Black Knight: Mortgage Rate Locks Edged Lower In June

Purchase lending accounted for 88.4% of rate locks in June, a record high.

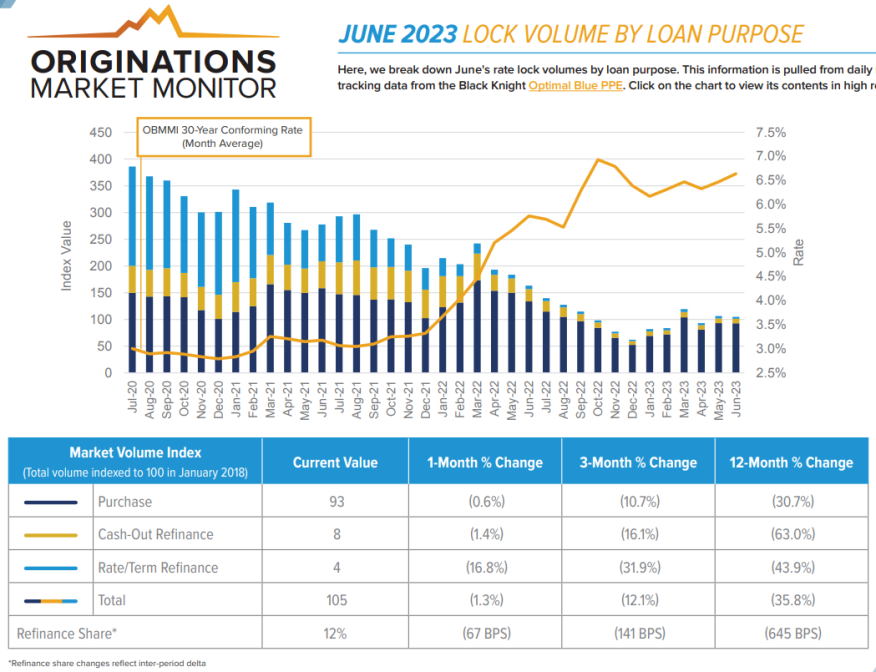

- Overall rate lock volumes were down 1% month over month in June.

- Purchase lock counts were down 31% year over year.

- The average purchase price rose for the seventh consecutive month to $457,000.

- At 735, the average credit score among purchase locks hit a record high in June.

If you’re a loan originator who has recently refinanced a client’s mortgage, consider yourself lucky. There just aren’t many refi opportunities around.

That’s according to Black Knight Inc., which released its June 2023 Originations Market Monitor Report on Wednesday. The report showed that purchase lending accounted for 88.4% of rate locks in June, a record high. The refi share of lock volume dipped to 11.6%, a new low.

Even with the percentage of purchase locks increasing to record levels, purchase lock counts were still down 31% in June from a year earlier, and down 29% from pre-pandemic levels in 2019, Black Knight said. Conforming loans gained share mainly at the expense of non-conforming loan products.

In fact, overall rate lock volumes in June fell 1% from May, as the Optimal Blue Mortgage Market Indices (OBMMI) showed 30-year conforming rates rose 6 basis points in June to 6.78%.

Overall, lock volumes were down 12% over the last three months, 36% below last year’s levels. Purchase lock volumes were down 11% from the end of March, the report said.

Cash-out refinances have fallen 16% over the past three months and in June were 63% below a year earlier. Rate/term refinances decreased 32% over the three-month period and 44% from the same month in 2022.

“Purchase loans continue to claim a larger share of a shrinking origination pipeline, as refinance opportunities remain scarce,” said Andy Walden, vice president of enterprise research and strategy at Black Knight. “Indeed, we saw the purchase lending share of June’s locks hit another all-time high. But keep in mind: it is a dominant share of a very constrained market.”

Still, in a few select metropolitan statistical areas, refis made up 15% or more of the loan origination volume, the report showed. Those included the Los Angeles-Long Beach-Anaheim, Calif., metro area (20%); the Atlanta-Sandy Springs-Roswell, Ga., metro area (15%); and the Miami-Fort Lauderdale-West Palm Beach, Fla., metro area (15%).

Walden also noted that banks in June seemed to lose their appetite for jumbo loans. “While the OBMMI 30-year conforming index rose 6 basis points over the month, the jumbo rate index was up by three times that level,” he said. The jumbo rate rose 18 basis points to 6.99%.

“As we noted in our most recent Mortgage Monitor report, the housing market has been reheating as we approach the traditional tail end of the homebuying season,” he continued. “What’s clear is that continued economic uncertainty, tightening credit, and affordability concerns have all helped to skew the market toward higher-credit borrowers.”

Walden noted that the average credit score among purchase locks hit a record high in June at 735, with the average credit score among rate/term refinances jumping 7 points in the month.

At the same time, he said, the average purchase price rose for the seventh straight month (to $457,000), while the average loan amount remained flat (at $360,000), which he said, “suggests lower loan-to-value ratios as well.”

The report said credit quality of conforming, FHA, and VA borrowers improved slightly in June, suggesting a tightening of credit standards in an uncertain economy.