Homebuyers Challenged By Mortgage Rate 'Whiplash'

Redfin says a house hunter looking for a $500,000 home saw their potential total mortgage payment decrease $64,000 from July to August, but jump up $118,000 from August to September.

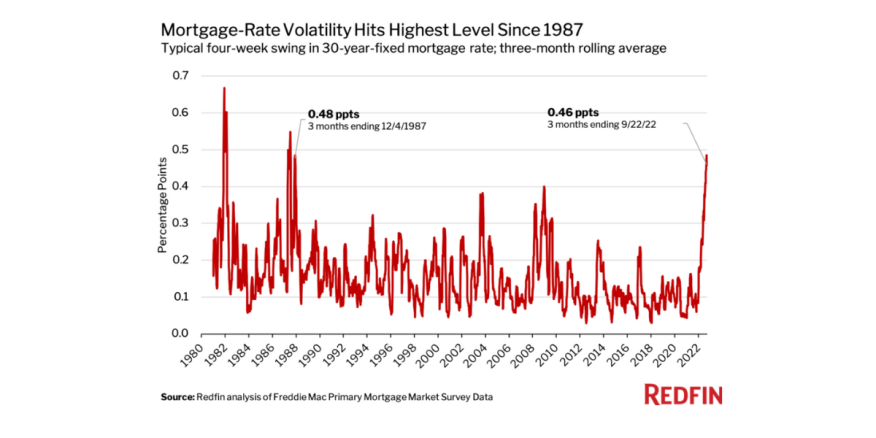

- Homebuyers who started shopping in July saw their potential mortgage rate fluctuate by roughly half a percentage point every four weeks.

- Last week, the Fed increased interest rates by three-quarters of a percentage point to a range of 3% to 3.25%, and predicted they’ll reach 4.4% by the end of the year.

House hunters have faced all kinds of challenges in the past couple of months, but the worst might just be mortgage rate "whiplash."

The typical house hunter who started searching in July and closed the deal on a new home in September saw their potential mortgage rate fluctuate by roughly half of a percentage point every four weeks, according to a new report from Redfin.

That marks the most volatile three-month period since 1987, when mortgage rates swung wildly after surging to a record high of nearly 19% earlier in the decade.

A typical buyer’s total expected payment declined by about $64,000 (5.8%) from July to August, and then shot back up by about $118,000 (11.4%) from August to September.

The report noted that, for a house hunter looking to buy a $500,000 home, this could mean that:

- When a buyer started looking in early July, they expected their monthly payment to be $3,051. That equates to a total of $1.098 million over 30 years, assuming a 20% down payment and the prevailing 5.7% mortgage interest rate. Of that total payment, $435,777 is interest.

- When a buyer found their dream home in early August, they expected their monthly payment to be $2,874. That equates to a total of $1.035 million over 30 years, assuming a 20% down payment and the prevailing 4.99% mortgage rate. Of that total payment, $372,143 is interest.

- When they locked in a mortgage rate for the home in late September, their final monthly payment turned out to be $3,202. That equates to a total of $1.153 million over 30 years, assuming a 20% down payment and the prevailing 6.29% mortgage rate. Of that total payment, $490,382 is interest.

“The challenges homebuyers face in today’s market go beyond the dwindling affordability caused by high mortgage rates and home prices,” said Redfin Deputy Chief Economist Taylor Marr. “The whiplash in mortgage rates between when homebuyers set their budget and when they make an offer is also making it extraordinarily difficult to plan ahead.”

Mortgage rates are seeing drastic change due to the Federal Reserve raising its federal funds\ rate as it works to control inflation. Last week, the Fed increased its benchmark interest rate by three-quarters of a percentage point, to a range of 3% to 3.25%, and predicted it'll reach 4.4% by the end of the year.

The volatility in mortgage rates will likely persevere in the near term, but mortgage rates should fall in the next 12 to 18 months if inflation eases as expected, according to Justin Dimler of Bay Equity, Redfin’s mortgage company.

“The good news for people who can still afford to buy a home and are set on making a purchase now is that they should be able to refinance to a lower rate in a year or two,” said Dimler, a regional sales manager at Bay Equity in the Seattle area. “I advise house hunters who qualified for a loan one or two months ago to get requalified by their mortgage adviser because the change in mortgage rates may mean they’re no longer eligible to borrow as much as before.”