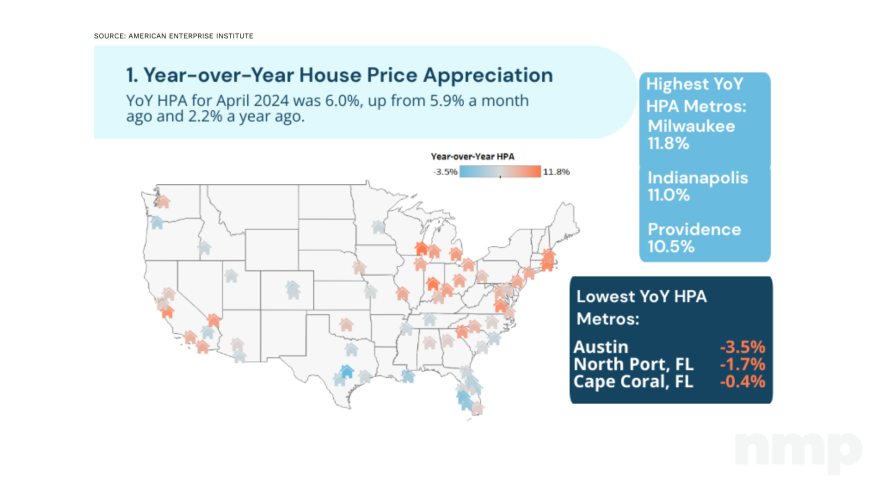

Home Price Appreciation Reaches 6% In April

AEI Housing Center expects strong HPA into June

Home price appreciation (HPA) is projected to remain around 6% through June, despite mortgage rates still hovering above 7% and a quieter-than-normal spring homebuying season.

Year-over-year HPA for April 2024 was 6%, up from 5.9% in March and 2.2% in April 2023, according to a new report from the American Enterprise Institute (AEI) Housing Center.

“Despite subdued purchase activity and relatively high rates, YOY HPA remains strong, largely due to buyers being well-qualified and continued competition due to a strong sellers’ market,” AEI Housing Center Senior Fellows and Co-directors Edward Pinto and Tobias Peter said in their report.

April’s year-over-year HPA varied significantly among the 60 largest metros, ranging from -3.5% in Austin (-6.9% inflation-adjusted) to 11.8% in Indianapolis (+8.4% inflation-adjusted). Notably, Austin is down significantly from its April 2022 peak of 10.6%.

By region, HPA ranged from 8.5% in the Northeast to 5% in the South (a decline largely driven by Florida metros). The West’s HPA has recovered from its -3.7% low in April 2023 to this April’s 5.2% YOY.

Historically, the low price tier HPA has outpaced those in the upper price tiers. This trend continued in April, with year-over-year HPA up 8% and 5.3% for the low price tier and high price tier, respectively.

Months’ supply stood at 2.9 months in April 2024, down from 3.5 months in March 2024 and 3.5 months in April 2019. Low levels of supply continue to signal a strong seller’s market, analysts said. The months’ supply for the low price tier came in at 1.9 months in April 2024, helping to explain the 8% year-over-year price growth for this tier.