Housing Market Witnesses First Monthly Sales Gain Since February

Despite monthly gains, all regions report year-over-year transaction declines; housing market recovery stagnates amid lack of supply.

The National Association of Realtors (NAR) reported a slight increase in pending home sales for June, the first monthly gain since February.

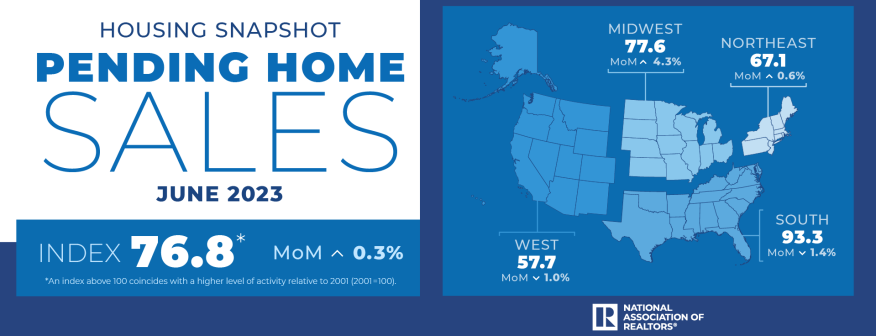

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, rose by a modest 0.3% to 76.8 in June.

Despite the rise, all four U.S. regions experienced year-over-year declines in transactions. The South and West reported monthly losses, while the Northeast and Midwest saw growth in sales.

"The housing recession is over, but the recovery has not taken place," said Lawrence Yun, NAR's chief economist. He attributed the stagnation to a lack of inventory in the face of increasing demand, evidenced by the presence of multiple offers on available homes.

"It is critical to expand supply as much as possible to widen access to homebuying for more Americans," Yun said. "Home prices will be influenced by how much inventory is brought to market. Increased homebuilding will tame price growth, while limited construction will lead to home price appreciation outpacing income growth."

NAR projects a 12.9% decrease in existing home sales in 2023, followed by a 15.5% increase in 2024. The national median existing-home price is expected to decline slightly by 0.4% to $384,900 before rebounding to $395,000 next year.

In terms of regional changes, the West is anticipated to see reduced prices, while the Midwest could see a small increase. Yun stressed the necessity of expanding supply to ensure accessible home buying for more Americans.

Despite the current market volatility, Yun remains optimistic about the housing market's future, expecting mortgage rates to decline due to recent calming in consumer price inflation and ongoing job additions. "Any meaningful decline in mortgage rates could lead to a rush of buyers later in the year and into the next," he added.

NAR forecasts that the 30-year fixed mortgage rate will hit 6.4% this year and then decline to 6% in 2024, while the unemployment rate will rise slightly to 3.7% in 2023 before increasing to 4.1% in 2024.

Due to increased inventory, sales of newly constructed homes are expected to rise by 12.3% in 2023 to 720,000. The median new home price will decrease slightly by 1.9% this year to $449,100, before increasing by 4.2% next year to $468,000.

As for regional breakdowns in pending home sales, the Northeast PHSI climbed by 0.6% from last month to 67.1, while the Midwest index jumped 4.3% to 77.6. Conversely, the South PHSI decreased 1.4% to 93.3, and the West index fell 1.0% to 57.7.