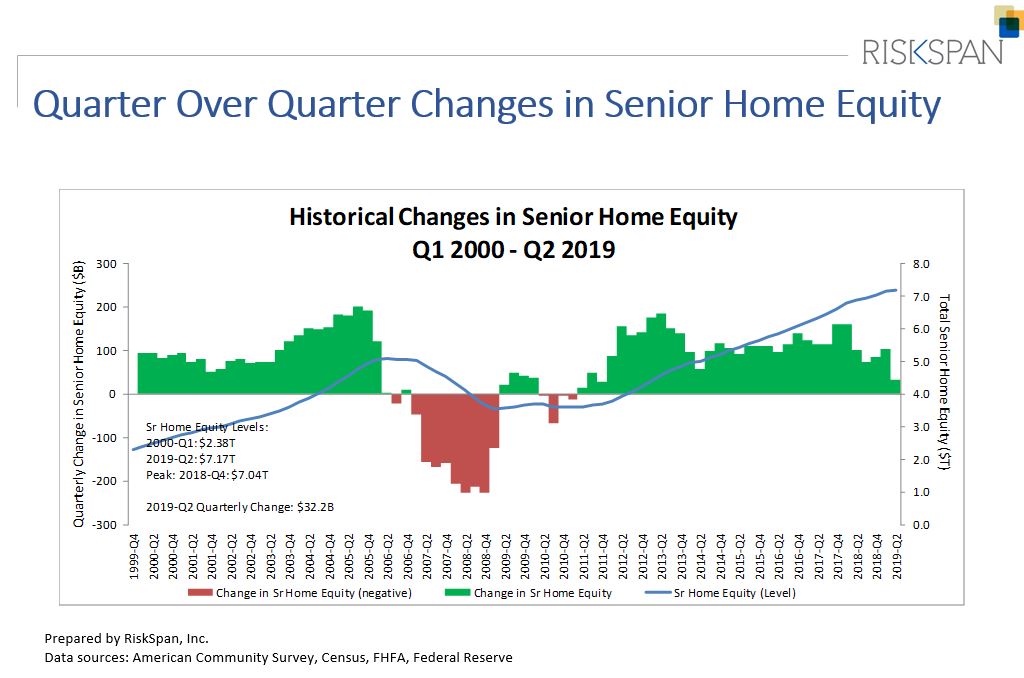

Homeowners ages 62 and older grew by $32 billion uptick in their housing wealth from the first to the second quarter, according to new data from the National Reverse Mortgage Lenders Association (NRMLA). This 0.5 percent quarter-over-quarter uptick resulted in a new record high of $7.17 trillion in senior housing wealth.

The NRMLA/RiskSpan Reverse Mortgage Market Index for the second quarter increased to 258.44, another all-time high since the index was first published in 2000. The spike in senior homeowners’ wealth was primarily attributed to an estimated 0.5 percent or $47 billion increase in senior home values, which was offset by a 0.9 percent or $14.6 billion increase of senior-held mortgage debt.

“Many retired and soon-to be-retired Americans lack the financial assets for a comfortable retirement, yet the most commonly held and valuable asset for most of them is their home,” said NRMLA’s Executive Vice President Steve Irwin. “Responsible use of home equity may be the best option that ensures they have food, medicine and other basics for a comfortable retirement.”

About the author