LendingTree: 2 In 5 Americans Expect Housing Market Crash In ‘23

Inflation, high interest rates among reasons cited.

- 41% said they believe the housing market will crash in the next 12 months.

- 25% of those surveyed don’t think the housing market will crash in the next year, but expect a crash two or three years from now.

A significant portion of U.S. consumers expect the housing market to crash next year, according to a new survey commissioned by LendingTree.

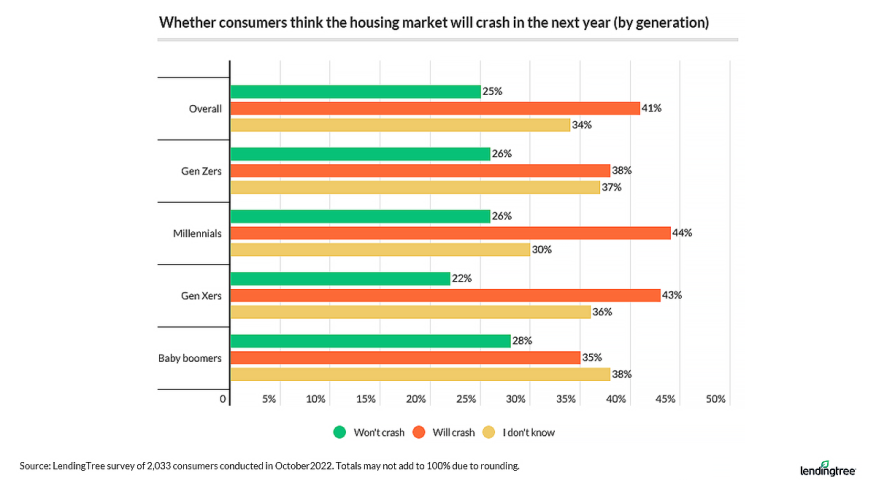

Survey results show 2 in 5 Americans (41%) believe the housing market will crash in the next 12 months. Of those who believe a crash is coming, 74% think it’ll be as bad or worse as the 2008 housing market collapse.

Among those expecting a crash, 33% said they believe inflation will be the biggest driver, followed by 24% who cited high-interest rates and 16% who cited a lack of affordable housing.

Millennials, at 44%, were the most likely generation to agree a crash is coming, while baby boomers (35%) were the least likely.

Meanwhile, 25% of those surveyed don’t think the housing market will crash in the next year. Of this group, 22% said they don’t think the crash will happen that soon. Instead, they said they believe the housing market will crash in the next two or three years.

Another 16% said the housing market won’t crash because the supply and demand aren’t there, while 15% said the measures being taken to prevent inflation from getting worse will prevent a housing crash. Another 13% said affordable housing is abundant.

Other key highlights:

- Regardless of whether the housing market crashes, mortgage concerns weigh heavily on consumers, with 58% worried about rising rates. This was most true among Americans looking to become homeowners (83%) and Gen Zers (68%). Among those concerned about rising mortgage rates, 55% expect rates to rise for another six to 18 months, while 23% said it could be more than two years before the increases end.

- 55% of homeowners surveyed think their home appraisal is accurate, while 33% said their estimated home value is inflated and 12% said the value is less than what they think it’s worth. That's consistent with Black Knight research that found 1 in 12 homes sold in 2022 were underwater in value.

- 61% of renters saiid the average monthly rent where they live is more expensive than it’s been or what they think it should be. By generation, millennials and baby boomer renters are the most likely to view prices as inflated, with 66% in both groups agreeing.

LendingTree commissioned Qualtrics to conduct the online survey of 2,033 U.S. consumers ages 18 to 76 on Oct. 18, 2022. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population, LendingTree said. It added that all responses were reviewed by researchers for quality control.