Asian, Black & Hispanic-White Borrowers Increase Share Of Home Purchases

CFPB report also reveals the official end to the refinance boom and shift to home purchase loans in 2021.

- Black borrowers’ share of home purchase loans increased from 7.3% in 2020 to 7.9% in 2021.

- Hispanic-white borrowers saw their share of home purchase loans increase from 9.1% to 9.2%; Asian borrowers’ share increased to 7.1%.

- The increase in mortgage originations was driven by home purchase loans, as refinance loans fell.

- Most of the origination increases from 2020 to 2021 were due to jumbo home purchase loans.

The Consumer Financial Protection Bureau (CFPB) released its annual report on residential mortgage lending activity and trends for 2021, including data submitted by thousands of the nation’s lending institutions under the Home Mortgage Disclosure Act (HMDA).

The report reveals the official end to the refinance boom and shows a shift to home purchase loans in 2021.

One of the key takeaways from the report is that a greater share of home-purchase loans are going to Asian, Black, and Hispanic-white borrowers relative to the share of home purchase loans for non-Hispanic white borrowers. The top 25 closed-end lenders by loan volume held nearly half of the market share of residential mortgage lending — a trend that has risen each year since 2018.

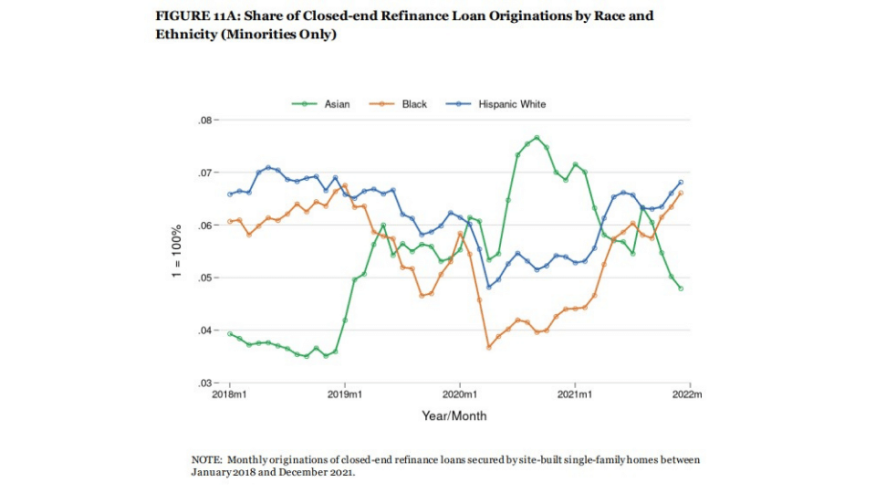

The increase in mortgage originations was driven by home-purchase loans, as refinance loans fell. Closed-end mortgage originations, excluding reverse mortgages, shot up 2.4% from 13.4 million in 2020 to 13.7 million in 2021. While the 66.8% increase in originations from 2019 to 2020 was largely driven by refinances, most of the increases from 2020 to 2021 were due to jumbo home-purchase loans. Non-cash-out refinance loans began declining after its peak in March 2021.

The number of mortgage lending institutions reporting on HMA data dropped in 2021 — down 3.1% from 2020. At least one closed-end mortgage loan had been reported by 4,332 financial institutions compared to 4,472 financial institutions in 2020. The top 25 closed-end lenders by loan volume held a combined market share of 43.9%, which has risen yearly since 2018. The top 25 by loan volume were prominent in the refinance market, accounting for 53% of all refinance loans.

Asian, Black, and Hispanic-white borrowers increased their share of home purchases from 2020 to 2021. Black borrowers’ share of home purchase loans increased from 7.3% in 2020 to 7.9% in 2021. Hispanic white borrowers saw their share of home purchase loans increase from 9.1% to 9.2% and Asian borrowers’ share increased from 5.5% in 2020 to 7.1% in 2021. Non-Hispanic white borrowers’ home purchase loans fell from 59.1% to 55.6% during the same time period.

Black and Hispanic-white borrowers, overall, continued to qualify for lower median loan amounts, had lower median credit scores, and had higher denial rates compared to non-Hispanic white and Asian borrowers. Also, Black and Hispanic white borrowers paid higher median interest rates and higher total loan costs overall.