Advertisement

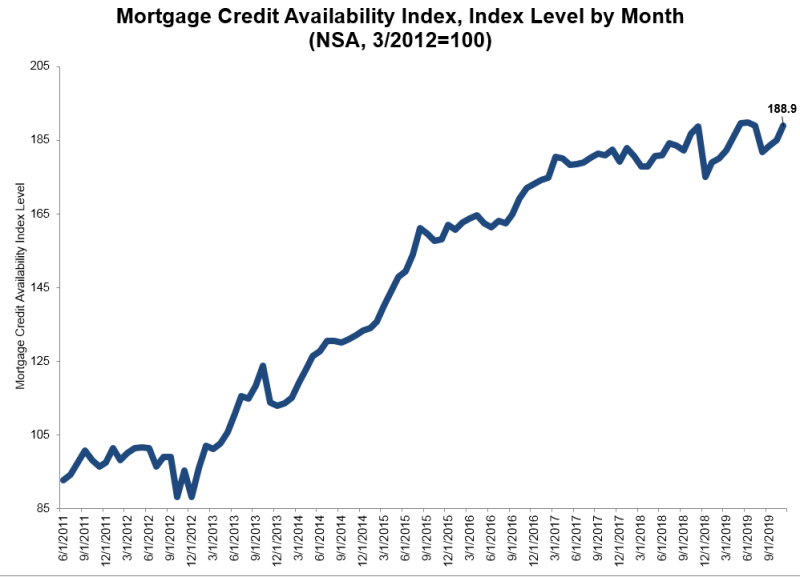

Mortgage Credit Availability Up in November

There was a greater abundance of mortgage credit to be enjoyed in November, according to the latest Mortgage Credit Availability Index (MCAI) from the Mortgage Bankers Association (MBA).

The MCAI recorded a 2.1 percent increase to 188.9 in November. The Conventional MCAI was up by 1.4 percent and its component indices, the Jumbo MCAI and Conforming MCAI were up by 2.2 percent 0.2 percent, respectively. The Government MCAI increased by 2.9 percent.

“Credit availability rose for the third straight month in November, with an increase in supply across all loan types,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting. “Most notably, the jumbo index climbed to yet another record high, as investors increased their willingness to purchase loans with lower credit scores and higher LTV ratios. Additionally, the government index saw its first increase in nine months, driven by streamline refinance programs. Expanding credit availability will continue to support active levels in mortgage lending, even as refinance activity starts to level off.”

About the author