Confidence In Housing Market Remains Near All-Time Low

Fannie Mae survey finds a large majority of consumers believe it's a bad time to buy a home.

- The percentage of respondents who say it is a good time to buy a home remained unchanged at 20%.

- The percentage who say it is a bad time to buy remained unchanged at 79%.

- The percentage of respondents who say it is a good time to sell a home increased from 54% to 58%.

Fannie Mae’s monthly look at how consumers feel about the housing market showed signs of improvement in March, but it essentially had nowhere to go but up.

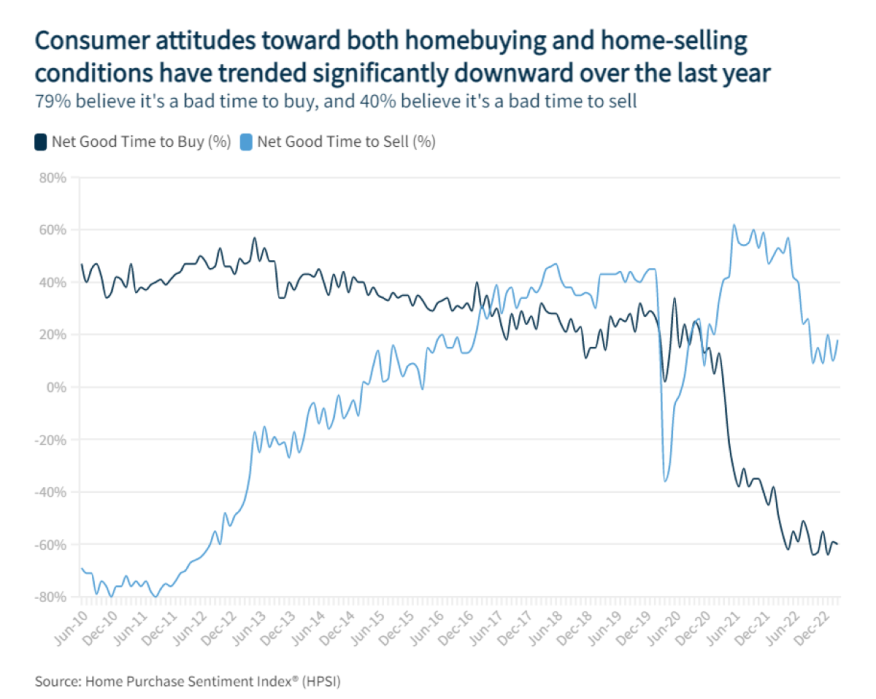

The Fannie Mae Home Purchase Sentiment Index (HPSI) increased 3.3 points in March to 61.3, but it remained only slightly above the all-time low set late last year.

Overall, four of the HPSI’s six components increased month over month, most notably those associated with home-selling conditions and consumers’ sense of job security. While the former component remains slightly positive on net, in March 40% of consumers reported that it’s a bad time to sell a home, down from 44% last month, and 21% expressed concern about losing their job in the next 12 months, down from 24% last month.

Year over year, the full index is down 11.9 points.

Mark Palim, Fannie Mae vice president and deputy chief economist, noted that despite the arrival of the typically strong spring homebuying season, buyers remain skeptical.

“A large majority of consumers continue to believe that it’s a bad time to buy a home,” he said. “Homeowners sharing this belief frequently cited ‘unfavorable mortgage rates’ as the primary reason for their pessimism, further corroborating the often-discussed disincentive — or ‘lock-in effect’ — that many mortgage holders who may be considering moving have toward giving up their lower rates.”

By contrast, he said, “surveyed renters once again indicated that high home prices are their primary concern for buying a home.”

The survey also found consumers apprehensive about the direction of home prices, Palim noted.

“In March, there was an even split among respondents who said home prices over the next 12 months will go up compared to those who expect them to go down,” he said. “With affordability constraints, the lock-in effect, and home price direction uncertainty weighing heavily on consumers’ minds, we maintain our forecast that total home sales for the year will remain subdued.”

HPSI Highlights

- Good/Bad Time to Buy: The percentage of respondents who say it is a good time to buy a home remained unchanged at 20%, while the percentage who say it is a bad time to buy remained unchanged at 79%. As a result, the net share of those who say it is a good time to buy decreased 1 percentage point month over month (due to rounding).

- Good/Bad Time to Sell: The percentage of respondents who say it is a good time to sell a home increased from 54% to 58%, while the percentage who say it’s a bad time to sell decreased from 44% to 40%. As a result, the net share of those who say it is a good time to sell increased 8 percentage points month over month.

- Home Price Expectations: The percentage of respondents who say home prices will go up in the next 12 months increased from 30% to 32%, while the percentage who say home prices will go down decreased from 35% to 31%. The share who think home prices will stay the same increased from 33% to 35%. As a result, the net share of those who say home prices will go up increased 4 percentage points month over month.

- Mortgage Rate Expectations: The percentage of respondents who say mortgage rates will go down in the next 12 months decreased from 15% to 12%, while the percentage who expect mortgage rates to go up decreased from 55% to 51%. The share who think mortgage rates will stay the same increased from 28% to 34%. As a result, the net share of those who say mortgage rates will go down over the next 12 months increased 1 percentage point month over month.

- Job Loss Concern: The percentage of respondents who say they are not concerned about losing their job in the next 12 months increased from 73% to 78%, while the percentage who say they are concerned decreased from 24% to 21%. As a result, the net share of those who say they are not concerned about losing their job increased 7 percentage points month over month.

- Household Income: The percentage of respondents who say their household income is significantly higher than it was 12 months ago decreased from 22% to 20%, while the percentage who say their household income is significantly lower decreased from 12% to 11%. The percentage who say their household income is about the same increased from 63% to 68%. As a result, the net share of those who say their household income is significantly higher than it was 12 months ago decreased 2 percentage points month over month.

Methodology

The Home Purchase Sentiment Index (HPSI) distills information about consumers’ home purchase sentiment from Fannie Mae’s National Housing Survey (NHS) into a single number. The HPSI reflects consumers’ current views and forward-looking expectations of housing market conditions and complements existing data sources to inform housing-related analysis and decision making.

The HPSI is constructed from answers to six NHS questions that solicit consumers’ evaluations of housing market conditions and address topics related to their home purchase decisions. The questions ask consumers whether they think that it is a good or bad time to buy or to sell a house, what direction they expect home prices and mortgage interest rates to move, how concerned they are about losing their jobs, and whether their incomes are higher than they were a year earlier.

The NHS is a monthly attitudinal survey, launched in 2010, which polls the adult general population of the United States to assess their attitudes toward owning and renting a home, purchase and rental prices, household finances, and overall confidence in the economy. Each respondent is asked more than 100 questions, making the NHS one of the most detailed attitudinal longitudinal surveys of its kind, to track attitudinal shifts, six of which are used to construct the HPSI (findings are compared with the same survey conducted monthly beginning June 2010).

Fannie Mae conducts this survey and shares monthly and quarterly results. The March 2023 NHS was conducted between March 1-19, 2023. Most of the data collection occurred during the first two weeks of this period. The March 2023 NHS was conducted exclusively through AmeriSpeak, NORC at the University of Chicago’s probability-based panel, on behalf of PSB Insights and in coordination with Fannie Mae.