ICE Uncovers Hidden Costs Eroding Lender Profits

ICE whitepaper finds mortgage fee cures cost $1,225 per loan, on average.

A whitepaper from Intercontinental Exchange, Inc (NYSE:ICE), a global provider of technology and data, exposes the hidden costs of mortgage fee cures based on an analysis of preventable expenses eating away at mortgage lender profits.

The TILA-RESPA Integrated Disclosure (TRID) rule, also called the “know before you owe” rule among borrowers, requires mortgage lenders to provide borrowers with a detailed account of the costs and fees associated with their purchase or refinance. The lender is responsible for detecting and rectifying any errors made in the disclosure. Depending on the specifics of the error, lenders may be required to pay the difference between the disclosed and updated costs.

As originations begin lifting off from a 30-year low, Tim Bowler, president of ICE Mortgage Technology, emphasized the importance of lenders being diligent and efficient in correcting those errors, saying that "Every basis point counts."

“Unfortunately, fee cures and the costs associated with them – entirely preventable expenses – are contributing to the already ballooning cost to originate a mortgage,” Bowler said.

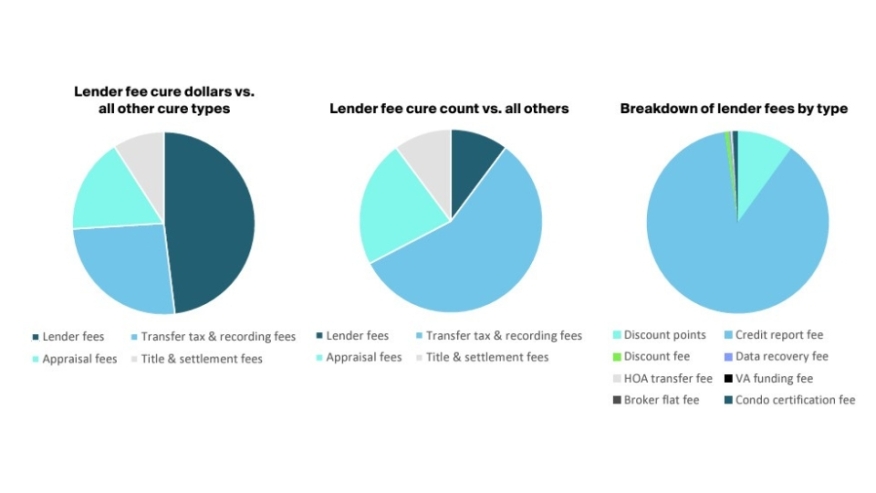

A major paint point for lenders is keeping track of frequently changing closing costs and especially transfer taxes. Failing to keep up with those changes could lead to further runup costs.

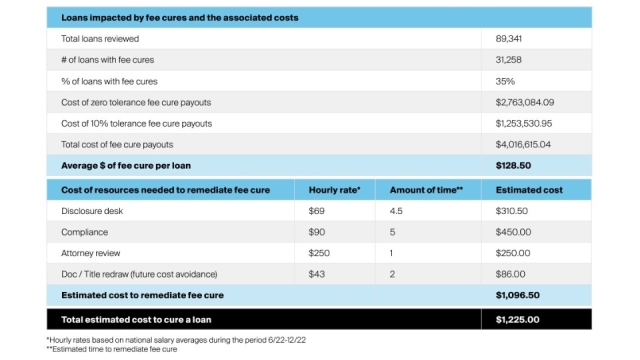

Anecdotal evidence suggests that fee cures are cutting into origination revenue. An ICE review of nearly 90,000 mortgages found an average $1,225 per loan wasted on fee cures and related expenses.

The whitepaper calls the prevalence of such fee cures – a significant amount when extrapolated over a lender’s entire pipeline – “startling.” Over a period of six months, the study also found that more than one-third of loans reviewed in the study required some type of fee cure.

After looking at more than 31,000 transfer tax changes documented by ICE Fee Solutions from 2021 through early 2023, it appears the trend is accelerating. These changes can have short implementation timelines, variable schedules, and substantial fee increases, all of which pose operational challenges for lenders trying to rapidly document these changes.