1 In 12 Mortgaged Homes Bought In 2022 Fall Underwater

Black Knight says the housing market correction has only just begun.

- 80% of major markets have now begun to see prices come off their peaks.

- Of the 450K mortgaged homes underwater at the end of the third quarter, nearly 60% are loans originated in 2022.

- More than 250K borrowers who purchased in 2022 owe more than their home is now worth.

- Low or negative equity may have a marginal effect on mortgage performance in the near term.

Home prices continue to pull back and interest rates have come down from their peak, but it’s hardly had an effect on affordability. That was the conclusion to Black Knight’s latest Mortgage Monitor report.

What it has done, though, is expose a growing pocket of equity risk concentrated among purchase mortgages originated in the last year or so. As a result, 1 in 12 mortgaged homes bought in 2022 are now underwater, Black Knight said.

The housing market correction has only just begun. Nationwide, home prices are dropping and the 30-year interest rate dipped by nearly half a percentage point in recent weeks, yet home affordability remains near a multi-decade low.

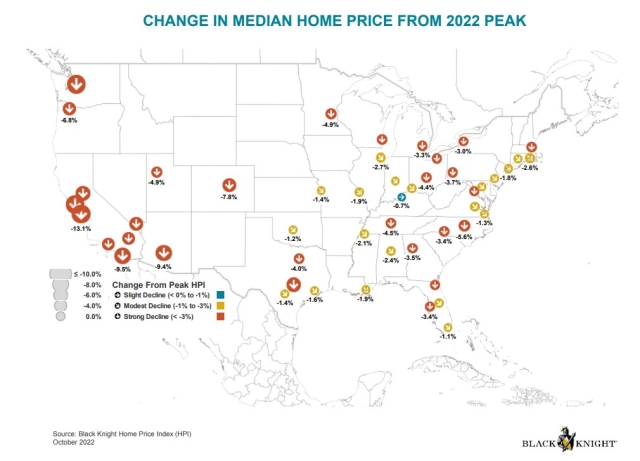

Adjusted for seasonality, 80% of major markets have now begun to see prices come off their peaks. Some markets are seeing stronger declines than the national average, with nearly a quarter down by 4% or more on a seasonally adjusted basis.

As of Nov. 17, with the Freddie Mac PMMS at 6.61%, the monthly principal and interest (P&I) payment on the median-priced home purchased with 20% down was $2,171. That’s down $65 from the month before, but up $838 (65%) from a year ago.

Currently, monthly payments are equivalent to 37.4% of the median monthly household income, down slightly from October 38.5%, but still uncomfortably close to the near 40-year high, the report states. The imbalance is most severe in Los Angeles, where it currently takes 54% of the median income to make P&I payments, which is 128% above its own long-run average.

Though it seems counterintuitive, a higher rate environment may be limiting the pace of price corrections due to its dampening effect on inventory inflow and subsequent gridlock in home sale activity. Near multi-decade low affordability would suggest home prices should be seeing strong declines, stalling inventory levels are holding home prices higher than current demand levels would suggest they should be.

These home price corrections are having an effect on equity levels, though. Of the 450,000 mortgaged homes underwater at the end of the third quarter, nearly 60% are loans originated in 2022, with purchase loans representing 95%.

More than 250,000 borrowers who purchased in 2022 owe more than their home is now worth, while another million borrowers have less than 10% equity. In all, 5% of mortgages originated in 2022 are marginally underwater with another 19% having less than 10% equity.

Of the homeowners who purchased their mortgage at the peak of the market — between May and July 2022 — nearly 10% are now marginally underwater and more than 30% have less than 10% equity. Among originations in early 2021, hardly any are underwater, and fewer than 5% have less than 10% equity.

Those who purchased their mortgage in 2021 are hardly getting wet, with fewer than 1% of 2021 homes mortgages currently underwater with only 3% having limited equity.

Cash-out refinances remain in a strong equity position, with less than half of 1% currently underwater and only 2% with limited equity. Also, only a modest share of originations among Portfolio/PLS-held (2%) or government-sponsored enterprise (GSE) (1%) mortgages in 2022 are now marginally underwater; most risk is concentrated among FHA and VA mortgages. This is mainly due to the fact GSE and portfolio-held mortgages require larger down payments.

The FHA/VA loans are in bigger trouble, with more than 20% of originations now marginally underwater and nearly two-thirds have less than 10% equity. The report states that it’s not unusual for FHA-insured loans to be functionally underwater at the time of origination, due to the ability to finance mortgage insurance and some origination fees. Such loans historically have relied on rising home prices and principal paydowns over time to gradually improve equity positions.

The share of 2022 mortgaged homes marginally underwater or with limited equity at the end of the third quarter varies significantly by market and recent price corrections aren’t the only variable.

In San Jose, the prevalence of high-down payment jumbo mortgages has kept the percentage of 2022-vintage underwater loans at just 2.4%, despite the sharpest local price correction of any U.S. market.

At the other end of the spectrum, markets such as Colorado Springs and Honolulu — which have higher concentrations of VA-backed higher LTV loans — have seen more than 30% of 2022-vintage purchase loans slip underwater.

Low or negative equity may have a marginal effect on mortgage performance in the near term, but these borrowers tend to be more susceptible to financial stress and may face additional challenges under a prolonged economic downturn.