Advertisement

Mortgage Rates Remain Unchanged Week-Over-Week

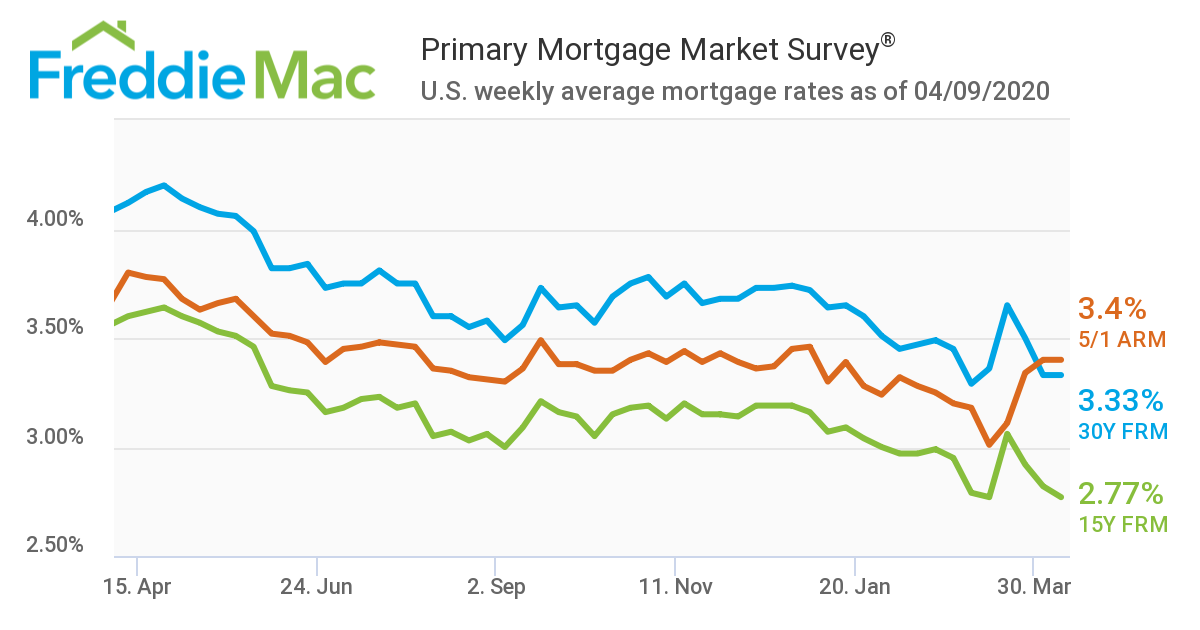

Fixed-rate mortgages (FRMs) averaged 3.33 percent for the week ending April 9, 2020, unchanged from last week’s totals, according to Freddie Mac’s Primary Mortgage Market Survey (PMMS). Last year at this time, the 30-year FRM averaged 4.12 percent.

“While mortgage rates remained flat over the last week, there is room for rates to move down,” said Sam Khater, Freddie Mac’s chief economist. “This year, the 10-year Treasury market has declined by over a full percentage point, yet mortgage rates have only declined by one-third of a point. As financial markets continue to heal, we expect mortgage rates will drift lower in the second half of 2020.”

The U.S. Department of Labor also released its weekly statistics on Thursday, which found for the week ending April 4th, initial unemployment claims was 6,606,000, a decrease of 261,000 from the previous week's revised level. Note that the previous week's level was revised up by 219,000 from 6,648,000 to 6,867,000.

“Initial claims for unemployment insurance (UI) remained at historically-unprecedented levels, coming in at 6.6 million last week,” said Doug Duncan, chief economist at Fannie Mae. “While a slight decline from last week’s upwardly revised level of 6.9 million, this figure still represents an extraordinary degree of labor market distress, with a three-week total of approximately 17 million persons filing for unemployment benefits, or more than 10 percent of the workforce. Continued claims (also referred to as insured unemployment), which represents the cumulative number of Americans claiming UI benefits, was nearly 7.5 million, surpassing the previous high set during the previous financial crisis. Continued claims is reported with a one-week lag and is expected to continue to rise. The recent surge in UI claims is a direct result of the ongoing COVID-19 outbreak (along with a contribution from the oil sector downturn) and is showing no signs of abating.”

And while the drop in unemployment numbers is a move in the right direction, record low rates during the COVID-19 pandemic are still not driving a stalled housing market, as the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey found that mortgage applications decreased 17.9 percent from one week earlier for the week ending April 3.

About the author