Growing Majority Of Baby Boomers Plan To Age In Place

Empty-nesters own twice as many large homes as millennials

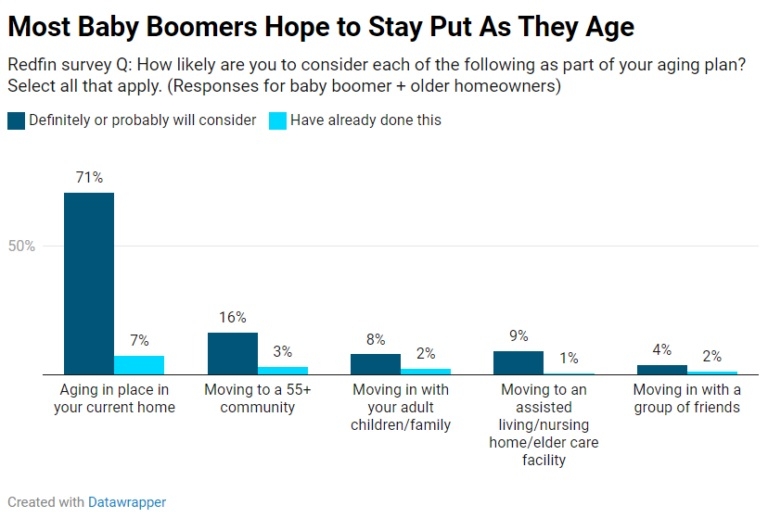

The number of older Americans planning to remain in their current homes as they age is increasing, according to recent data released by Redfin.

The real estate company surveyed baby boomers (60-78 years old) and a small segment of the silent generation (ages 79 and up) in February 2024. Findings indicate that 78% of older homeowners plan to stay in their current homes as they age. The next most common plan is moving to a 55-plus community, with 20% of respondents planning to or having already done so. A smaller group (10%) said they plan to move in with adult children, and 6% plan to move in with friends.

There were 838 respondents representing the baby boomer generation and 62 respondents from the Silent Generation, all of whom are homeowners.

The results from baby boomers who rent their homes were similar, according to Redfin analysts.

“Aging in place is already contributing to the housing shortage, and is likely to continue doing so. The fact that the vast majority of baby boomer homeowners plan to age in place could prolong the shortage of homes for sale,” Redfin data journalist Dana Anderson commented in her report.

Freddie Mac surveyed 55 and older on their housing plans in 2021, comparing the results with the same survey performed in 2016. In 2016, 63% of respondents planned to age in place, while that percentage increased to 66% in 2021.

Baby boomers staying put is one reason inventory remains at historic lows, according to a separate Redfin analysis. It found that empty-nest baby boomers own 28% of U.S. homes with three or more bedrooms, while millennials with kids own just 14% of this stock. Furthermore, nearly 80% of boomers own the home they live in, compared to 55% of millennials. More than half (51%) of baby boomers who are planning to age in place say it’s because they like their home and have no reason to move, according to the same Redfin survey. More than a quarter (27%) say it’s because their home is completely or almost paid off, and roughly one in five (21%) are staying put because home prices are still too high.

Analysts say baby boomers are holding onto their homes largely because there’s not much financial incentive to let go of them. Most (54%) who own homes have no mortgage, and for those who do have a mortgage, nearly all bear a much lower interest rate than they would if they sold and bought a new home.

“Older Americans are aging in place because it makes financial sense, but also because it’s human nature to avoid thinking about challenging scenarios such as needing help as you get older,” Redfin Chief Economist Daryl Fairweather said. “In reality, many homeowners and renters will need to move somewhere that better meets their needs as they age, like a senior-living community or a one-story home in an accessible neighborhood. But the government isn’t prioritizing building housing for seniors, which is further encouraging older Americans to stay put, exacerbating the inventory shortage. Politicians should focus on expanding housing stock that meets the needs of older Americans, which could help with housing affordability and availability for all.”