Housing Starts Surge Nearly 22% In May

Permits, completions also rise as market enters 'prime season'

- Construction of new privately owned housing surged 21.7% in May.

- The number of privately owned housing units authorized by building permits in May rose 5.2% from April.

- Housing completions rose 9.5% in May from April.

Housing construction blossomed in May.

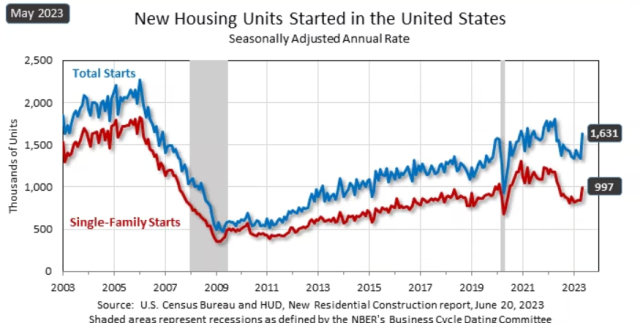

Construction of new privately owned housing surged 21.7% in May to a seasonally adjusted annual rate of 1.63 million, according to a report released Tuesday by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development.

That was up from the revised April estimate of 1.34 million, and up 5.7% from 1.54 million a year earlier. The April revision changed what had initially been reported as an increase to a decrease from a month earlier.

Both single-family and multi-family housing saw strong monthly increases. Buildings with five units or more were started at a rate of 624,000, up 28.1% from the revised estimate of 487,000 in April, and up nearly 40% from a year earlier.

Single‐family housing starts in May were at a rate of 997,000, up 18.5% from the revised April figure of 841,000, but down 6.6% from a year earlier.

Nationwide, three of the four regions saw both monthly and annual increases in starts, led by the Midwest, which was up 66.9% from April and up 24.2% year over year. Starts were also up in the South (up 20.3% from April and 6.7% YoY), and the West (+16.4% from April and 1.2% YoY). Starts fell in the Northeast, dropping 18.7% from April and 21.9% YoY.

Permits, Completions Rise

The number of privately owned housing units authorized by building permits in May also increased, rising to a seasonally adjusted annual rate of 1.49 million. That was up 5.2% from the revised April rate of 1.42 million, but still 12.7% below the May 2022 rate of 1.71 million.

Single‐family authorizations in May increased 4.8% to 897,000 from the revised April figure of 856,000.

Authorizations for buildings with five units or more were at a rate of 542,000 in May, up 7.8% from April but down nearly 12% from a year earlier.

Permits increased in all four regions, led by a 27.1% increase in the Northeast.

Privately owned housing completions in May also increased, rising to a seasonally adjusted annual rate of 1.52 million, up 9.5% from the revised April estimate of 1.39 million and 5% above the May 2022 rate of 1.45 million.

Single‐family housing completions in May were at a rate of 1.01 million, up 3.9% from the revised April rate of 971,000, but down 3.3% from a year earlier.

The May rate for buildings with five units or more was 493,000, up 24.2% from April and up 23.9% from a year earlier.

Watch it on The Interest: Builder Sentiment Optimistic

Prime Season

George Ratiu, chief economist at Keeping Current Matters, said housing construction is entering its prime season, since warmer weather makes completing projects easier, but there are other reasons for the surge in new construction.

“Market dynamics have turned the tides in builders’ favor over the past 12 months, as homebuyers frustrated with still-limited existing inventory take a closer look at new homes,” Ratiu said.

“After spending the fall and winter of 2022 fretting over declining buyer traffic and rising concessions, new home builders are finding 2023’s housing market more buoyant,” he continued. “After stepping back from the market in the second half of 2022 due to the shock of surging mortgage rates, homebuyers have accepted the new normal interest range of 6%-7%. With redefined budgets, buyers are looking for their first or next home. In light of tight supply in the existing market, more buyers are visiting builders’ model homes, attracted by availability, new technology, higher efficiency, and the benefit of a warranty.”

Homebuilders, he noted, have welcomed the shift in buyer traffic, as shown by the six consecutive months of improvement in the NAHB/Wells Fargo Housing Market Index. The May index reading reached the highest point since August 2022.

“For buyers and homeowners looking to move, the pipeline of new homes opens doors toward more options,” Ratiu said. “While most new homes coming to market are not affordable to entry-level buyers, repeat buyers or those with stronger finances may find more options in builders’ catalogs of upcoming floorplans and new neighborhoods. In addition, some builders may offer more flexibility with financing terms, offering a viable solution for those hampered by today’s higher mortgage rates.”