FHA: 1.8M Borrowers Got COVID-19 Forbearance

In annual report to Congress, FHA says serious delinquencies fell to 4.77%.

- Over 2 million FHA borrowers became delinquent in FY 2022, and 1.8 million sought relief.

- Over 1 million entered a loss mitigation plan, while 655,000 have cured or paid off their mortgage without one.

- Mutual Mortgage Insurance Fund had a capital ratio of 11.11% as of Sept. 30, up from 2.76% in 2018.

The Federal Housing Administration (FHA) provided COVID-19 forbearance to more than 1.8 million borrowers in fiscal year 2022, including more than 400,000 who sought assistance for the first time.

That data was presented to Congress on Tuesday as part of the FHA’s annual report on the financial status of its Mutual Mortgage Insurance (MMI) Fund, which is used to operate FHA single-family mortgage insurance programs that are authorized under Title II of the National Housing Act. FHA fiscal year 2022 ran from Oct. 1, 2021, through Sept. 30, 2022.

According to the report, over 2 million FHA borrowers became delinquent “during perhaps the most serious health emergency the nation has ever faced,” the report states. “Over 1.8 million FHA borrowers took advantage of FHA’s COVID-19 forbearance offering, which permitted borrowers to postpone making their mortgage payments. This forbearance provided financial assistance and peace of mind through a very stressful period.”

While forbearance permits borrowers to defer their mortgage payments, FHA said, it does not forgive the debt. “Borrowers are still responsible for repaying arrearages at a later date,” the report states. “To address this issue, FHA offers COVID-19 loss-mitigation policies to help borrowers retain their homes by bringing their mortgage current at the end of forbearance without requiring a lump sum payment or an onerous short-term payment plan.”

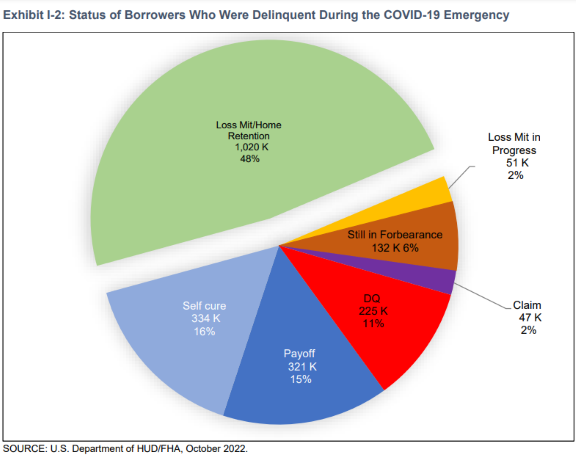

The report states that over 1 million FHA borrowers have subsequently entered into a loss mitigation plan that would enable them to remain in the home through a home retention option, or are in process of doing so. Another 655,000 have cured or paid off their mortgage without need of a loss mitigation plan.

“The performance of loss mitigation plans keeping borrowers in their homes has been unusually strong to date,” the report states, noting that in fiscal year 2022, FHA reduced by half the number of serious delinquencies — defined as mortgages 90 or more days past due — ending with a serious delinquency rate of 4.77% on Sept. 30. The rate had been more than 11% during the height of the COVID-19 crisis.

Home-Price Growth Boosts Fund

The forbearance program was backed by a much improved MMI Fund, which as of Sept. 30 had a capital ratio of 11.11%, FHA said. The ratio has grown steadily each year since it stood at 2.76% in 2018.

The MMI Fund has $147.7 billion in MMI Capital, a $41.2 billion increase from fiscal year 2021, the report states.

“The MMI Fund has seen increases over the past four fiscal years, due largely to strong home price appreciation, significant refinance volume, and responsible and responsive management, policies, and practices,” said Marcia L. Fudge, secretary of the U.S. Department of Housing and Urban Development. “Shifts in the housing market in the second half of fiscal year 2022 are expected to decelerate capital accumulation in the near term. However, the strong state of the MMI Fund will allow FHA to play its important countercyclical role in facilitating liquidity and access to mortgage credit for qualified borrowers should other market participants constrict their activity.”

Home prices have soared the past six years, the report notes. Average home prices have increased by 73% since 2017, it said, with the largest increases coming the past two years. Home price appreciation is the “most significant driver” of the improvement in the MMI Fund.

“As HPA cools due to macro-economic factors, the MMI Capital Ratio is not likely to grow in future years at anything close to the same rate, and in fact may decline,” the report states.

In addition, the report reviews FHA’s efforts to reduce barriers to homeownership and increase housing supply and affordability, all of which are part of its core mission.

New policies included allowing using positive rental history as a factor in FHA first-time homebuyer mortgage underwriting assessments; revised guidance for calculating effective income for borrowers with employment gaps due to the pandemic; and program modifications to FHA’s property disposition programs to provide priority purchase opportunities for owner-occupant buyers.

Other highlights of the FHA report:

- 84% of FHA’s total forward purchase mortgage endorsements (678,675 mortgages), were for mortgages made to first-time homebuyers in fiscal year 2022.

- The share of FHA’s fiscal year 2022 total purchase mortgage endorsements on mortgages for first-time homebuyers was 37 percentage points higher than that of other participants in the U.S. housing market.

- In fiscal year 2022, FHA provided an insurance endorsement on mortgages for 284,807 self-identified individuals and families of color, 29% of its total forward mortgage insurance endorsements.

- FHA served three times as many Black borrowers by share of its total forward mortgage insurance endorsements than the rest of the market, and twice as many Hispanic borrowers by share than the rest of the market, according to 2021 Home Mortgage Disclosure Act (HMDA) data, the latest such data available.

“I’m so proud of FHA’s work to make homeownership possible for our nation’s underserved households and communities,” said Federal Housing Commissioner Julia R. Gordon. “Behind the bottom-line numbers are some 2 million individuals and families who were able to achieve homeownership or stay in their homes through hard times thanks to assistance from FHA.”