Delinquency Rate Falls Below 3% In March, 1st Time On Record

Black Knight says rate hit 2.9%; First American RHPI shows a wave of foreclosures unlikely.

- Serious delinquencies fell to their lowest level since March 2020.

- Both foreclosure starts and sales rose in March, but remain below pre-pandemic levels.

- First American RHPI for February shows real house prices decreased 0.2% from January.

- Consumer house-buying power rose 0.5% in February, but is down 21.7% YOY.

The national mortgage delinquency rate in March fell below 3% for the first time on record, according to a report from Black Knight. The report comes as another report says falling house prices and a softening labor market are unlikely to trigger a wave of foreclosures.

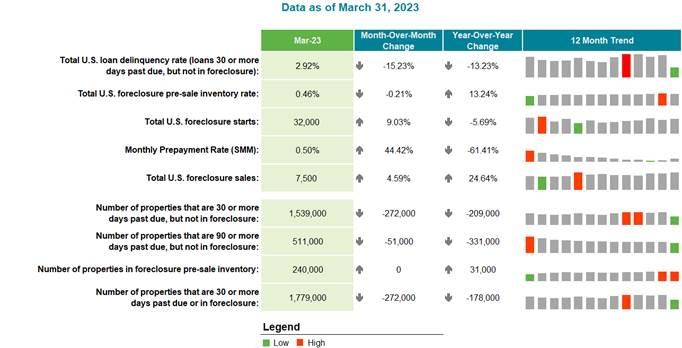

According to Black Knight’s “First Look” report, U.S. mortgage delinquencies fell to 2.92% in March, with overall delinquencies dropping more than 50 basis points from February.

The report notes that while delinquency rates almost always fall in March — as borrowers use tax refunds and other seasonal revenues to pay down past-due debt — the drop marked the second-largest decline in the past 17 years.

Serious delinquencies, those 90 or more days past due, showed strong improvement, falling 51,000 to their lowest level since March 2020, with volume shrinking in all 50 states, Black Knight said. Improvements ranged from 11.9% in Washington to 21.5% in Vermont.

Both foreclosure starts (+9%) and foreclosure sales (+4.6%) rose in March, but remained well below pre-pandemic volumes at the national level, the report said.

The solid First Look report on delinquencies seems to support the findings of First American Financial Corp.’s Real House Price Index (RHPI) for February. The report measures the price changes of single-family properties nationwide adjusted for the impact of income and interest rate changes on consumer house-buying power over time at the national, state, and metropolitan levels.

Because the index adjusts for house-buying power, it also serves as a measure of housing affordability, First American said.

According to the RHPI for February, real house prices decreased 0.2% from January, but were up 31.6% from a year earlier. Consumer house-buying power — how much a person can buy based on changes in income and interest rates — increased 0.5% in February from January, but decreased 21.7% from a year earlier.

“Affordability has now improved for four straight months, yet remains down 32% since February 2022, according to the RHPI,” First American Chief Economist Mark Fleming said. “Recently falling mortgage rates have overpowered the affordability-dampening effects of higher nominal house prices.”

He continued, “Nominal house-price appreciation has slowed dramatically in response to affordability-constrained lower demand. After peaking in March 2022 at 21% nationally, annual nominal house price growth has since decelerated by 18 percentage points to 3.1% in February.”

Fleming added that real estate is local, and that house prices are down from their peaks in 37 of the top 50 markets. “With house prices declining, some are concerned about the rising risk of a wave of foreclosures. Yet, foreclosures are the result of two triggers: economic hardship and lack of equity.”

Foreclosure is a two-step process, Fleming said.

“First, the homeowner suffers an adverse economic shock — such as a loss of income, serious illness, or the death of a spouse — leading to the homeowner becoming delinquent on their mortgage,” he said. “However, not every delinquency turns into a foreclosure. With enough equity, a homeowner has the option of selling the home.”

The reverse is also true, he said. “If the homeowner has little equity in their home, but suffers no financial setback that leads to delinquency, there is no need for a foreclosure. This is what we call the ‘dual-trigger hypothesis.’ Economic hardship or a lack of equity are alone insufficient to trigger a foreclosure. Only when both conditions exist does foreclosure become a likely outcome.”

Given that, he added, while nominal house prices are declining across many of the top 50 markets, there is one trend that bodes well for homeowners in all markets.

“Much of the equity gained during the pandemic remains,” he noted. “For example, San Jose, Calif., has experienced the most severe price declines from the peak, yet house prices remain 14% above their pre-pandemic level. As the housing market rebalances, price declines will continue across many markets, but those declines would have to be substantial to erase all of the equity gains accumulated by homeowners during the pandemic boom.”

Inventory also remains at historically low levels in many top markets, which Fleming said creates a floor on how low house prices can fall.

“The risk of the equity trigger for foreclosure is low,” he said.

Other highlights of the RHPI report:

- Median household income has increased 4.1% since January 2022 and 80.8% since January 2000.

- Real house prices are 33.3% more expensive than in January 2000.

- Unadjusted house prices are now 50% above the housing boom peak in 2006, while real, house-buying power-adjusted house prices are 6.5% below their 2006 housing boom peak.

- The five states with the greatest year-over-year increase in the RHPI are: Maryland (+41.3%), Nebraska (+40%), Alabama (+39.7%), Iowa (+39.6%), and Florida (+39.5%).

- There were no states with a year-over-year decrease in the RHPI.