Fitch: Overvaluations Shifting East, Home Price Growth To Slow

Ratings agency says U.S. homes were overvalued by 10.5% in Q3.

- The report estimates that Buffalo-Cheektowaga-Niagara Falls, N.Y., is the most overvalued.

- Fitch said it expects nominal home-price growth to slow substantially in 2023 due to cooling demand and worsening affordability.

Housing prices in the U.S. were overvalued by 10.5% in the third quarter of 2022 on a population-weighted average basis, according to a new report by Fitch Ratings.

The ratings agency, however, expects overvaluation to continue moderating as home price growth trends downward in 2023. Prices dropped 0.5% in October, marking the fourth consecutive month of declines, the agency said.

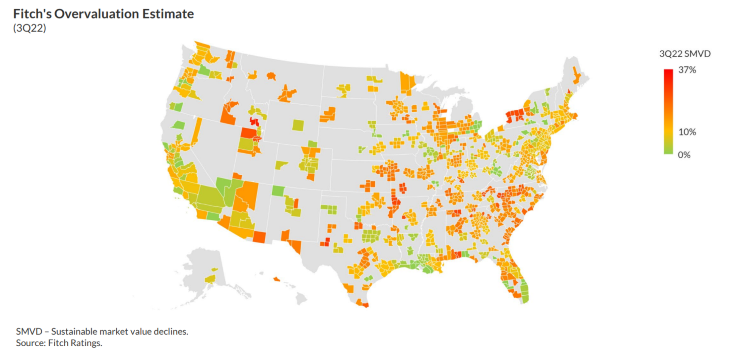

“Overvaluation is shifting from the West Coast to the East,” Fitch said in the report, titled “U.S. RMBS Sustainable Home Price Report (Fourth-Quarter 2022)." As of the third quarter, the report continued, “the most overvalued states were Hawaii, South Carolina, and North Carolina vs. Idaho and Nevada a year prior.”

Among the top 100 most populated metropolitan statistical areas (MSAs), the report estimates that Buffalo-Cheektowaga-Niagara Falls, N.Y., is the most overvalued, followed by Fayetteville-Springdale-Rogers, Ark.-Mo., and Rochester, N.Y. A year ago, Boise City, Idaho, was the most overvalued MSA, Fitch said.

High mortgage rates continue to pressure home prices, Fitch said, noting that 30-year fixed mortgage rates reached 6.33% as of Jan. 12, up from 6.27% two weeks prior, according to Freddie Mac. The housing market remains stagnant, with declining sales, low inventory, and falling prices. Both homebuying and home-selling sentiment are significantly lower than in 2022, according to Fannie Mae.

Fitch said it expects nominal home-price growth to slow substantially in 2023 due to cooling demand and worsening affordability. Fitch’s Global Housing and Mortgage Outlook forecasts nominal national home prices to fall by between 0% and 5% in 2023, with a 30-year mortgage rate remaining between 6.5% to 7%.

Fitch added, however, that uncertainty driven by high inflation and federal interest rate hikes will intensify the volatility of mortgage rates and the downside risk in 2023.

On the supply side, Fitch said it does not expect a sharp drop in the near term, with active listings in the 50 largest U.S. metros increasing by 62.8% over the last year and housing completions at a 6% annual increase (as of November 2022), according to Realtor.com.

Last week, Rocket CFO Brian Brown discussed the housing market for 2023 with Fitch. He predicts a 5% drop in home prices and first-time home buyers will be a major purchasing segment.