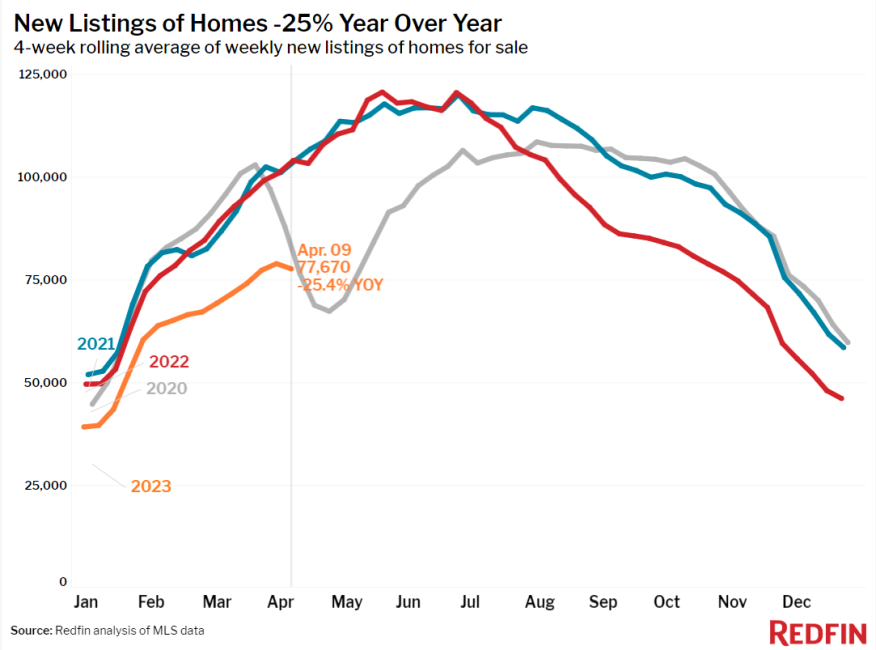

For 8th Straight Month, New Listings Drop By Double Digits

Redfin said the 25% decline for the four weeks ended April 9 was the biggest since the start of the pandemic.

New listings of U.S. homes for sale dropped 25% from a year earlier during the four weeks ended April 9, continuing an eight-month streak of double-digit declines, according to a report from Redfin.

The technology-powered real estate brokerage said the 25% decline was the biggest since the start of the pandemic. However, it noted there was a holiday weekend effect, as Easter fell a week earlier this year than last, making the new-listings decline larger than it would have been if Easter had fallen during last year’s comparison period.

The reluctance to sell homes is due primarily to homeowners not wanting to give up their low mortgage rates, Redfin said, adding that it’s also hard to find another home to buy.

Angela Langone, a Redfin agent in San Jose, stated that "many buyers here aren’t held back by high mortgage rates; it’s the lack of inventory that’s really getting in their way. I have several clients who are serious about buying a home and they’re actively looking, but they can’t find anything right now and they’re waiting for more homes to trickle onto the market.”

Buyers in other parts of the country have more options, Redfin said. Listings are not a major concern in some cities, such as Nashville, Tenn. “Inventory isn't a major problem here because the greater Nashville area is so sprawling, and there are a lot of newly built homes on the market in the suburbs,” said Nashville Redfin agent Jennifer Bowers.

The report shows that the median U.S. home-sale price fell 2.3% year over year to roughly $364,000, the biggest decline in more than a decade. Prices fell significantly more than that in some metros, but rose in others. Home-sale prices dropped in more than half (29) of the 50 most populous U.S. metros. Sale prices increased most in Fort Lauderdale, Fla., where they rose 11.6% year over year.

The scarcity of homes hitting the market, along with elevated mortgage rates, is holding back sales, the report states. Pending home sales dropped more than 30% in each of the major metros in California, with the biggest declines being in Sacramento and Oakland (-47% YoY apiece), San Francisco (-43.2%), San Jose (-42.9%), and San Diego (-41.4%). However, early-stage homebuying demand is ticking up, with mortgage-purchase applications up 8% from a week earlier, seasonally adjusted.

Two new pieces of economic data serve as “tea leaves” to anticipate how mortgage rates will trend over the next few months, the report states, adding it’s unlikely they’ll skyrocket, but it’s also unlikely they’ll come down enough to motivate locked-in homeowners to sell.

The March consumer price index and jobs reports showed that inflation continued to cool and wage growth ticked down from the month before, but inflation is still higher than the Fed’s target.

“The Fed has made some progress cooling inflation with rate hikes but there’s still work to be done,” said Redfin Chief Economist Daryl Fairweather. “Even if the Fed chooses not to hike interest rates next month, which would likely bring down mortgage rates, the limited supply of homes for sale would remain a major obstacle for would-be buyers. Rates dipping below 6% would probably pique the interest of more buyers, but enough homeowners have rates in the 3% or 4% range that we’re unlikely to see a big uptick in new listings.”

Leading Indicators Of Homebuying:

- For the week ended April 13, average 30-year fixed mortgage rates dropped to 6.27%, the fifth straight week of declines, though it only ticked down slightly from the week before. The daily average was 6.42% on April 12.

- Mortgage-purchase applications during the week ending April 7 increased 8% from a week earlier, seasonally adjusted. Purchase applications were down 31% from a year earlier.

- The seasonally adjusted Redfin Homebuyer Demand Index — a measure of request for home tours and other homebuying services from Redfin agents —d ropped slightly from the 10-month high hit a week earlier during the week ending April 9. It was up 6% from a month earlier, but down 21% from a year earlier.

- Google searches for “homes for sale” were up about 40% from the trough they hit in November during the week ending April 8, but down about 18% from a year earlier.

- Touring activity as of April 8 was up about 13% from the start of the year, compared with a 26% increase at the same time last year, according to home tour technology company ShowingTime.