The digital mortgage company goes public.

Digital mortgage lender Better.com's plans to combine with Aurora Acquisition Corp. through a SPAC (special purpose acquisition) has received shareholder approval, the company announced.

According to a filing with the Securities and Exchange Commission, Better.com will combine with Aurora, or go public, "on or about August 22, 2023."

"At least 65% of the outstanding ordinary shares of the company entitled to vote at this meeting have voted in favor of (the) proposal," Arnaud Massenet, CEO of Aurora Acquisition Corp, said during a shareholder's meeting.

Once the transaction closes, the newly combined entity will receive an infusion of at least $550 million in new capital from SoftBank, as noted in Aurora's filing with the SEC in July. An additional $200 million might be received if Novator, an investment firm that sponsors Aurora, exercises its $100 million option, in which case SoftBank would be required to match the amount. In late November 2021, Aurora Acquisition Corp. and SoftBank modified their financing agreement to provide Better with half of the $1.5 billion they committed without waiting for the deal to close.

Better.com initially made plans to go public via a $6 billion SPAC in May 2021. The deal was later valued at $7.7 billion but faced delays amid numerous challenges for the company, including layoffs, high-profile executive departures, a housing market slowdown, and negative publicity. Industry observers had expressed doubt about the company's ability to materialize its public debut plans.

In late July, Aurora mentioned in an SEC filing that shareholders would vote on a proposal to change Aurora's name to "Better Home & Finance Holding Company" if the SPAC merger occurred, with Aurora surviving the merger.

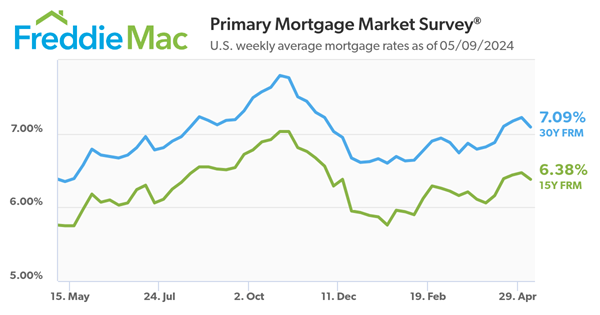

Last year, Better.com asserted its intention to go forward with its planned public debut, notwithstanding the poor performance of blank-check combinations in previous quarters. Better.com has faced turbulence since announcing its merger with a SPAC, including multiple layoffs and changing market conditions that affected parts of its business, including a rise in mortgage interest rates. In a meeting regarding layoffs, CEO Vishal Garg was recorded saying the company had "probably pissed away $200 million."

The SEC had conducted an investigation to determine if violations of federal securities laws occurred but eventually stated it did not intend to recommend enforcement action against Better.com. It also faced an investor lawsuit.

The struggling fintech startup laid off its real estate team on June 7, shifting to a partnership agent model, and continues to face financial challenges.

Other Aurora filings from July reveal that Better.com posted a net loss of $89.9 million in Q1 2023 and had cut about 91% of its workforce over roughly an 18-month period. Despite narrowing its loss compared to a net loss of $327.7 million in the first quarter of 2022, the company is still clearly struggling.