Advertisement

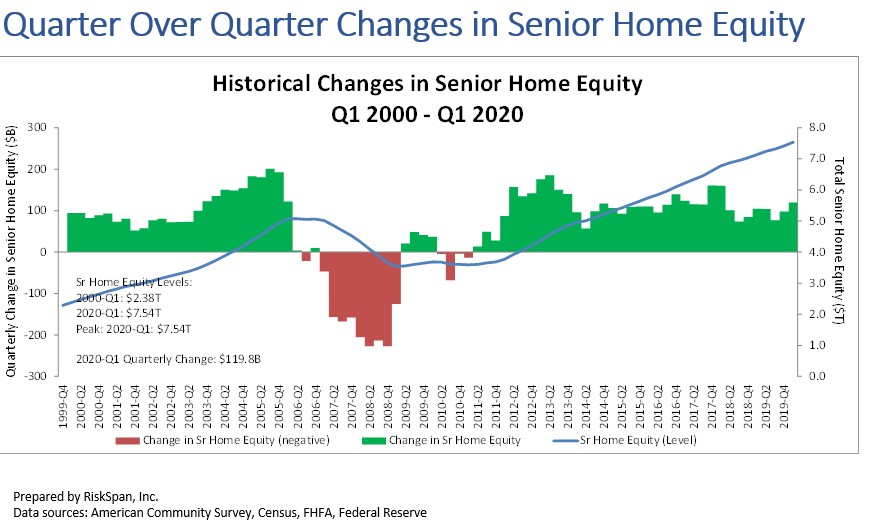

Q1 Senior Housing Wealth Hits Record $7.54 Trillion

In its quarterly NRMLA/RiskSpan Reverse Mortgage Market Index, the National Reverse Mortgage Lenders Association reports that homeowners 62 and older saw their housing wealth grow by 1.6% or $120 billion in Q1 of 2020 from Q4 2019 to a record $7.54 trillion. It is an all-time high since the index was first published in 2000.

The increase in senior homeowner's wealth was mainly driven by an estimated 1.4% or $132 billion increase in senior home values, offset by a 0.7% or $12.3 billion increase in senior-held mortgage debt.

“COVID-19 has impacted millions of families and their retirement portfolios, and a new study from the Center for Retirement Research at Boston College indicates that market shocks are a growing concern for many families whose retirement assets are in 401(k)s,” said Steve Irwin, the association's president. “The responsible use of home equity may be an option to help mitigate certain market risks and help seniors stay financially secure during future market disruptions.”

About the author