CFPB Unveils Lender Naughty List For Repeat Offenders

CFPB calls out nonbanks that have broken consumer protection laws

The Consumer Financial Protection Bureau (CFPB) is cracking down on corporate repeat offenders after finalizing plans June 3 to create a registry of nonbank financial companies that have broken consumer protection laws. The registry will also be made public to help not just the CFPB, but also to assist investors, creditors, business partners, and consumers in identifying repeat offenders.

The new rule requires nonbank companies hit with local, state, or federal consumer protection-related court or agency enforcement orders to register with the CFPB and a senior executive from the company to attest the company is not still offending.

“This is the first ever rule under the CFPB’s authority to register nonbank companies,” CFPB Director Rohit Chopra said in a public statement. “The registry will help the CFPB and other law enforcement agencies monitor and track repeat offenders in order to better hold them accountable if they break the law again.”

The new registry is part of the agency’s ongoing effort to hold lawbreaking companies accountable and stop corporate recidivism, meaning repeat offenders. The CFPB is fed up with the rinse-and-repeat cycle of illegality in which fraudsters and scam artists get caught in one part of the country and restart their scheme in a new place.

“This order is not some sort of tipsheet or set of suggestions,” Chopra added in his statement. “It carries the force of law and binds the company, its executives, and its board of directors.”

The CFPB expects that the registry will be used by state attorneys general, state regulators, and a range of other law enforcement agencies. The registry will also assist investors, creditors, business partners, and members of the public that are conducting due diligence or research on financial firms bound by law enforcement orders.

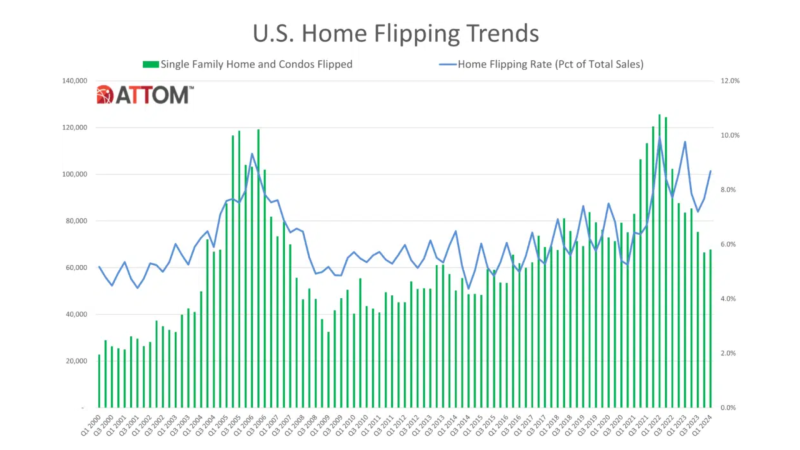

Chopra referenced the housing crisis and Great Recession in his statement, claiming that states had attempted to stop many of the abuses in the mortgage market during the early 2000s, including those perpetrated by nonbanks, but were consistently rebuffed by federal regulators.

“Had a registry, such as the one today’s rule establishes, been around in the early 2000s, many of the concerns identified by state regulators would have been undeniable,” Chopra said.

Industry Reaction & Lenders Compliance Group

Lenders Compliance Group, a mortgage risk management firm in New York, stated that they’ve gotten so many calls from lenders regarding the CFPB’s new registry over the past few days, they had to double up the reception team.

One inquiry the group received shows how some nonbank executives are reacting to the news.

“I am really angry about this,” the original poster (OP) wrote to the compliance group, June 6. “And I am turning to you for feedback. This type of filing could crush our business reputation.”

The author, who claims to be the president of a nonbank for 20 years running, said that their company is going to be considered “repeat offenders” by the CFPB because of “a few violations,” which were not specified in OPs inquiry. OP explained how that label would damage the company’s reputation, causing “the whole world” to view them as “repeat offenders.”

“Our lawyers are telling us how to manage the situation legally,” OP said. “But all I’m hearing is there’s nothing we can do but accept that we are going to be called ‘repeat offenders.’ One of our lawyers used a fancy word, saying we are a ‘recidivist’ company. Is that word supposed to make me feel better?”

The group did address OP’s question extensively; first, by explaining that “repeat offender” terminology is not new. Since 2022, the CFPB has had a Repeat Offender Unit to review and monitor the activities of repeat offenders, as well as recommend remedies that hold entities accountable for failing to comply with Federal law.

The firm also confirms that the CFPB will make the registry publicly accessible, allowing consumers to identify the entities that are registered with the Bureau.

The group also provided an outline to help lenders identify whether to file with the registry.

An order is covered by the rule if it:

- Is a final public order issued by an agency or court.

- Identifies a covered nonbank by name as a party subject to the order;

- Was issued at least in part in any action or proceeding brought by any Federal agency, state agency, or local agency;

- Contains public provisions that impose obligations on the covered nonbank to take certain actions or to refrain from taking certain actions;

- Imposes obligations on the covered nonbank based on an alleged violation of a covered law, which includes Federal consumer financial laws, other laws enforced by the CFPB, and certain unfair, deceptive, or abusive acts or practices laws at both Federal and state levels identified in the final rule; and

- Has an effective date on or after January 1, 2017. An order is effective on the date specified in the order. If an order does not have an effective date identified, the date of issuance is the effective date. If the issuing agency or a court stays or otherwise suspends an order’s effectiveness, the order’s effective date for purposes of the final rule is delayed until the stay or suspension is lifted.[ix]