First American: Housing Market Slowing by Design

Title company’s chief economist says history shows rising mortgage rates may take the steam out of rising house prices, but don’t necessarily trigger a decline.

The housing market is “normalizing” as affordability rapidly declines, forcing both buyers and sellers to adjust their expectations, according to a new report.

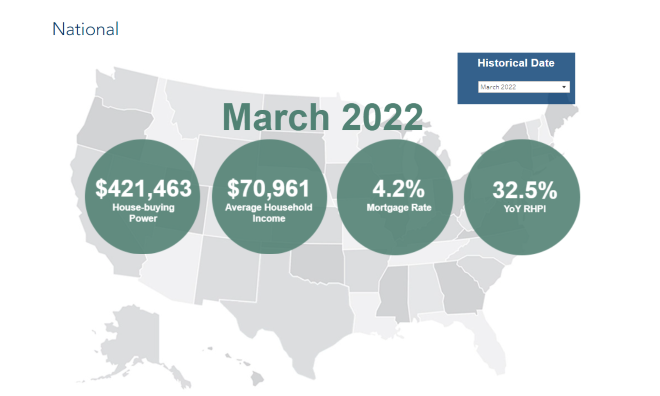

First American Financial Corp., a provider of title, settlement, and risk solutions for real estate transactions, today released its March 2022 First American Real House Price Index (RHPI), which measures the price changes of single-family properties throughout the U.S. The index is adjusted for the impact of income and interest rate changes on consumer house-buying power over time at national, state, and metropolitan area levels, and because the RHPI adjusts for house-buying power, it also serves as a measure of housing affordability.

In March 2022, the RHPI increased 32.5% year over year, the fastest growth in the more than 30-year history of the series, First American said.

“This rapid annual decline in affordability was driven by two factors: a 21.6% annual increase in nominal house prices and over a full percentage point increase in the 30-year, fixed mortgage rate compared with one year ago,” said Mark Fleming, chief economist at First American. “Even though household income increased 4.9% since March 2021 and boosted consumer house-buying power, it was not enough to offset the affordability loss from higher mortgage rates and fast-rising nominal prices.”

Fleming noted that reduced affordability prompts some buyers to pull back from the market and sellers to adjust their price expectations.

“The housing market is slowing down by design, as the Federal Reserve tightens monetary policy in order to tame inflation,” Fleming said. “Early data signals the housing market is normalizing — our preliminary nominal house price index for the months of April and May indicates annual house price growth is decelerating. Historical data provides helpful perspective on how house prices react to rising mortgage rates.”

Fleming provided answers for some key questions facing the housing market:

Do rising mortgage rates always slow nominal house-price appreciation?

“Rising mortgage rates and declining affordability have been two of the defining trends of the 2022 housing market,” he said., “However, mortgage rates and their effect on home prices may not be as straightforward as many think. … More often than not, house-price appreciation has been resistant to rising mortgage rates. One exception is the 1994 rising-rate era, when house prices declined slightly and briefly. Another exception is the 2005-06 period, otherwise known as the U.S. housing bubble, when house prices peaked in early 2006 and started to decline through 2006 and 2007. The rising rate periods during the housing bust of 2008 and 2009 is another key exception.”

Aside from those exceptions, he said, “In the longest rising mortgage rate era, 1998-2000, nominal house prices remained elevated as the economy continued to recover from the previous recession. This period was defined by tight labor markets, low inflation, and a higher minimum wage — all contributing to a healthy housing market. In just over a year and a half, house prices increased nearly 14% during this era. In the most recent rising mortgage rate era from 2017-18, nominal house prices increased approximately 7% over a 15-week period.”

What effect does the low supply-high demand imbalance have on the market?

“House prices don’t fall just because mortgage rates rise. Rising mortgage rates do influence house prices, but broader economic conditions are often more influential,” Fleming said. “The Federal Reserve is purposely trying to slow the housing market in order to tame inflation, and early indications, based on our preliminary house price index, signal a normalizing housing market. History has shown that rising mortgage rates may take the steam out of rising house prices, but they don’t necessarily trigger a decline. In today’s housing market, demand for homes continues to outpace supply, which is keeping the pressure on house prices, so don’t expect house prices to decline.”

March 2022 Real House Price Index Highlights:

- Real house prices increased 6.7% between February 2022 and March 2022.

- Real house prices increased 32.5% between March 2021 and March 2022.

- Consumer house-buying power, how much one can buy based on changes in income and interest rates, decreased 4.6% between February 2022 and March 2022, and decreased 8.3% year over year.

- Median household income has increased 4.9% since March 2021 and 70.8% since January 2000.

- Real house prices are 12% more expensive than in January 2000.

- While unadjusted house prices are now 50.8% above the housing boom peak in 2006, real, house-buying power-adjusted house prices remain 21.1% below their 2006 housing boom peak.

March 2022 Real House Price State Highlights:

- The five states with the greatest year-over-year increase in the RHPI are: Florida (+46.7%), South Carolina (+46.1%), Georgia (+40.5%), Arizona (+39.7%), and Idaho (+37.7%).

- There were no states with a year-over-year decrease in the RHPI.

March 2022 Real House Price Local Market Highlights:

- Among the Core Based Statistical Areas (CBSAs) tracked by First American, the five markets with the greatest year-over-year increase in the RHPI are: Charlotte, N.C. (+46.6%), Raleigh, N.C. (+43.5%), Tampa, Fla. (+43.3%), Phoenix (+42%), and Jacksonville, Fla. (+41.2%).

- Among the Core Based Statistical Areas (CBSAs) tracked by First American, there were no markets with a year-over-year decrease in the RHPI.