As smaller players exit the market, scaled originators like UWM and PennyMac Financial dominate, but challenges persist with low origination volume and pressured margins amidst rising interest rates.

Tagged: Fitch Ratings

Strategic collaboration between dv01 and Fitch Ratings introduces benchmarks aiming to enhance transparency and redefine market analysis in Non-QM and Prime Jumbo markets.

How loosened credit standards in 2022 manufactured volume at the cost of loan performance, doubling delinquencies.

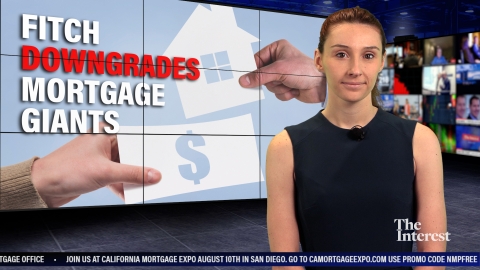

Fitch Ratings says non-bank mortgage companies might grapple with challenges due to subdued origination volumes and prevailing high-rate environment.

Despite the gloom, DSCR mortgages tied to investment properties stand strong, but affordability products pose future risks.

While FOA faces tangible equity erosion and continuous covenant breaches, peers like Rocket and United Wholesale Mortgage showcase resilience.

U.S. debt five times higher than it was after 2011 downgrade.

It’s guilt by association because U.S. government rating was dropped.

Ratings service says they are well-positioned to handle liquidity and funding challenges.