An Exodus From The Industry

A breaking point has been reached: is it your failure or failure of the market?

The mortgage industry has long been regarded as a field that offers opportunities for financial success. A refinancing boom from 2020 through 2021 brought excited newcomers into the business. Now, inflation, competition, market volatility, and economic uncertainty have led to an increasing number of mortgage professionals finding themselves disenchanted and disillusioned with the prospects of achieving success in this once-thriving sector.

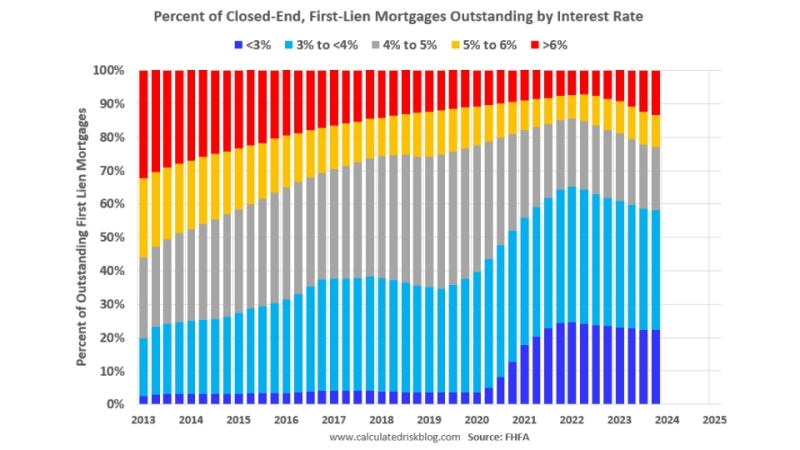

But is it the market’s problem or a survival of the fittest game? Some say that the industry is merely weeding out and that those who know how to deal with the cyclical market will prevail. According to Fannie Mae, overall mortgage activity is down 74% from the 3rd quarter highs in 2021 versus the 1st quarter of 2023, evidently reflecting on industry employment.

“Fourteen percent of producing loan officers changed employers, and almost 12% left the industry entirely in the last year. Put everything together, and one thing is clear: LOs are facing one of the most significant challenges the market has seen since 2008," said Modex Founder and CEO Dale Larson III, courtesy of the MBA.

Joel Kan, MBA deputy chief economist, has his finger on the pulse of this and weighed in on mortgage banking employment changes. “We’ve been tracking this for a few years now, with special attention to a few Bureau of Labor Statistics series that are as close to mortgage employment as there is. As of May 2023, there were 343,000 mortgage employees, down 15% year over year and down 18% from the peak in July 2021 of 420,000.”

To make matters worse, 60% of mortgage professionals are living paycheck to paycheck, according to a survey done by payroll tech company Everee. And 31% of those surveyed say that they plan to jump ship from the industry within the next year.

Steve Richman, a mortgage consultant, recognizes that many in the industry aren’t happy right now. “Two things are happening: normal reductions in force and people voluntarily leaving,” he explained. “Some people are tired of the industry.”

Richman says that as a consultant, he constantly sees companies posting on LinkedIn that they’re hiring. But he also knows that since the market is down, some companies cannot offer equal compensation to what originators were making in the booming 2020 and 2021 markets. “[My advice is] to be comfortable in your own skin and know your worth, but also know the worth of what the market is paying right now,” he said. “Some people say that they know they’re worth more which is great, but that’s not what the market is worth now.”

Richman also recognizes that many people stepping out today were a part of the big refinance boom. “They’ve never had a big purchase book of business, they haven’t worked those relationships and that’s why they're leaving,” he explained. “Refi’s are just sitting back and order-taking. We are not in the position where you can sit back and wait for customers to ask for help. No, you’re in a position to ask customers how I can help you.”

Richman tries to keep a positive attitude – both in-person and online – about the market. And he says that downturns can’t be prevented. “I don’t know what business isn’t cyclical,” he said. “If you are a long-standing member of any business you understand that. You never get too high on the highs and too low on the lows.”

Leaving On His Own Terms

Anthony Yap was a marketing director for several companies in the mortgage services realm: GI Home Loans, Sun West Mortgage, and Nationwide Mortgage Bankers, to name a few. But he found himself lost when the market transitioned into a purchase market. “I saw a lot of newer LOs who got into the market for refi’s,” Yap explained. “But now they’re not trained to adapt to today’s market.”

And Yap even admitted that he was unprepared, too. Yap formerly worked for call center-modeled lenders and found that when he moved on to non-call centers, half of his skill set was lost or nonessential. Yap says that throughout his 13 years of experience in the industry, this past year has been the toughest, which is why he’s worked for three separate companies since last May.

Now, he’s at Express Capital – a commercial lender for business loans – as a marketing director. “During the last few years I’ve hopped companies to accommodate my skills and where I’m needed,” Yap said. “I’ve seen colleagues dip, especially some of the tens of thousands of new LOs that came in because of refinances. Now, they're dropping off since they don’t know what they're doing, and they didn’t establish a strong book of business.”

But Yap says he sees a silver lining for LOs, especially if they have their own teams. “There’s only a finite amount of houses and leads. We’re facing affordability and lead generation issues at the same time,” he said. “But originators who have their own structured team – their own processor, LOA, etc. – regardless of what branch or brand they work for, the workflow doesn’t change… and they’ll have significant success compared to loan officers [who are] working on their own.”

No Choice But To Get Out

While Yap had the choice to realign his marketing career, others didn’t have the option. Joy Grissom, who formerly worked as a senior underwriter for Supreme Lending, was laid off in May 2022 after a 25-year career in the mortgage industry. She said that the layoff was a “shock” and that just a year prior, Supreme Lending had given her a matching salary and retention bonus. “In an instant, it was all ripped away from me,” she said.

During her nine-month unemployment, Grissom said she applied to jobs on LinkedIn, Indeed, and Glassdoor and had zero luck. “It wasn’t a choice. I was forced to pursue other ventures, which is how I got my current job at United Health,” she explained. “The business is cyclical, but getting laid off from such a senior position nearly killed me and our livelihood.”

Grissom explained that she lives with her sister, a schoolteacher. “Not everyone is so lucky to live in a dual-income home, and when I got laid off, we relied on unemployment money to help,” she said. “It wasn’t much, but we were very grateful.”

Despite the heartbreak of being forced out, Grissom says that she still loves mortgages – but she wouldn’t go back. “I love the industry, it’s lucrative, and there’s a ton of money to be made,” she said. “But when you lose it all, and it takes you nine months to find a new job … I would say that I’m pretty scarred because I was just so devastated and wasn’t prepared. I probably will never go back to the industry.”

Dipping Back In

For Asaad Dennis, a break from the industry was a healthy pause for him to reassess his career goals. Dennis began in the industry in 2019 as a real estate agent and, in December 2020, decided to get his license as an LO to make more money. “I was working as an Uber driver on the side of doing real estate, and I kept picking up the same customer who happened to be a loan officer, and he kept telling me about how much money he was making by doing loans,” Dennis said. “I remember I had given him an Uber ride for the third time, and when I saw his house and the car he drove, I knew that I had to get into the industry.”

Dennis worked all throughout 2021 at San Diego-based GI Home Loans. “I think that first year I made about 100 grand, but the bubble popped in late September of 2021,” he said. “When the whole refi market ended, and rates went up, it got to a point where we barely had loans to put in.”

Dennis says that he made the decision to step back from doing loans in the start of 2022 because he couldn’t make money. “I see a lot of loan officers stepping out because they can’t find that business,” Dennis said. “I had only started doing loans a year earlier. Money was easy to make. It was hard trying to bounce back after the refi boom, so I went back to doing probates in real estate.”

Now, Dennis is stepping back into the industry with a new company, Equitable Mortgage & Realty Inc., which is based out of Los Angeles. He started June 1 and, by mid-June, had three loans already in his pipeline. Dennis admitted that he found it hard to build up a book of business due to the “one-dimensional” boom, but now he feels more prepared to take on the industry. “I think now that I know what type of market to expect, I can roll with the punches,” he said. “If you can make money in a bad time, that’s the key. I’m still fresh in the industry and still trying to figure out how to make the phone ring in a down market.”