Fuel, Food, and Shelter Drive Consumer Price Index Spike

Gasoline prices fuel more than half the increase; Federal Reserve faces pressure ahead of upcoming interest rate decision.

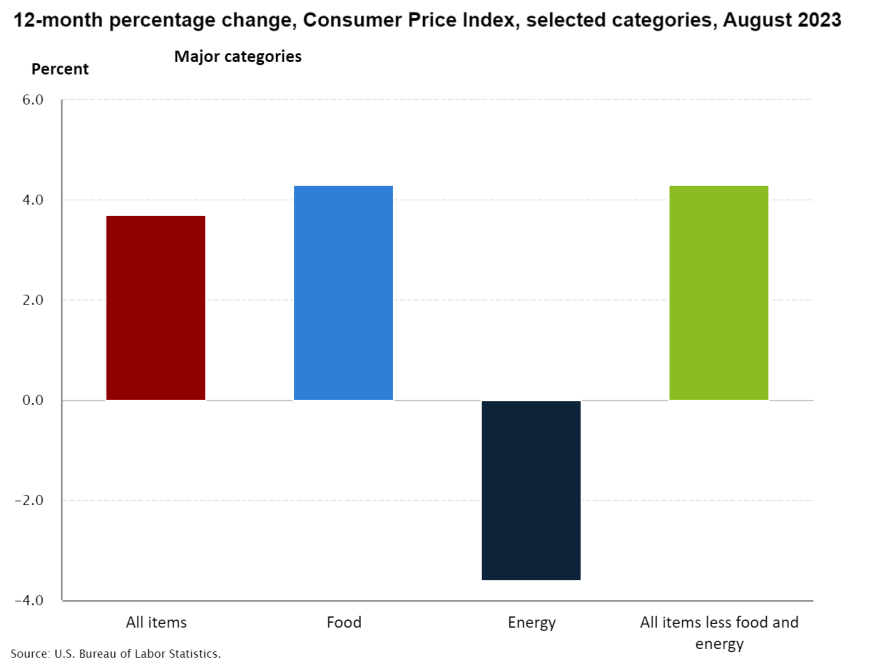

The Consumer Price Index increased again in August as consumers saw higher prices on energy, shelter, and food.

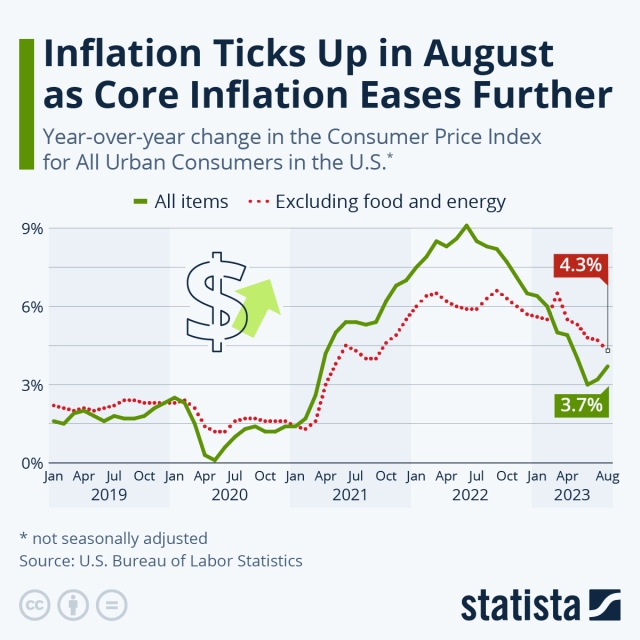

The CPI, which measures costs across a broad variety of goods and services, rose a seasonally adjusted 0.6% for the month, and was up 3.7% from a year ago, the U.S. Department of Labor reported Wednesday.

The report is one of the final inflation reads before the Federal Reserve's interest rate decision next week.

A significant portion of the monthly rise in the all items index can be attributed to the index for gasoline. Gasoline prices played a pivotal role, being responsible for more than half of the overall increase. The shelter index, another significant factor, advanced for the 40th month in a row.

The energy sector saw notable movement in August, with the energy index going up by 5.6%. This rise was consistent across all primary energy component indexes. On the food front, the index marked a 0.2% rise in August, mirroring the figures from July. While the index for food consumed at home observed a 0.2% increase, food consumed away from home saw a slightly higher increase of 0.3%.

First American Economist Ksenia Potapov said inflation data is in line with consensus expectations, but shelter inflation cooling is expected to drag down headline CPI through 2024.

“Shelter accounts for one-third of overall CPI, but lags observed rental and house price increases by approximately 6-12 months. The recent rent and house price declines are only just starting to show up in the CPI and will likely drag down headline CPI through 2024,” Potapov said.

The Federal Reserve's preferred measure of inflation, core inflation, rose 0.3% in August, following a 0.2% increase in July.

Lowering inflation to the Fed's 2% target is expected to be difficult. Goods prices have fallen as pandemic-related supply chain bottlenecks have eased. However, the cost of services have risen sharply, primarily due to rising wages for employees.

"Inflation remains higher than pre-pandemic levels, but shows signs of slowing, especially after stripping out energy prices. Based on the August CPI report, however, it remains likely that the Federal Reserve will hike rates one more time to reach a terminal federal funds rate of 5.6% by the end of the year," Potapov said.