Housing Confidence Continues Upward Trend

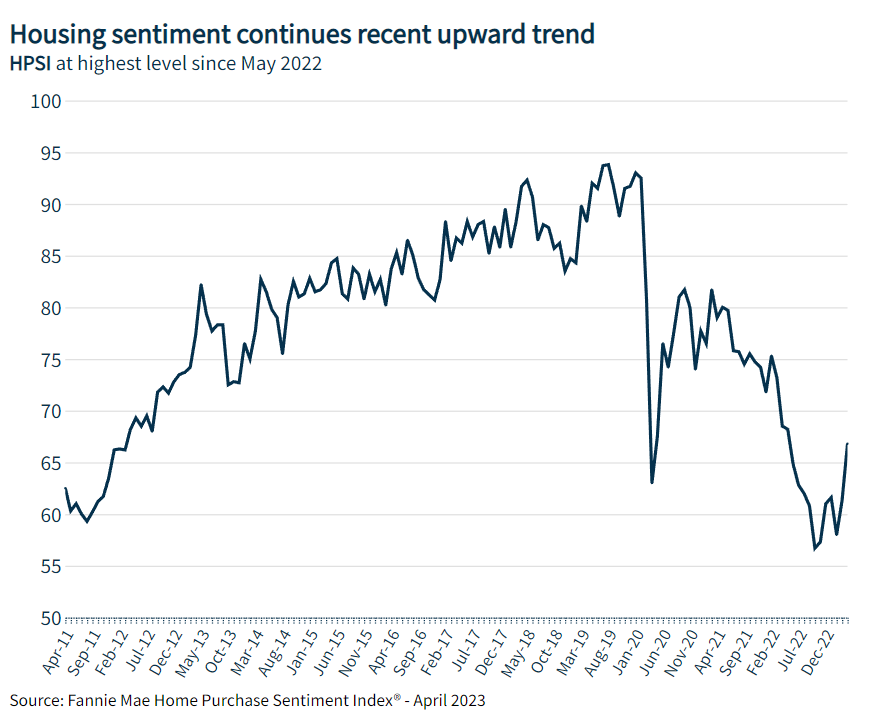

Fannie Mae index climbs to highest level since May 2022.

- Fannie Mae's HPSI increased in April to its highest level since May 2022, jumping 5.5 points to 66.8.

- 22% of consumers indicated that they expect mortgage rates to go down, compared to only 12% last month.

- Only 23% of respondents indicating it’s a good time to buy a home.

If you needed more evidence that the housing market is sensitive to what happens with mortgage rates, Fannie Mae’s latest Home Purchase Sentiment Index (HPSI) provides more evidence.

The HPSI increased in April to its highest level since May 2022, jumping 5.5 points to 66.8, Fannie Mae said Monday. All six of the HPSI’s components increased month over month, most notably the component associated with consumers’ expectations of mortgage rates.

While the component remained negative on net — meaning more respondents expected mortgage rates to go up over the next year — in April, 22% of consumers indicated that they expect mortgage rates to go down, compared to only 12% last month.

Affordability constraints, though, continue to hinder overall home-buying sentiment, with only 23% of respondents indicating it’s a good time to buy a home, while a plurality once again believe that home prices will increase over the next 12 months. Year over year, the full index is down 1.7 points.

“This month’s increase in the HPSI was the largest in over two years, primarily driven by consumers’ more optimistic mortgage rate expectations,” said Doug Duncan, Fannie Mae senior vice president and chief economist. “An increased number of respondents indicated they think mortgage rates will go down over the next year, a belief that could be due to a combination of factors, including an awareness of decelerating inflation, market suggestions that monetary conditions will ease in the not-too-distant future, and, of course, actual mortgage rate declines during the month.”

Duncan noted, however, that the “bump in optimism may prove to be temporary, as consumers continue to report uncertainty about the direction of home prices — and we know that high home prices remain the primary reason given by consumers who think it’s a bad time to buy a home. Until affordability improves for a larger swath of the homebuying public, we believe home sales will remain subdued compared to previous years.”

Key Highlights

- Good/Bad Time to Buy: The percentage of respondents who said it’s a good time to buy a home increased from 20% to 23%, while the percentage who said it’s a bad time to buy decreased from 79% to 77%. The net share of those who said it’s a good time to buy increased 6 percentage points month over month.

- Good/Bad Time to Sell: The percentage of respondents who said it's a good time to sell a home increased from 58% to 62%, while the percentage who said it’s a bad time to sell decreased from 40% to 38%. The net share of those who said it's a good time to sell increased 5 percentage points month over month.

- Home Price Expectations: The percentage of respondents who said home prices will go up in the next 12 months increased from 32% to 37%, while the percentage who said they will go down increased from 31% to 32%. The share who think home prices will stay the same decreased from 35% to 31%. As a result, the net share of those who said home prices will go up increased 5 percentage points month over month.

- Mortgage Rate Expectations: The percentage of respondents who said mortgage rates will go down in the next 12 months increased from 12% to 22%, while the percentage who expect rates to go up decreased from 51% to 47%. The share who think mortgage rates will stay the same decreased from 34% to 31%. As a result, the net share of those who said mortgage rates will go down over the next 12 months increased 13 percentage points month over month.

- Job Loss Concern: The percentage of respondents who said they are not concerned about losing their job in the next 12 months increased from 78% to 79%, while the percentage who said they are concerned remained unchanged at 21%. As a result, the net share of those who said they are not concerned about losing their job increased 1 percentage point month over month.

- Household Income: The percentage of respondents who said their household income is significantly higher than it was 12 months ago increased from 20% to 24%, while the percentage who said their household income is significantly lower remained unchanged at 11%. The percentage who said their household income is about the same decreased from 68% to 64%. As a result, the net share of those who said their household income is significantly higher than it was 12 months ago increased 4 percentage points month over month.

Methodology

Fannie Mae’s HPSI distills information about consumers’ home purchase sentiment from Fannie Mae’s National Housing Survey (NHS) into a single number. The HPSI reflects consumers’ current views and forward-looking expectations of housing market conditions and complements existing data sources to inform housing-related analysis and decision making.

The HPSI is constructed from answers to six NHS questions that solicit consumers’ evaluations of housing market conditions and address topics that are related to their home purchase decisions. The questions ask consumers whether they think that it's a good or bad time to buy or to sell a house, what direction they expect home prices and mortgage interest rates to move, how concerned they are about losing their jobs, and whether their incomes are higher than they were a year earlier.

The NHS is a monthly attitudinal survey, launched in 2010, which polls the adult general population of the United States to assess their attitudes toward owning and renting a home, purchase and rental prices, household finances, and overall confidence in the economy. Each respondent is asked more than 100 questions, making it one of the most detailed attitudinal longitudinal surveys of its kind, to track attitudinal shifts, six of which are used to construct the HPSI (findings are compared with the same survey conducted monthly beginning June 2010).

The April 2023 National Housing Survey was conducted between April 1-19, 2023. Most of the data collection occurred during the first two weeks of this period. It was conducted exclusively through AmeriSpeak, NORC at the University of Chicago’s probability-based panel, on behalf of PSB Insights and in coordination with Fannie Mae.