Fannie Mae: A Recession A Matter Of 'When,' Not 'If'

Economic and Strategic Research Group says evidence of downturn unlikely to appear until it is unavoidable.

The recent data is mixed enough to create a “muddled picture” of the U.S. economy, but a recession “remains the most likely outcome,” Fannie Mae said Monday.

The government-sponsored enterprise’s Economic and Strategic Research (ESR) Group released its June 2023 forecasts for the economy and the housing market, stating that while inflation has moderated, it still believes “continued robustness in the labor market risks an entrenchment of some core inflationary pressures.”

The ESR Group’s commentary continued, “Lessons learned from the inflationary era of the 1970-80s, a time when price pressures eased and then quickly reaccelerated, lead the ESR Group to expect that the Fed will maintain its restrictive monetary policy stance until it is abundantly clear that inflation pressures from the labor market have eased.”

The group added, however, that “based on the timing of data releases, that evidence is unlikely to appear until a recession is already unavoidable, making the question of a downturn more a matter of ‘when’ than ‘if.’”

According to its revised economic forecast, a recession will likely begin in the fourth quarter of this year or the first quarter of 2024.

The Federal Reserve announced this month it was pausing its rate hikes as it tries to bring annual inflation down to its goal of 2%. The Federal Open Market Committee had raised its benchmark federal funds rates 10 times over the previous 14 months.

Fed Chairman Jerome Powell, however, told Congress last week, that interest rates will have to be increased again to curb economic growth and control inflation.

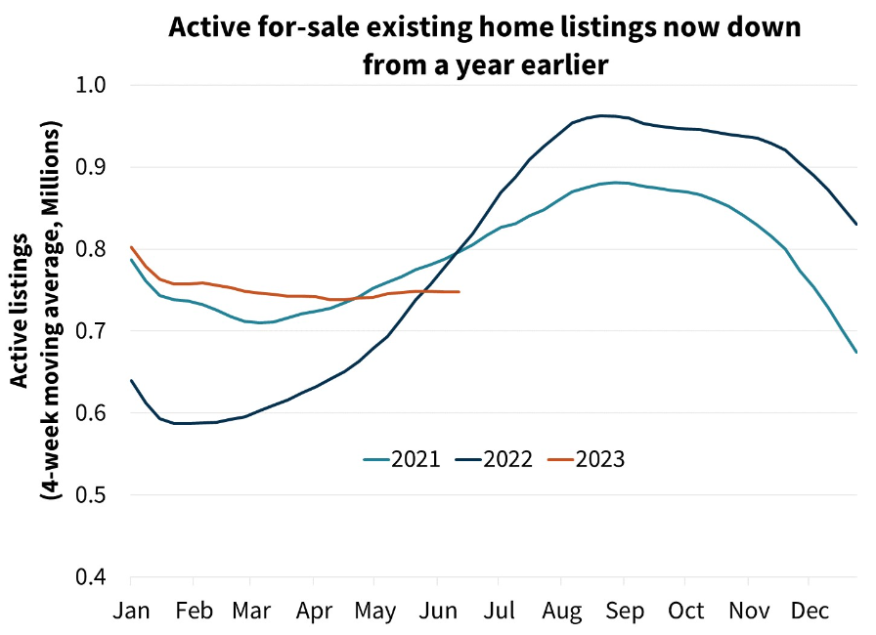

The ESR Group said in its commentary that the housing market’s struggles continue to be caused by the lack of existing homes for sale, a trend that did not improve during the spring homebuying season.

“This has supported a return to home price growth in recent months and continued to boost new home construction,” the group said.

While the ESR Group said it continues to expect housing starts to weaken in coming quarters, that is predicated on the business cycle turning. “In the absence of a recession, the ESR Group notes substantial upside risk to its new home sales and starts forecasts,” it said.

“Core inflation remains sticky, having not fallen as rapidly as other price measures, creating upside risk to the fed funds rate, as noted in the Federal Reserve's Summary of Economic Projections, and making it likely in our view that it maintains a restrictive posture for longer than most market participants initially anticipated,” said Doug Duncan, Fannie Mae’s senior vice president and chief economist, Fannie Mae. “Meanwhile, housing prices continue to show stronger growth than what was previously expected given the suddenness and significant magnitude of mortgage rate increases.”

Duncan said the housing market's performance is “a testimony to the strength of demographic-related demand in the face of Baby Boomers aging in place and Gen-Xers locking in historically low rates, both of which have helped keep housing supply at historically low levels.”

He added that homebuilders continue to add to that supply, “but years of meager homebuilding over the past business cycle means the imbalance will likely continue for some time. We do expect housing will be supportive of the overall economy as it exits the modest recession.”