Industry Input Sought On Proposed Increases To Mortgage Licensing Fees

Conference of State Bank Supervisors seeking public comment on proposed increases

It soon could cost more to be a mortgage originator.

The legal system of record for mortgage licensing in the U.S. may increase fees for the first time in its 16-year history, but its parent organization is gauging industry opinion first. The Conference of State Bank Supervisors (CSBS) has issued a request for public comment on proposed increases to processing fees for the Nationwide Multistate Licensing system (NMLS).

The State Regulatory Registry Board of Managers, which reviews NMLS fees annually, has decided the fee structure needs updating to support ongoing modernization efforts as well as recent increases in inflation and vendor fees. If the proposal is approved, this will mark the first time NMLS fees have changed since the system launched nationwide in 2008.

“NMLS has become a vital tool for the states, consumers, and the 600,000 industry users who depend on it,” CSBS President and CEO Brandon Milhorn said in a statement. “This proposal reflects our commitment to sustain and enhance NMLS while keeping fees as low as possible. The new fee structure will support a responsible and stable NMLS budget, while sharing the cost of system enhancements fairly with industry.”

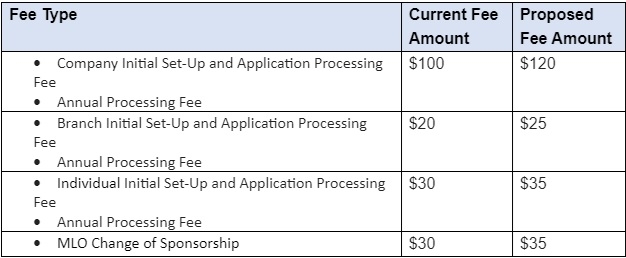

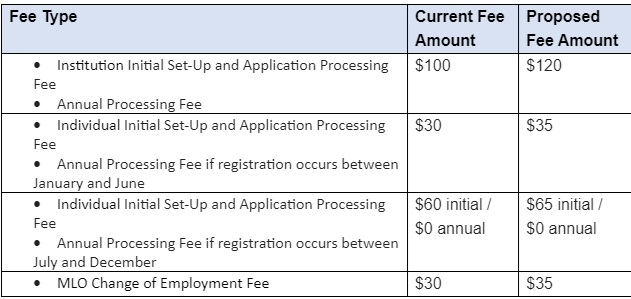

The proposed fee changes are as follows:

NMLS Processing Fees For State Licensure

NMLS Processing Fees For Federal Registration

The CSBS is specifically looking for industry input related to the following questions:

- Do you anticipate these fee changes affecting staffing plans for your company?

- Does your company pay licensing-related fees on behalf of MLOs? a. If yes, will this fee change affect whether you pay licensing-related fees for your company’s MLOs?

- Does your company pay licensing-related fees on behalf of non-MLO employees/contractors? a. If yes, will this fee change affect whether you pay licensing-related fees for your company’s non-MLO employees or contractors (e.g., branch fees, etc.)?

Comments should be emailed to [email protected], by July 22 at 5 p.m. EDT.