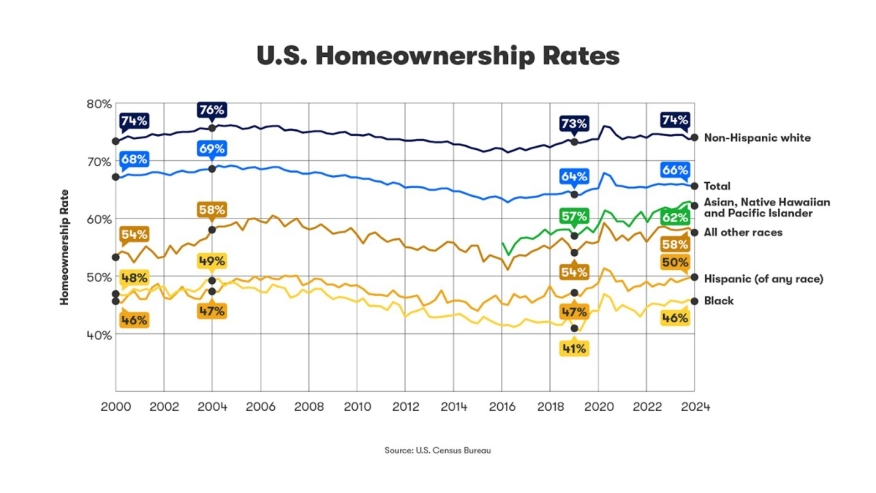

Black Homeownership Rate Increases But Remains Below 2004 Level

Nearly one in four Black mortgage applicants are denied, versus one in 10 white applicants.

- Zillow says if the typical home was worth $1, Black-owned homes would be worth 85 cents and white-owned homes worth $1.03.

The homeownership rate for Black households has grown faster than average since 2019, but it's still below the high-water mark reached in 2004, before the Great Recession. That's according to a report from Zillow.

Insufficient credit is holding many Black households back from homeownership. Nearly one in four mortgage applications from Black borrowers — 24% — are denied, according to 2023 Home Mortgage Disclosure Act data.

Zillow noted that's almost twice the rate of all applicants (12.6%) and far higher than the one-in-10 denial rate for white applicants. More than 43% of Black mortgage applicants are turned down due to credit history – the most common reason given. That's compared to 32% of denials for white applicants.

"While discriminatory policies like redlining have long been outlawed, the damage from these historic practices is still felt today. Many communities once barred from accessing credit are now finance deserts, with few traditional financial institutions, making it harder to build credit and buy a house," said Zillow senior economist Orphe Divounguy. "That's why it's so important to expand credit access. Allowing rent payments to count in credit scores is one example of how to move the industry forward."

Nearly 46% of Black households own their home, which is up from 43% in 2019, but still down from a 49.7% peak ownership rate reached in 2004, before the Great Recession, and far off from the 74% rate for white households. Since the Black homeownership rate peaked in 2004, U.S. home values have more than doubled, rising 117%.

The single largest asset for most homeowners is their house, and it's a major means of building wealth and passing it on to the next generation. Zillow Research found a $3 trillion wealth gap between Black and white families. Nearly 40% of the gap — $1.18 trillion — could be credited to disparities in home values and ownership.

Despite rising faster than average since 2019, Black-owned home values are still far lower than average. If the typical home was worth $1, Black-owned homes would be worth 85 cents and white-owned homes worth $1.03, according to Zillow.