Homebuyers In Past 2 Years Don’t Regret Buying

LendingTree survey finds one in five have issues with appraisals, though.

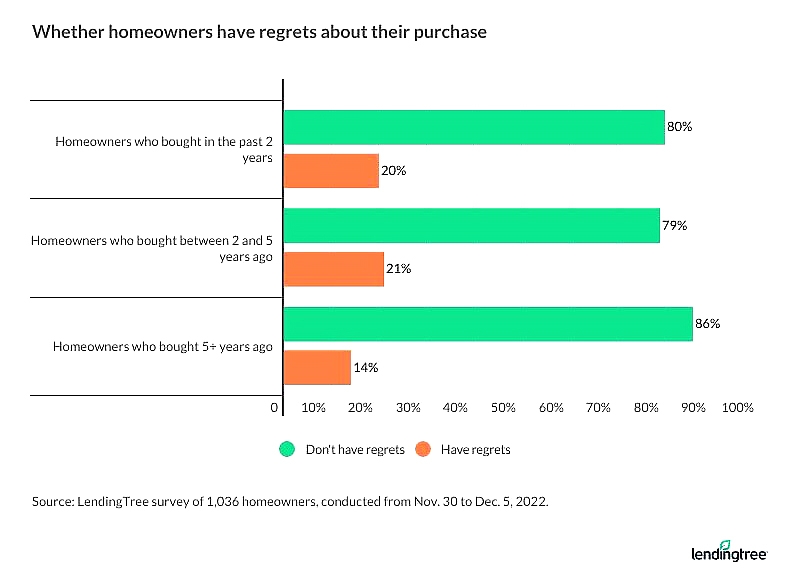

Over 80% of homebuyers don’t regret purchasing their homes in the last two years, despite a tough market and making significant compromises, according to a new LendingTree survey.

The high satisfaction rate amid the hot market makes sense, says Jacob Channel, LendingTree senior economist. Given the market climate, prospective homeowners were willing to do what it took to buy a home. And with low-interest rates in 2020 and 2021, buyers could make financial compromises to guarantee their purchase, he says.

Among the key findings of the survey of 1,000 purchasers:

- Despite housing market headwinds, most recent homebuyers don’t regret buying. 80% of buyers in the past two years don’t regret their most recent home purchase, but remorse fluctuates by generation. Baby boomers — regardless of when they bought their home — are most likely to report no regrets (90%), versus 80% of Gen Zers and Gen Xers.

- The recent hot housing market fueled price competition. Homebuyers in the past two years are more than five times as likely to have paid over listing price than those who purchased their home more than five years ago — 27% versus 5%. Meanwhile, bidding wars were reported at more than double the rate. 8% of buyers in the past two years say they entered a bidding war, versus 3% who bought more than five years ago.

- Appraisals are having a growing impact on mortgage approvals, possibly because of those rising home prices. Among those who bought their home in the past two years, 22% say they had issues getting their mortgage because of appraisal values. That’s compared with the 14% who bought between two and five years ago and the 7% who bought more than five years ago.

- As market prices changed, so did the homebuying process. More than a quarter (27%) of homebuyers from the past two years say they put in an offer on a home without seeing the interior in person. Only 7% of homeowners who purchased their home more than five years ago say they took that same leap of faith.

- Buyers are not only turning a blind eye to the physical appearance of a home, but they’re also ignoring the problems that could be hiding behind the walls. Buyers from the past two years are twice as likely to have opted out of an inspection for their new homes than buyers from more than five years ago — 24% versus 12%.

Younger buyers are more likely to run into appraisal issues: 19% of GenZers and 17% of millennials report financing issues because of the appraisal. Consequently, they were also more likely to include an appraisal gap clause, with 8% of GenZers and 4% of millennials saying they had one in their offer.

Baby boomers are least likely to encounter appraisal issues, with only 3% saying they had a problem. Naturally, they are also least likely to include an appraisal gap clause, with only 1% reporting they included one in their offer.