A Gloomy Snapshot Of The Housing Market

3 separate reports show low inventory affecting homebuyers’ perceptions.

- Redfin: New listings fell 25% YOY to the lowest level for any early June on record.

- NAR & Realtor.com: Market missing nearly 320,000 affordable homes.

- Fannie Mae: Home Purchase Sentiment Index fell 1.2 percentage points in May.

Three different housing market reports were released Thursday, and each painted a fairly gloomy picture.

First, digital real estate brokerage Redfin reported that new listings of homes for sale during the four weeks ended June 4 fell 25% year over year to the lowest level of any early June on record.

According to the report, the continued lack of new listings has pushed the total number of homes on the market down by 5% year over year.

Elevated mortgage rates are driving the inventory shortage, Redfin said, with the daily average hitting 6.94% on June 7, near its highest level in two decades. The vast majority of homeowners have a mortgage rate below 6%, discouraging them from listing their homes and giving up their relatively low rates.

Limited inventory is also keeping national home-price declines relatively modest, with the typical U.S. home price down 1.6% year over year. That’s the smallest dip in three months and half the size of April’s 3.2% drop, which was the biggest in at least a decade.

Home prices are still increasing in some parts of the country, Redfin said. The median U.S. asking price is unchanged from a year ago after several weeks of declines, a sign that sellers in at least some metro areas are noticing that they can command favorable prices.

In addition to propping up prices, the lack of listings is limiting purchases, with pending home sales down 17%, continuing a yearlong streak of double-digit drops, the report states.

Still, homebuyers are still out there, Redfin said, noting that its Homebuyer Demand Index — which measures requests for tours and other services from Redfin agents — near its highest level in a year.

“Homes priced under $500,000 are flying off the market because buyers in that price range don’t have many options,” said Sacramento Redfin Premier agent David Orr.

320,000 Affordable Homes Needed

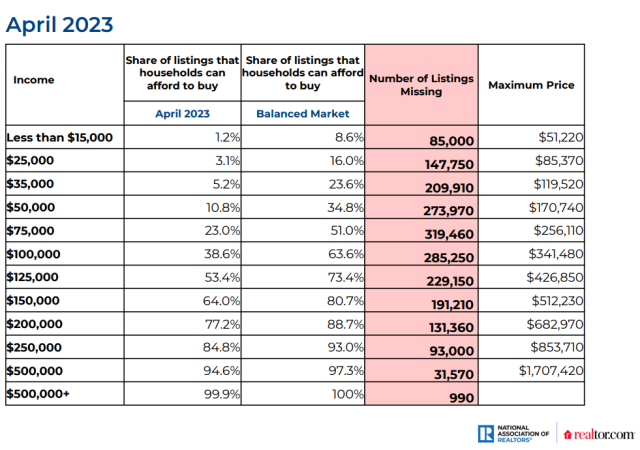

That’s detailed in a housing affordability and supply report released Thursday by the National Association of Realtors (NAR) and Realtor.com, which found that the U.S. housing market needs about 320,000 affordable homes for middle-income buyers.

The country’s persistent housing inventory crunch impacts middle-income buyers more than any other income bracket, the report states.

The NAR and Realtor.com report examines the number of listings missing by price range in the current market when compared to a balanced market. The report defines a balanced market as when half of all available homes fall within the price range affordable for middle-income buyers.

At the end of April 2023, approximately 1.1 million homes were available for sale, up 5 percentage points from a year ago. However, the market is missing almost 320,000 home listings valued up to $256,000, the affordable price range for middle-income buyers or households earning up to $75,000.

As a result, middle-income buyers can afford to buy less than a quarter (23%) of listings in the current market. Five years ago, that income group could afford to buy half of all available homes.

Among the 100 largest metro areas, El Paso, Texas; Boise, Idaho; and Spokane, Wash. have the fewest affordable homes available for middle-income buyers. Three Ohio cities — Youngstown, Akron, and Toledo — have the most affordable homes available for that income group, the report found.

“Middle-income buyers face the largest shortage of homes among all income groups, making it even harder for them to build wealth through homeownership,” said Nadia Evangelou, NAR senior economist and director of real estate research. “A two-fold approach is needed to help with both low affordability and limited housing supply. It’s not just about increasing supply. We must boost the number of homes at the price range that most people can afford to buy.”

'A Bad Time To Buy'

Which may be why Fannie Mae’s monthly Home Purchase Sentiment Index (HPSI) decreased in May by 1.2 percentage points to 65.6, as affordability constraints continued to dampen consumers’ perceptions of homebuying and selling. The full index is down 2.6% year over year.

Four of the HPSI’s six components decreased in May from a month earlier, led by a drop in consumers’ belief that it’s a “good time to buy,” which once again is nearing its survey low.

The “good time to sell” component, however, increased in May to its highest level since last July, Fannie Mae said, adding that for the second straight month, a greater share of consumers said they expect home prices to increase over the next year.

“As we near the end of the spring homebuying season [summer officially begins June 21], the latest HPSI results indicate that affordability hurdles, including high home prices and mortgage rates, remain top of mind for consumers, most of whom continue to tell us it’s a bad time to buy a home but a good time to sell one,” said Mark Palim, Fannie Mae vice president and deputy chief economist. “Consumers also indicated they don’t expect these affordability constraints to improve in the near future, with significant majorities thinking that both home prices and mortgage rates will either increase or remain the same over the next year.”

Palim noted that the same factors affecting affordability may also be affecting the “perceived ease” of getting a mortgage.

“This was particularly true,” he added, “among renters: 81% believe it would be difficult to get a mortgage today, matching a survey high.”