Existing-Home Sales Slid 5.4% In June: NAR

Sales have declined for five straight months.

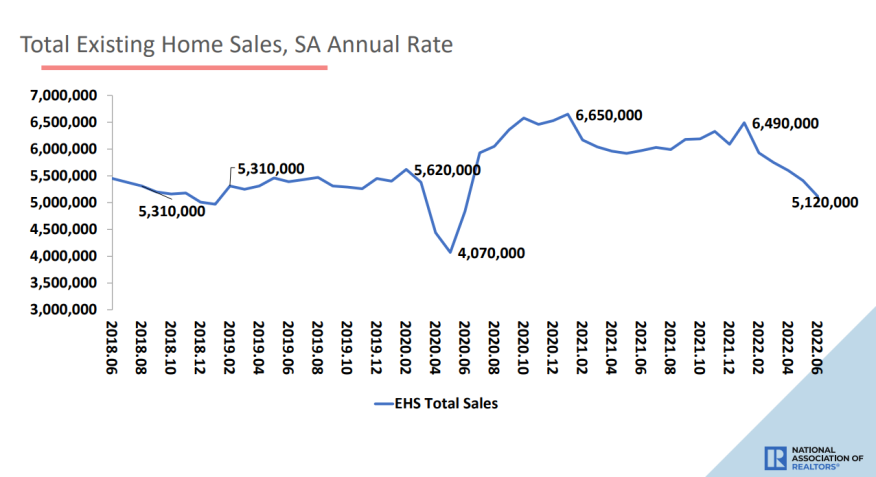

- Existing-home sales declined for the fifth straight month to a seasonally adjusted annual rate of 5.12 million. Sales were down 5.4% from May and 14.2% from one year ago.

- The median existing-home sales price climbed 13.4% from one year ago to $416,000, a new record high.

- The inventory of unsold existing homes rose to 1.26 million by the end of June, or the equivalent of 3 months at the current monthly sales pace.

Sales of existing homes fell for the fifth straight month in June, the National Association of Realtors said today.

Three out of four major U.S. regions experienced month-over-month sales declines, while the other region held steady. Year-over-year sales sank in all four regions, NAR said.

Total existing-home sales — consisting of completed transactions that include single-family homes, townhomes, condominiums, and co-ops — dropped 5.4% from May to a seasonally adjusted annual rate of 5.12 million in June. Sales also fell 14.2% from 5.97 million in June last year.

"Falling housing affordability continues to take a toll on potential home buyers," NAR Chief Economist Lawrence Yun said. "Both mortgage rates and home prices have risen too sharply in a short span of time."

Total housing inventory at the end of June was 1.26 million units, up 9.6% from May and up 2.4% from June 2021 (1.23 million). Unsold inventory sits at a 3-month supply at the current sales pace, up from 2.6 months in May and 2.5 months in June 2021.

The median existing-home price for all housing types in June was $416,000, up 13.4% from $366,900 in June 2021, as prices increased in all regions. It marks 124 consecutive months of year-over-year increases, the longest streak on record.

Properties typically remained on the market for 14 days in June, down from 16 days in May and 17 days in June 2021. The 14 days on the market are the fewest since NAR began tracking it in May 2011, the organization said. Of homes sold in June 2022, 88% were on the market for less than a month, NAR said.

"Finally, there are more homes on the market," Yun said. "Interestingly though, the record-low pace of days on market implies a fuzzier picture on home prices. Homes priced right are selling very quickly, but homes priced too high are deterring prospective buyers."

Buyer breakdown

First-time buyers were responsible for 30% of sales in June, up from 27% in May but down slightly from 31% in June 2021. NAR's 2021 Profile of Home Buyers and Sellers — released in late 20214 — reported that the annual share of first-time buyers was 34%.

All-cash sales accounted for 25% of transactions in June, the same share as in May and up from 23% in June 2021.

Individual investors or second-home buyers, who make up many cash sales, purchased 16% of homes in June, unchanged from May and a slight increase from 14% in June 2021.

Distressed sales — foreclosures and short sales — represented less than 1% of sales in June, essentially unchanged from both a month and a year earlier.

According to Freddie Mac, the average commitment rate for a 30-year, conventional, fixed-rate mortgage was 5.52% in June, up from 5.23% in May. The average commitment rate across all of 2021 was 2.96%.

"If consumer price inflation continues to rise, then mortgage rates will move higher," Yun said, referring to the most recent CPI report, which showed annual inflation at 9.1% in June. "Rates will stabilize only when signs of peak inflation appear. If inflation is contained, then mortgage rates may even decline somewhat."

Realtor.com’s Market Trends Report in June showed that the largest year-over-year median list-price growth occurred in Miami (+40.1%), Orlando (+30.6%), and Nashville (+30.6%). Austin, Texas, reported the highest increase in the share of homes that had their prices reduced compared to last year (+24.7 percentage points), followed by Phoenix (+22.2 percentage points), and Las Vegas (+20.1 percentage points).

Single-family home sales declined to a seasonally adjusted annual rate of 4.57 million in June, down 4.8% from 4.8 million in May and down 12.8% from a year earlier. The median existing single-family home price was $423,300 in June, up 13.3% from June 2021.

Existing condominium and co-op sales were recorded at a seasonally adjusted annual rate of 550,000 units in June, down 9.8% from May and down 24.7% from one year ago. The median existing condo price was $354,900 in June, an annual increase of 11.5%.

Regional Breakdown

At an annual rate of 670,000 in June, existing-home sales in the Northeast were unchanged from May and down 11.8% from June 2021. The median price in the Northeast was $453,300, a 10.1% jump from one year ago.

In the Midwest, existing-home sales slid 1.6% from the previous month to an annual rate of 1.23 million in June, retreating 9.6% from June 2021. The median price in the Midwest was $306,900, a 10.2% increase from one year before.

Existing-home sales in the South slipped 6.2% in June to an annual rate of 2.26 million, down 14.1% from the previous year. The median price in the South was $374,900, a 16.8% bounce from one year ago. For the 10th consecutive month, the South recorded the highest pace of price appreciation in comparison to the other three regions, NAR said.

Existing-home sales in the West decreased 11.1% compared to the month before to an annual rate of 960,000 in June, down 21.3% from this time last year. The median price in the West was $624,000, up 9.6% from June 2021.

The National Association of Realtors is America's largest trade association, representing more than 1.5 million members involved in all aspects of the residential and commercial real estate industries.