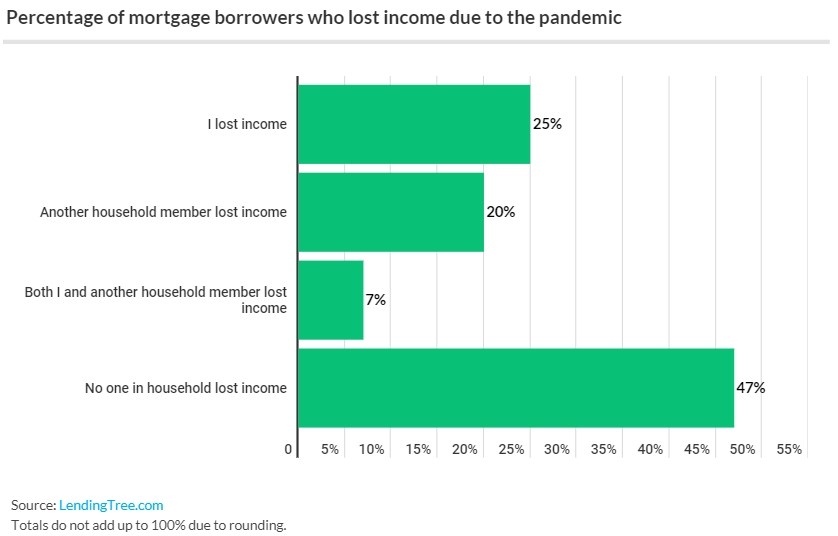

Lending Tree is out with a new report that shows 53% of mortgage borrowers in the United States have lost income during the pandemic. About 4 in 10 mortgage borrowers said they, or members in their household, have been receiving unemployment benefits.

Compounding the issue is layoffs once thought to be temporary are becoming permanent in many cases. Tendayi Kapfidze, LendingTree's chief economist, says “Unfortunately, the response to the coronavirus crisis has been very poor; many layoffs that were temporary are beginning to become permanent, and the economy is likely to remain weak well into 2021."

When broken down by age groups, 61% of millennials have lost household income, followed by 57% of Generation X and about 37% of baby boomers. Nearly half (48%) of millennial and 50% of Gen X borrowers report they or another person in their home are receiving unemployment insurance benefits. Just about 17% of baby boomer borrowers fall into this group.

Since March, the

report says when the COVID-19 outbreak began to spread widely across the United States, nearly 1 in 5 (18%) of mortgage borrowers have missed a mortgage payment. Of that group, 5% were not in a mortgage forbearance agreement with their lender, which permits a temporary reduction or suspension of monthly payments. In comparison, 82% of borrowers have continued to make payments – 22% of which are participating in a mortgage forbearance plan.

Amid the national economic turmoil caused by the coronavirus pandemic, less than one-third (30%) of mortgage borrowers have entered into a mortgage forbearance agreement. Another 12% are in the process of negotiating the terms of their mortgage assistance, while 2% of borrowers were denied forbearance help.

“The forbearance program is essential to maintaining the health of the housing market and supporting the economy,” said Kapfidze. “Without it, millions of people would be at risk of losing their homes.”

Of the 30% of borrowers in forbearance, more than 4 in 10 (44%) have an annual household income of at least $100,000, which is more than any other income bracket. About 7% of borrowers earning less than $25,000 in income applied for mortgage relief but were denied. This is the highest denial rate among all income brackets.