First American: Real House Prices Up Yet Again

The monthly RHPI report said potential sellers are unlikely to lose all the equity they have gained.

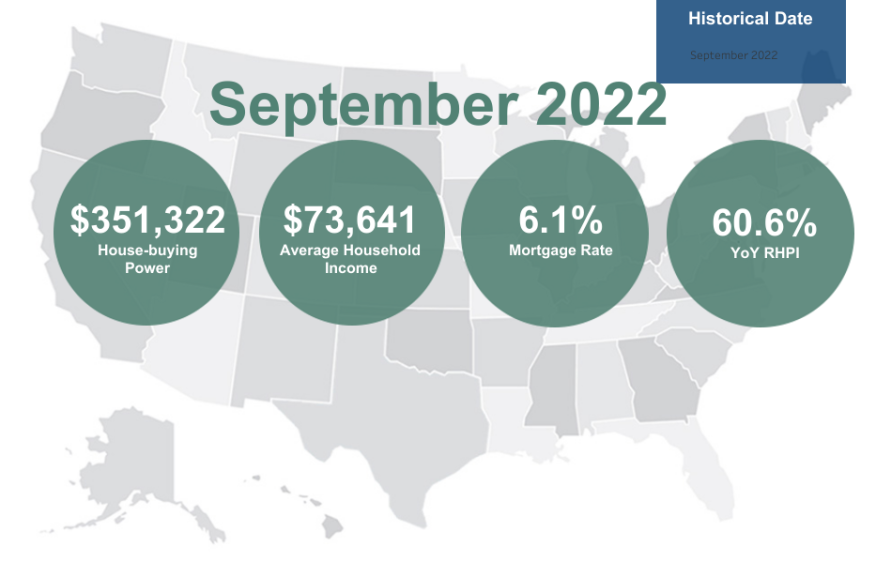

- In addition to house prices increasing over 60% year over year, house prices increased 10.5% between August and September 2022.

- Median household income increased by 3.1% since September 2021 to $73,641.

Nominal house price growth peaked at 21% in September, but has slowed since, according to a report from First American Financial Corp.

First American on Monday released its September 2022 Real House Price Index (RHPI), which jumped by 60.6% on an annual basis.

“This rapid annual decline in affordability was driven by two factors — a 13.5% annual increase in nominal house prices and a 3.2 percentage point increase in the average 30-year, fixed mortgage rate compared with one year ago,” said Mark Fleming, chief economist at First American. "Even though household income increased 3.1% since September 2021 and boosted consumer house-buying power, it was not enough to offset the affordability loss from higher mortgage rates and fast-rising nominal prices."

Fleming added, that, "As affordability wanes and prompts buyers to pull back from the market, nominal house price appreciation has slowed. Nationally, annual nominal house price growth peaked in March at nearly 21 percent, but has since decelerated by approximately 7 percentage points to 13.5% in September.

Nominal house prices in many markets, he said, are poised to fall further "as the hot sellers’ market of the pandemic turns in favor of buyers, but not all that was gained in the pandemic will necessarily be lost.”

The index reported that in addition to house prices increasing over 60% year over year, house prices increased 10.5% between just August and September 2022.

Median household income has increased by 3.1% since September 2021 and 77% since January 2000 to $73,641 as of this September. Relative to income, house prices are 38.1% more expensive than in January 2000.

While unadjusted house prices are now 55.4% above the housing boom peak in 2006, real, house-buying power-adjusted house prices remain 2.5% below their 2006 housing boom peak.

Consumer house-buying power — which is how much one can buy based on changes in income and interest rates — decreased by 8.9% between August and September 2022. Year over year, it decreased by 29.3%.

Fleming hinted towards strong equity in his analysis.

“House-buying power has declined by $145,500 compared with one year ago, primarily due to higher mortgage rates," he said. "Affordability will likely remain a drag on the housing market until house-buying power recovers as house prices decline. House prices have already begun to adjust to the reality of higher mortgage rates in many markets, which will help bring more balance to the housing market heading into 2023.”

He added that potential home sellers gained significant equity over the pandemic, "so even as affordability-constrained buyer demand spurs price declines in some markets, potential sellers are unlikely to lose all that they have gained.”

The RHPI measures the price changes of single-family properties throughout the U.S. adjusted for the impact of income and interest rate changes. Because the RHPI adjusts for house-buying power, it also serves as a measure of housing affordability.