Black Knight: Past-Due Mortgages Fall To 3rd-Straight Record Low In May

Company’s “first look” finds serious delinquencies, foreclosure starts showing continued improvement.

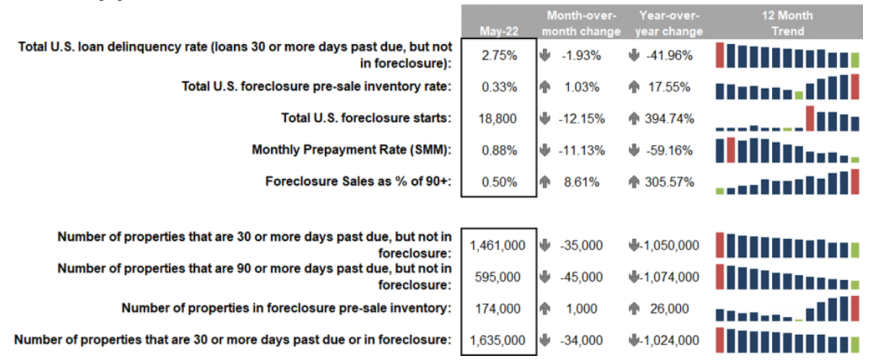

- The national delinquency rate fell 5 basis points from April to 2.75% in May, the third straight decline and a record low.

- Early-stage delinquencies edged slightly higher (+0.2%) in May from a month earlier.

- Serious delinquencies fell 7% from April, but the number of loans 90 days or more past due remains 45% above pre-pandemic levels.

For the third straight month, the U.S. mortgage delinquency rate fell to yet another record low in May.

According to Black Knight's "first look" at May 2022 month-end mortgage performance data, the national delinquency rate fell another 5 basis points to 2.75%, with overall delinquencies now down 42% from this time last year.

The month did see a slight seasonal uptick (+0.2%) in early-stage delinquencies (borrowers who’ve missed a single payment), the data and analytics company said.

Meanwhile, serious delinquencies — mortgages that are 90 or more days past due but not yet in foreclosure — saw strong improvement, falling another 7% from April. But even after 21 consecutive months of improvement, the population of seriously delinquent homeowners is still 45% higher than it was prior to the pandemic, Black Knight said.

Despite the elevated levels of serious delinquencies, foreclosure starts fell 12% from April and, at just under 19,000 for the month, continue to hold well below pre-pandemic levels. Similarly, while the number of loans in active foreclosure rose marginally (+1,000), this population also remains well below pre-pandemic norms.

Finally, prepayment activity fell again as mortgage rates continued to climb, with prepays in May down 11.1% from April and down 59.1% from last year.

Black Knight will provide a more in-depth review of the data in its monthly Mortgage Monitor report, which includes an analysis of data supplemented by detailed charts and graphs that reflect trend and point-in-time observations. The Mortgage Monitor report will be available by July 6, 2022.