CoreLogic: Non-QM Share Of Loans Has Nearly Doubled In 2022

After falling to a 2% share of the market during the pandemic, Non-QM loans have rebounded to a 4% share in the first three months of 2022.

After falling to its lowest level during the pandemic, the share of non-qualified mortgages (Non-QM) has nearly doubled so far this year, according to a new report.

CoreLogic, a provider of property information, analytics, and data-enabled solutions for the mortgage industry, reported this week that the Non-QM share of total mortgage counts has doubled from it lowest level in 2020, at 2% of the market, to about 4% of the first mortgage market, based on an analysis of loans originated during the first three months of 2022.

“Though the Non-QM loan is a small piece of today’s mortgage market, it plays a key role in meeting the credit needs for homebuyers not able to obtain financing through the GSE (government-sponsored enterprises) or government channels,” Archana Pradhan, chief economist for CoreLogic, said in a post on the company’s website. “Creditworthy borrowers — such as self-employed borrowers, first-time homebuyers, borrowers with substantial assets but limited income, jumbo loan borrowers and investors otherwise not qualifying for the GSE and government loans —may benefit from non-QM loan options.”

Any home loan that doesn’t comply with the federal Qualified Mortgage (QM) rules is referred to as a Non-QM loan. The federal Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in July 2010, imposed an obligation on lenders to make a good-faith effort to determine applicants have the ability to repay a mortgage, known as the ability-to-repay (ATR) rule. The act also mandates that qualified mortgages cannot have risky loan features, such as negative-amortization, interest-only, balloon payments, or terms beyond 30 years, and also cannot have excessive points and fees.

A qualified mortgage must also satisfy at least one the following criteria:

- Borrower’s debt-to-income (DTI) ratio must be 43% or less.

- The loan must be eligible for purchase, guarantee, or insurance by a government-sponsored enterprise (GSE), such as Fannie Mae or Freddie Mac; the Federal Housing Administration (FHA); U.S. Department of Veterans Affairs (VA); or the U.S. Department of Agriculture (USDA), regardless of the DTI ratio, and

- The loan must be originated by insured depositories with total assets less than $10 billion, and must be held in a portfolio for at least three years.

“A Non-QM loan is not necessarily a high-risk loan, however, as the inclusion of terms such as interest-only or limited/alternative documentation can increase the risk of repayment for lenders,” Pradhan said. “Non-QM loans must satisfy the ATR requirements.”

In CoreLogic’s review of Non-QM loans, it found that the three main reasons a Non-QM loan originated in 2022 failed to fit into the qualified-mortgage box were:

- Use of limited or alternative documentation.

- A debt-to-income (DTI) ratio above 43%, and

- Interest-only loans.

“Almost 55% of the Non-QM borrowers used limited or alternative documentation; 26% exceeded 43% DTI threshold; and 23% of the Non-QMs were interest-only loans,” CoreLogic reported. “The share of Non-QM loans exceeding the 43% DTI threshold has increased, and is now three times higher in 2022 than in 2014,” it said.

The share of interest-only loans also doubled in 2022 compared to the 2014 level, CoreLogic said.

“Notably, the risker factors such as negative amortization and balloon payments have completely vanished,” Pradhan said.

CoreLogic also reviewed the trend of three major factors for underwriting all home purchase loans: credit scores, DTIs and loan-to-value (LTV) ratios. According to its review, the average credit score of homebuyers with Non-QM loans in 2022 was 771, compared to 776 for homebuyers with qualified mortgages and 714 for government loans. Similarly, the average LTV ratio for borrowers with Non-QM loans was 76%, compared to 77% for borrowers with qualified loans. However, the average DTI ratio for homebuyers with Non-QM loans was higher when compared with borrowers with qualified mortgages.

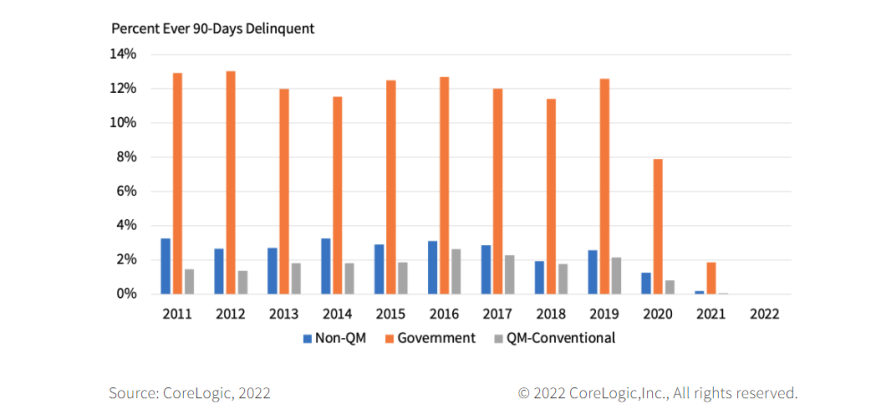

Despite the high DTI ratios, non-QMs are performing very well, CoreLogic said, noting that both Non-QM and qualified loans have low delinquency rates. In fact, it said, the serious delinquency rate for Non-QM loans is just slightly higher than the rate for qualified mortgages and significantly lower than for the government loans.

“To offset the risk of default, lenders generally set a higher interest rate on Non-QM loans,” Pradhan said. “For instance, the average 30-year, fixed initial interest rate for Non-QM was 2.9%, compared to 2.6% for QM loans in 2022. Also, lenders are attracted to borrowers with higher credit scores and low LTVs to help offset the added risk from a high DTI, limited documentation, and interest-only on non-QM loans.”

She added, “Today’s Non-QMs are high-quality loans. They are vastly different and less risky than the equivalent of non-QM loans originated prior to the Great Recession.”