Millennials are cynical on homebuying, according to an Alkami report.

Economists say the country is in the midst of the greatest intergenerational wealth transfer in history. In the next few years, millennials are expected to become the nation’s wealth holders, so financial institutions may find it prudent to study up on generational trends by taking a look at Alkami’s digital banking study.

Alkami, a fintech provider for regional banks and credit unions, published “Generational Trends in Digital Banking Study” that specifically looks at how banks and credit unions can attract and retain millennials. It outlines five major insights from analyzing their financial history and current financial landscape.

The first insight exposes “the truth about millennials” which is that many are traumatized from economic disasters of the past, spanning from 9/11 and the rapid adoption of the internet to the Great Recession and being adults during COVID-19. One of the generation’s most formative events, from a financial perspective, was coming of age during and around the Great Recession. Many crashed right into a rising cost of living, large student debt, and rising unemployment, the study noted.

Currently, millennials are still going through a difficult generational period driven by the rapidly rising interest rate environment. This comes at a time when many millennials are in their key careers and should be earning more for it.

The national study showed 73% of millennials (ages 28-44) say the rising interest rate environment has significantly impacted their standards of living, which is significantly more than Gen Xers and baby boomers. A whopping 65% of millennials report “they feel” they are living paycheck to paycheck, and over a quarter (26%) of millennials say that buying a home hinders wealth, as opposed to building it.

Ten years after the recession, the Federal Reserve Bank of St. Louis reported millennials are at risk of becoming a “lost generation” for wealth accumulation. It reported a statistic that, most likely, no millennial wants to hear: had the recession never occurred, millennials’ wealth levels would be 34% higher than where they are now.

The second insight is that half of millennials consider a major national bank or credit union their primary financial institution. That also means that half of millennials consider institutions not viewed as a major national bank or credit union as their primary financial institution. Essentially, millennials are very much “up for grabs,” as the study puts it, and open to working with all kinds of lending institutions.

Looking ahead, 30% of millennials plan to grow the number of financial providers with whom they have a financial relationship over the next twelve months. Compared to Gen Xers and baby boomers, Millennials are two-and-a-half times more likely to grow the number of financial providers over the next year.

Thirdly, the study found that adding millennial market share can lead to above-average financial product additions. The national study revealed that millennials have 14% and 28% more products with their personal financial institution than Gen Xers and baby boomers, respectively.

But any company looking to gain market share will have to act quickly. The study’s survey showed that millennials are 56% more likely to grow their relationship with their primary financial institution over the next twelve months than Gen Xers and baby boomers.

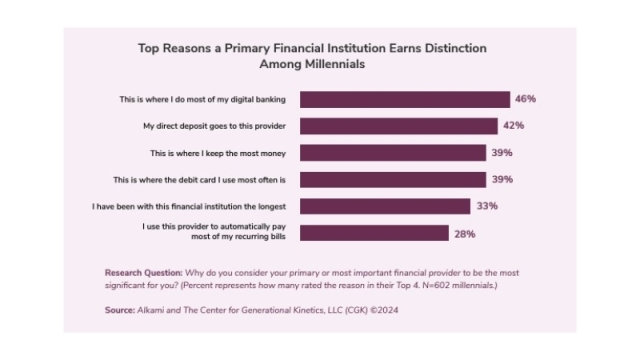

The fourth insight provides the key to unlock more millennial market share, and it starts with digital banking. The study found that millennials primarily define their personal financial institution as the one “where they do most of their online or mobile banking” (cited by 46% of them as one of their top four reasons). This shows the direct connection between the digital banking platform and how millennials view banking in general.

The last major insight from the study reveals personalization is more important to millennials than to any other generation, including Gen Z. They’re significantly more likely than any other generation to wish that their financial provider offered a more personalized digital banking experience (55%).

Additionally, millennials are much less skeptical of artificial intelligence (AI). They study finds they’re significantly more likely than any other generation to be comfortable with their financial data being processed by AI if it gives them a better banking experience (51%).