Black Knight: Rate Lock Volume Rises In January

Increase was first since March 2022, ending nine consecutive months of declines.

After falling for nine straight months and hitting the lowest level in five years in December, mortgage origination activity rose in January, according to a monthly report from Black Knight.

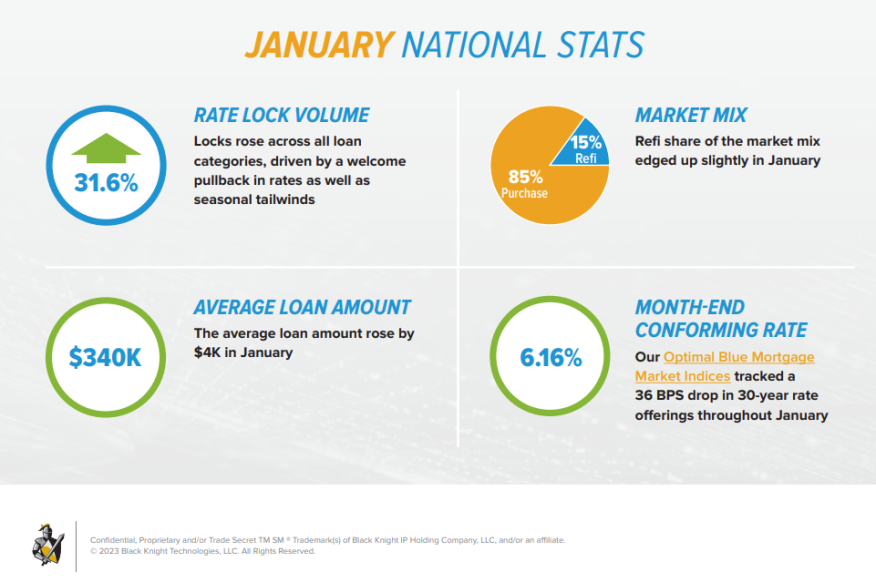

According to Black Knight’s Originations Market Monitor for January, rate lock volumes rose 32%, driven by declining mortgage rates and seasonal tailwinds. It was the first increase in rate lock volumes in 10 months.

“Mortgage rates declined in January, continuing a trend that began in early November 2022,” said Kevin McMahon, president of Optimal Blue, a division of Black Knight. “Conforming rates dropped 36 basis points from where they were at the start of the year, and we saw that rates associated with those FHA/VA/jumbo locks all came down in kind.”

Because of the rate pullback, he continued, “rate lock volumes rose for the first time since March 2022,” snapping a nine-month streak of declines.

The increase in rate lock volume from December was seen across the board, Black Knight said, as purchase volume rose 32%, rate/term volume rose 37%, and cash-out volume increased 25%.

The report notes that despite January’s improvement in rate lock volume, rate and affordability pressures continue to challenge purchase lending, with the dollar volume of such locks down 44% year over year and 14% below January 2020 levels.

In addition, the combined refinance locks accounted for 15% of the month’s activity, still historically low and an indication of the lack of incentive to refinance in the current market, the report said.

On a geographical level, the largest 20 metropolitan statistical areas (MSAs) by lock volume all saw double-digit growth, with Chicago; Nashville, Tenn.; and Charlotte, N.C., producing 50% month-over-month gains from December, Black Knight said.

“While this month’s Originations Market Monitor certainly brings welcome news, it’s important to remember that we would have expected to see a seasonal rebound in January, regardless,” McMahon said. “Mortgage originations continue to face significant rate, affordability, and inventory headwinds, and lock volumes are still down more than 60% from the comparable period last year. With rates picking back up in early February, it will be interesting to see whether the rebound in lock activity will hold.”

Other key report highlights:

- Optimal Blue Mortgage Market Indices showed 30-year rates dropping 36 basis points to 6.16%, continuing a downward trend that began in November 2022

- Nonconforming loans — including jumbos and expanded guidelines — fell as a percentage of total volumes to just under 10%; conforming (58.5%), FHA (18.5%) and VA (12.4%) all picked up share.

- The adjustable-rate mortgage (ARM) share of lending dropped further in January to just above 8% of total locks, as lower rates pushed borrowers back toward fixed-rate offerings.

- The average loan amount rose from $336,000 in December to $340,000 in January, while the average purchase price climbed from $419,000 to $421,000.

- Credit scores fell 4 points among cash-out refis — now down 36 points over the past 12 months — and 9 points for rate/terms, but remained relatively unchanged (+1 point) for purchase transactions.

Each month’s Originations Market Monitor provides origination metrics for the U.S. and the top 20 metropolitan statistical areas by share of total origination volume.

Black Knight Inc. is a software, data, and analytics company for the mortgage lending, servicing, and real estate industries, as well as the capital and secondary markets.