Curinos Sources Data Directly From Lenders For New Insights

The November 2021 mortgage rate-lock volume was down 26% year-over-year and down 5% month-over-month across all channels.

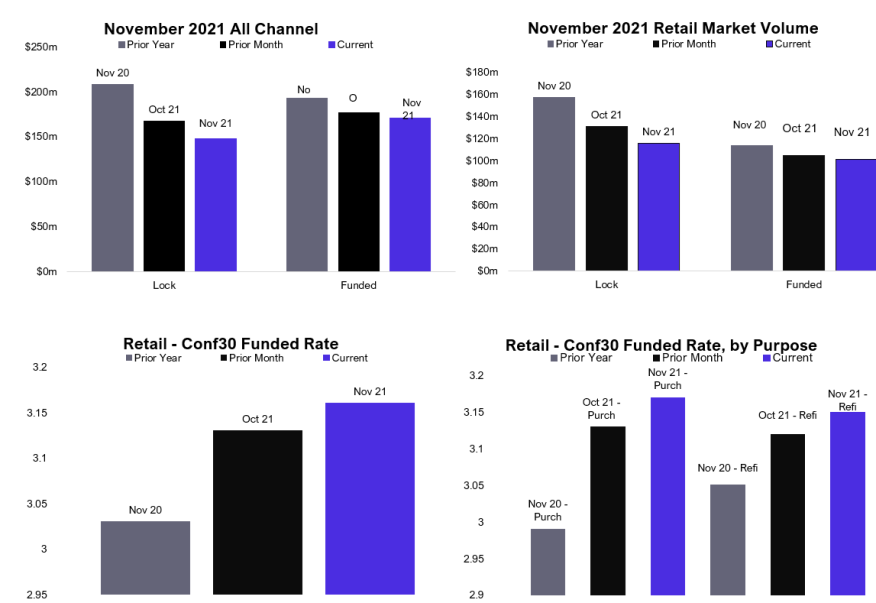

The November 2021 mortgage rate-lock volume was down 26% year-over-year and down 5% month-over-month across all channels, according to data, technologies and insights provider, Curinos. Funded volume fell 14% year-over-year and 9% month-over-month. Curinos sources a statistically significant data set directly from lenders to produce these benchmark figures.

Meanwhile, in the retail channel, lock volume decreased 23% year-over-year and 5% month-over-month as funded volume fell 13% year-over-year and 9% month-over-month.

The average 30-year conforming retail funded rate in November was 3.26%, which is 10 basis points higher than October and 26 basis points higher than the same period last year. Purchase rates were 11 basis points higher than the previous month and 33 basis points high than the same month last year, while refinance rates were 9 basis points higher than last month and 21 basis points higher year-over-year.

Through access to comprehensive datasets and analytics, intelligent technologies and behavioral insights, Curinos develops accurate tools to help mortgage professionals attract, retain, and grow more profitable customer relationships.