FHFA: Fannie, Freddie Prevented Nearly 60,000 Foreclosures In Q1

GSEs have helped more than 6.7 million troubled homeowners since 2008.

- The GSEs' completed 58,268 foreclosure prevention actions during the first quarter.

- That brought the total number of distressed households helped to 6.77 million since September 2008.

Fannie Mae and Freddie Mac helped keep nearly 60,000 more homeowners in their homes in the first quarter, according to a quarterly report.

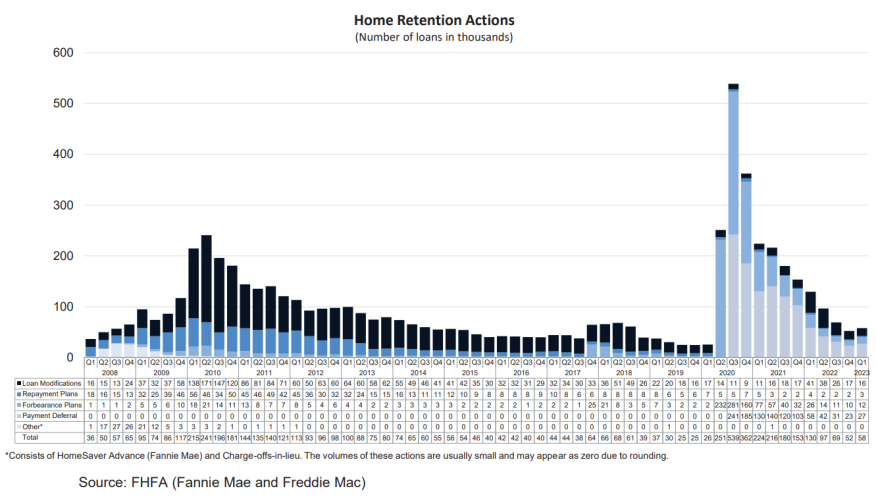

The Federal Housing Finance Agency (FHFA) on Monday released its Foreclosure Prevention and Refinance Report for the first quarter of 2023, which said the government-sponsored enterprises (GSEs) together completed 58,268 foreclosure prevention actions during the quarter, up 11.1% from 52,469 actions in the fourth quarter of 2022.

The results of the first quarter brought the total number of homeowners helped to 6.77 million since the start of FHFA’s conservatorship of the GSEs in September 2008.

FHFA’s quarterly foreclosure prevention and refinance reports include data on the GSEs’ mortgage performance, delinquencies, and active forbearance plans, as well as forfeiture actions and refinances by state.

The report showed that the GSEs completed 15,500 loan modifications in the first quarter, down 6.6% from 16,596 in the previous quarter. The report noted that 35% of loan modifications completed in the first quarter reduced borrowers’ monthly payments by more than 20%.

As mortgage rates rose, the number of refinances decreased to 78,445 in the first quarter from 111,251 in the previous quarter, a nearly 30% decline.

The GSEs’ serious delinquency rate, meanwhile, slipped from 0.65% to 0.6% at the end of the first quarter. That compares to a 4.01% rate for Federal Housing Administration (FHA) loans, 2.26% for Veterans Affairs (VA) loans, and 1.73% for all loans (industry average).

Other Key Highlights:

- Forbearance: As of March 31, there were 65,757 loans in forbearance, or about 0.21% of the GSEs' single-family conventional book of business, down from 81,173 or 0.26% at the end of the fourth quarter. About 3% of those loans have been on a forbearance plan for more than 12 months the report said.

- Mortgage Performance: The rate for loans 60 or more days delinquent decreased slightly from 0.84% at the end of the fourth quarter to 0.75% at the end of the first quarter of 2023.

- Foreclosures: The number of foreclosure starts increased 6% to 19,809, while third-party and foreclosure sales rose 12% to 3,700 in the first quarter.

- Real Estate Owned (REO) Activity & Inventory: The GSEs’ REO inventory increased 2% from 10,997 in the fourth quarter to 11,190 in the first quarter of 2023, as REO acquisitions outpaced property dispositions. The total number of property acquisitions decreased slightly to 1,692, while dispositions rose 56% to 1,529 during the quarter.

You can read the full report here.