Did Non-QM Lender's Chasing Volume Cause This Uptick In Defaults?

How loosened credit standards in 2022 manufactured volume at the cost of loan performance, doubling delinquencies.

Wall Street is beginning to see weaknesses in the performance of some Non-QM loan pools, including higher delinquency rates in some loan pools.

Fitch Ratings recently released a report detailing the looser credit underwriting standards that emerged in the second half of 2022, as mortgage demand fell throughout the year.

Court Lake, a director in the US RMBS group at Fitch Ratings and one of the analysts who authored the report, says that as the market shifted from agency refinance to more of a focus on Non-QM, driven largely by worsening economics for borrowers, “we saw the credit box of what we were seeing in our actual securitizations expand. That included lower FICOs, higher DTIs, and higher LTVs.”

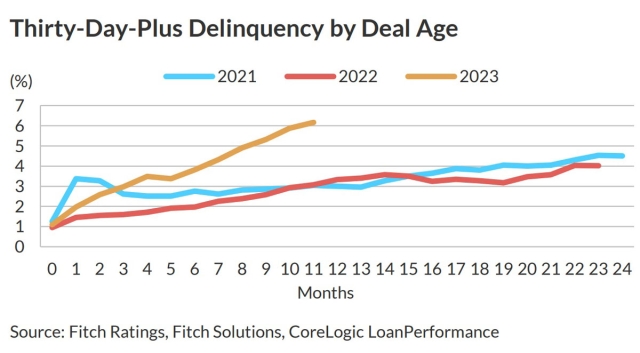

As a result, and the second key takeaway from the report, Lake says, “you're now seeing higher delinquency rates for that same vintage of collateral.”

Consequently, Fitch’s analysts have adjusted their loss and default expectations for these loan pools, and even individual loans that are likely to go delinquent early in the life of a deal. After very strong Non-QM performance in the agency market through 2020 and 2021, the beginning of 2022 was when Lake began to see deterioration in Non-QM originations.

“The worst cohort of collateral was sort of the second, third quarter of 2022,” Lake says.

He attributes the Non-QM deterioration to shifting demand. From the second quarter of 2020 to the second quarter of 2022, median U.S. home sale prices ballooned 28%, according to Federal Reserve Bank of St. Louis data. The first of seven interest rate hikes in 2022 occurred in March, a 25-basis point (bps) increase. The Federal Reserve then proceeded to raise the benchmark rate by 50 bps in May, and 75 bps in June, July, September, and November.

Worsening economics for homebuyers drove Non-QM lenders to chase volume, thereby manufacturing demand, through looser underwriting. As borrowing costs spiked, mortgage demand fell, but lenders’ profitability fell even faster. Loosening credit standards helped create volume, but at the cost of loan performance.

A similar pattern is emerging in the Prime Jumbo market, says Lake. “I think Non-QM was a little bit more alarming in terms of how much the delinquency shot up, but if you actually look at the Prime 2023 vintage, that's also at an elevated delinquency rate relative to their 2022, 2021, and 2020 vintages.” This is also on account of looser underwriting in 2022.

“We're seeing a lot of similar trends there. If you look at just the loans making their way into securitizations,” Lake says, “the weighted average FICO is lower. You've got a higher weighted average DTI. You're seeing, in our view, what we think is more cash-out loans. We just view that as a selection bias and leaning toward kind of a worse borrower base. So, you're seeing some similar trends that we brought out in the Non-QM report in the prime space as well.”

Victor Kuznetsov is the founder and managing director of the Imperial Fund, which serves as the capital partner for some of the top Non-QM lenders, such as A&D Mortgage. He’s observed the same deterioration across the Non-QM market, but in the loans that the Imperial Fund underwrites, “less deterioration than others.”

Kuznetsov attributes the resilience of the Imperial Funds originations to two things: their originate-to-securitize model, and how in 2022 they started placing more emphasis on valuations. “It’s always a question of how diligent you are and how diligent you want to be,” he says.

The Imperial Fund securitizes 100% of A&D’s collateral, which means they have to ensure that all loans perform. Other, smaller Non-QM lenders, Kuznetsov says, originate loans for aggregation, which incentivizes closing and volume. When mortgage demand began dropping through the summer of 2022, smaller lenders’ need to capture volume increasingly outweighed the need to ensure that every loan that closed would actually perform.

But, as long as the loan passed the 3-6 month payment default window, the aggregator would be on the hook for default and delinquency risk, not the originator (though, fraud and rep-and-warrant risks stay with the loan forever). “We are not incentivized to loosen the underwriting on ‘gray area’ loans,” Kuznetsov explains. “We basically understood that with less production on the street, lenders will widen their box to attract demand.” Kuznetsov did not.

Lake says that how they look at pools of loans over time changes, generally based on the collateral attributes, views on home prices, and macroeconomic headwinds and tailwinds. For the Non-QM market, Fitch has been adjusting their performance expectations to include an increased expectation of default because of the pools’ weaker collateral. What Fitch expected to happen, has happened. “The average delinquency rate for a 2023 vintage transaction four months after issuance is 3.2%, which is almost twice as high as the 2022 vintage,” Fitch’s report reads.

Home prices, particularly overvaluations, are playing a greater role in Fitch’s modeling, too. According to their fourth quarter, 2023 U.S. RMBS Sustainable Home Price Report, the rating agency says national home prices are currently 9.4% overvalued.

When modeling default rates, for example, they do not only look at the impact of home prices on borrower profiles, such as how elevated home prices lead to higher down payments, higher scheduled payments, and higher debt-to-income ratios (DTIs). “We look at home price overvaluation at the zip code level,” says Lake, “and essentially, that consideration is where are home prices today versus what we think is a long-term sustainable level.” As home prices grow, Lake explains, the result is less sustainable value and more overvaluation in the market.

“What we've seen, especially through the pandemic, and it's continued today,” he explains, “prices are actually more overvalued today than we think they are based on underlying fundamentals, and we actually think that it's higher possibility of a home price correction.”

By modeling default risk in this manner, Fitch uses a comparative analysis called the “sustainable loan-to-value ratio.” The sustainable LTV enhances analysts’ tracking of loan performance across cohorts, helping to answer the question: what would a borrower’s LTV be if the overvaluation was actually taken into account? An 80 LTV loan in 2020, for example, may be closer to an 85 or 90 LTV loan in 2022.

“We actually think that the home prices and home price gains and overvaluations created in the market is also a significant driver of higher default risk,” Lake says. Looking ahead, he predicts environmental issues and additional costs related to insurance to be key areas that will worsen consumers’ balance sheets, “and actually, likely impact home prices.” While Fitch hasn’t analyzed much background data on these issues, Lake says, “it's something that we think could possibly impact housing prices.”

The added emphasis on valuations has also helped Kuznetsov prevent more deterioration in the loans that the Imperial Fund underwrites. They already required full appraisals on 100% of their loans, but in 2022, the lender replaced collateral desk analyses (CDAs) with broker pricing opinions (BPOs) when secondary appraisals were needed. Kuznetsov believes BPOs more accurately reflect home valuations. Kuznetsov lowered LTVs, but raised FICO requirements, as well.

Adding more pressure to loan performance stemming from weaker collateral, Non-QM borrowers who entered into larger mortgages with higher interest rates thinking they would be able to refinance in the not-so-distant-future may be stuck paying their 9% or 10% rates for longer, Kuznetsov says. “Interest rates aren’t dropping how many people would like.”

Though 2024 has just begun, Lake says that Fitch is seeing “probably a better credit profile” in the securitization market so far, in part due to a pickup in mortgage demand as rates have dropped over the past couple of months. “We're starting to get back to maybe that early 2022, slightly higher FICOs, slightly lower LTVs,” he says. When demand increases organically because the economics are better for borrowers, Lake continues, lenders engage in less market creation, which often entails weaker underwriting and worse loan performance. With originators doing less chasing, issuers are seeing the securitization credit box tighten again.

In another sign of optimism, Lake says “excess spread,” which is a substantial form of credit enhancement in non-agency securitizations because it’s used to cover losses, is returning to the deals because rates have dropped. It takes six to eight months for loans to make their way into securitizations, so, September 2022 transactions do not show up in deals until early 2023. The excess interest the collateral is generating versus what the bond generates actually protects investors from losses.

Between stronger collateral and more excess spread, he anticipates an improvement in the Non-QM pools moving forward. The 2023 cohort of loans is probably still worse than 2020 and 2021, but not as bad as 2022, Lake thinks. “So, it's still not great. I think we're still, we still have concerns about heightened default risk, but I think it's improving.”

A number of headwinds for consumers still exist, like high home prices and elevated, non-mortgage consumer debt spending. “That being said, I think the overall quality of originations has improved in the second half of 2023, and we're starting to see that in the securitization market in 2024,” Lake concludes.