CoreLogic: Delinquencies Remain Near All-Time Low

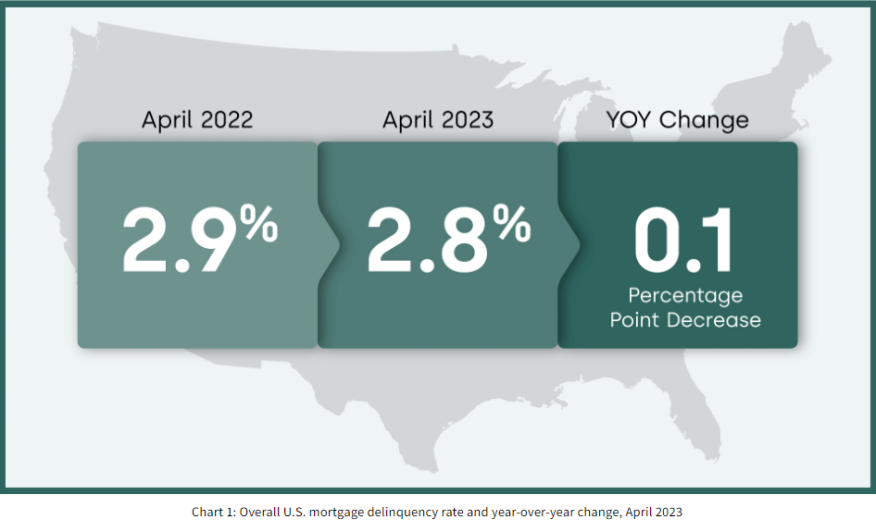

In April, just 2.8% of all U.S. mortgages were in some stage of delinquency.

- In April, 2.8% of all mortgages in the U.S. were in some stage of delinquency, down from 2.6% in March.

- 11 states posted an annual increase in overall delinquency rates in April.

- In April, 161 U.S. metro areas posted an increase in overall year-over-year delinquency rates.

Despite small annual upticks in some states and metro areas, overall mortgage delinquencies remained near an all-time low in April, CoreLogic said Thursday.

The property data and analytics company released its Loan Performance Insights Report for April 2023, reporting that 2.8% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure). That represents a 0.2 percentage point increase from 2.6% in March, and was down 0.1 percentage point from 2.9% a year earlier.

For its report, CoreLogic examines all stages of delinquency. In April, the U.S. delinquency and transition rates and their year-over-year changes, were as follows:

- Early-Stage Delinquencies (30 to 59 days past due): 1.4%, up from 1.2% in April 2022.

- Adverse Delinquency (60 to 89 days past due): 0.4%, up from 0.3% in April 2022.

- Serious Delinquency (90 days or more past due, including loans in foreclosure): 1.1%, down from 1.4% in April 2022 and a high of 4.3% in August 2020.

- Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, unchanged from April 2022.

- Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.8%, up from 0.7% April 2022.

Although almost a dozen states and more than 150 metro areas posted year-over-year increases in overall mortgage delinquency rates in April, U.S. loan performance remains resilient, CoreLogic said, with delinquencies and foreclosures continuing to hover near record lows.

The national overall delinquency rate increased slightly from March to April, but that is a typical seasonal pattern, as tax bills can stretch homeowners’ budgets in the short term and result in late mortgage payments for some borrowers, the company said.

“Mortgage performance remained strong in April, with overall delinquencies at minimal levels and serious delinquencies at a 23-year low,” said Molly Boesel, principal economist for CoreLogic. “However, there is concern that mortgages originated in a rising-interest-rate environment may have higher instances of delinquencies, as borrowers become stretched financially.”

She added that, “While early delinquencies for 2022 mortgage originations are about the same rate as those in other rising interest-rate environments, loans with low down payments are exhibiting comparably higher-than-usual early delinquencies.”

State and Metro Takeaways:

- 11 states posted an annual increase in overall delinquency rates in April. The states with the largest increases were Idaho, Indiana, Michigan, and Utah (all up by 0.2 percentage points). An additional 11 states saw no change in overall deliquency rates year over year. The remaining states' annual delinquency rates dropped between 0.7 and 0.1 percentage points.

- In April, 161 U.S. metro areas posted an increase in overall year-over-year delinquency rates. Cape Coral-Fort Myers, Fla., (up by 1.2 percentage points) led, followed by Punta Gorda, Fla., (up by 1 percentage points), and Bloomsburg-Berwick, Pa., (up by 0.8 percentage points).

- Four U.S. metro areas posted an increase in serious delinquency rates (defined as 90 days or more late on a mortgage payment) in April, while five showed no change. The metros that saw an increase were Cape Coral-Fort Myers, Fla., (up by 0.9 percentage points); Punta Gorda, Fla., (up by 0.8 percentage points); and Elkhart-Goshen, Ind., and Idaho Falls, Idaho (both up by 0.1 percentage points).