Why the usual boom turned into a bust and how lenders can rally for a strong finish to 2023.

SPONSORED CONTENT

We know that most of the loan originators look forward to the spring homebuying season with great anticipation. Traditionally, this has been when most consumers return to the market to make their home purchase decisions, which leads them in search of mortgage financing.

That’s how it traditionally happens. But this year, not so much.

From the conversations we’ve been hearing around the industry, the first half was…not great.

In this article, we’ll talk about why. We went deeper into this topic in a recent NMP webinar.

We won’t spend all our time on the bad news. After all, you can’t move forward by looking in the rearview mirror. Plus, it’s just news, and there are elements of this market you can use to differentiate you and your lender. Read on.

What went wrong this spring?

Have you ever thrown a party and no one came? That pretty much describes this year’s spring homebuying season. Whether it was the rising interest rates, the lack of suitable inventory to meet prospective buyers’ needs or just the fear that sellers would not make enough on a sale, consumers simply didn’t show up this season. At least not like they have in the past.

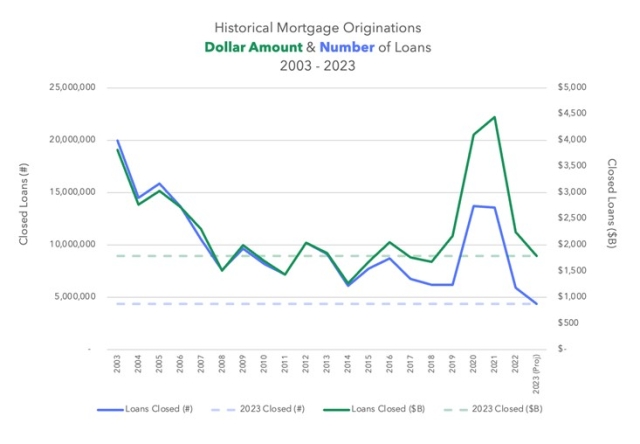

The Mortgage Bankers Association recently reduced its annual mortgage volume forecast again. Lenders who have been in the business for more than a year or two have watched loan volume fall from $4.4 trillion worth of loans in 2020 and 2021 to a new projected total of only $1.79 trillion for this year.

There’s no doubt that there will be far fewer loans up for grabs this year. But since we’re a data science company, let’s look at the numbers.

The blue line in the graph below shows the projected number of loans that will close in 2023 in comparison to closings across all years. The horizontal tail points back to the number. While not the lowest in terms of dollar amount of loans closed (the orange line), this year will see the lowest number of loans closed, at least for the last 20 years or so.

But that’s not the only thing that stood against the industry this spring. The cost to close a mortgage is now nearing $13,000 per loan. It’s at an all-time high. This has helped push profit per loan down to about nothing.

That would be bad enough if lenders were still originating fairly simple refinance loans, but the purchase share of originations is also at an all-time high, at about 88%. This means it’s taking longer and costing more to originate every loan.

Add to this a difficult regulatory environment -- which some estimate contributes more than 20% of the cost-to-close -- and it all adds up to a first half that most lenders would rather forget.

Here’s how to have a better second half of 2023.

To come out of this year with any chance of leading the industry into 2024, lenders are going to have to do better in the second half. This might be tough, given that the best months for real estate sales are now behind us. But again, what’s behind us is of no consequence.

And it’s far from hopeless. There are things any lender can do to make their second half better.

The first thing is pull your focus away from the microeconomic data (changes from week to week) and pull back to see a larger view of the industry. Only then can the longer-range trends be seen. This is information that can be used to set strategy.

When the lender stops trying to react to every weekly change the trade press showcases in its coverage, it frees the lender up to start looking at what parts of the market they actually can influence.

There is no Hogwartian solution to creating more inventory or getting mortgage interest rates to come down, and you can’t influence any deal that you don’t already have in your pipeline. All you can do is try to close every deal that comes through your doors.

But to do that, you’re going to have to beat out the other two or more lenders the average mortgage loan applicant will contact when they need a new loan.

This means that lenders need to find a way to close every deal they see.

How to help borrowers help themselves to a better deal.

The best way to keep the applicants in your pipeline from running to a competitor is to offer them a better deal. In the past, the way the industry did that was by lowering their credit standards.

There is a better way lenders can help borrowers get a better deal without increasing their risk. Walk into any underwriting department and everyone in the room will understand the three C’s of credit underwriting. Of these, the most important are arguably the consumer’s Collateral, Capacity, and Credit History.

The lender can’t do anything about the value of the collateral the mortgage loan applicant brings to the table. Nor can they do anything about the consumer’s current job or salary, amount of cash reserves they bring to the table or their current debt load, which together determine their capacity to repay.

The only thing the lender can influence in the short run is the consumer’s credit score. And therein lies the key to helping them get a better deal.

Our data, gleaned from the millions of credit inquiries that run through our platform each month, shows that roughly two-thirds of consumers can improve their credit scores by at least one 20-point bucket in about 30 days just by taking a few steps we outline in our reports.

When presented with a report that will get them a better deal on their new loan, our research shows that about 70% of applicants will follow through and raise their scores.

This makes a huge difference in terms of the deal lenders can offer these borrowers. And that’s a huge competitive advantage for the lenders that use this Credit First strategy and help their borrowers increase their scores.

In the recent NMP Webinar, which you can find and view on demand here, we go into much greater detail. Feel free to also reach out to us and see a short demo that will show you exactly how it works.

The lenders that act on this now will be the ones that see a much better second half in 2023.

SPONSORED CONTENT