Making Ends Meet To Afford Housing

Redfin reports nearly half of U.S. homeowners and renters are grappling with the financial strain of housing payments.

Many homeowners are reporting that affording their housing payments has forced them to make sacrifices.

Nearly half of U.S. homeowners and renters (49.9%) sometimes, regularly or greatly struggle to afford their housing payments, according to a new report from Redfin, which is based on a Redfin-commissioned survey conducted by Qualtrics in February 2024. The nationally representative survey was fielded to roughly 3,000 U.S. homeowners and renters. Most of Redfin’s report focuses on the 1,494 respondents who indicated that they sometimes, regularly or greatly struggle to afford regular rent or mortgage payments.

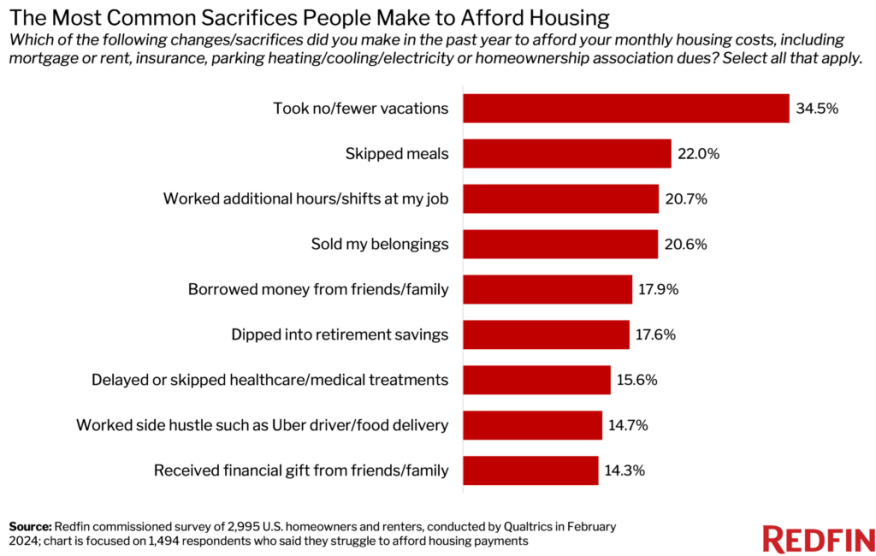

The most common sacrifice was taking no or fewer vacations. More than one-third of homeowners and renters (34.5%) who struggle to afford housing indicated that they skipped vacations in the past year in order to afford their monthly costs.

However, the report also referenced more serious sacrifices: 22% skipped meals and 20.7% worked extra hours at their job. A similar share (20.6%) sold belongings.

“Housing has become so financially burdensome in America that some families can no longer afford other essentials, including food and medical care, and have been forced to make major sacrifices, work overtime and ask others for money so they can cover their monthly costs,” said Redfin Economics Research Lead Chen Zhao. “Fortunately, the country’s leaders are starting to pay attention, and homebuyers may get a reprieve in June if the Federal Reserve cuts interest rates, which would bring down the cost of getting a mortgage.”

More than one of every six people (17.9%) who struggle to afford housing borrowed money from friends/family, and 17.6% dipped into their retirement savings. Over one in seven (15.6%) delayed or skipped medical treatments.

Mortgage payments are near their all-time high due to rising prices and elevated mortgage rates: The median U.S. home sale price is up about 5% from a year ago, and mortgage rates are hovering around 7%, not far from the 23-year high of roughly 8% hit in October. The typical household earns roughly $30,000 less than it needs to afford the median-priced home, and Redfin reports that rents are on the rise again.

Of the roughly 2,995 people who took the survey, half (50.1%) said they can easily afford their regular rent or mortgage payments, and half (49.9%) said they sometimes, regularly or greatly struggle to do so.

Demographic Divide

Not surprisingly, white respondents and current homeowners are most likely to afford housing payments easily. The results vary by demographic, with 54.5% of white respondents said they can easily afford their housing payments, compared with 37.8% of Hispanic/Latino respondents, 46.6% of Black respondents and 47.4% of Asian/Pacific Islander respondents. Present homeowners (59.9%) were roughly twice as likely as renters (30.8%) to indicate that they easily afford their housing payments.

Black respondents who struggle to afford housing were most likely to say they worked extra hours (25.9%) to cover their monthly costs, while Hispanic respondents were most likely to say that they sold belongings (28.2%). Skipping vacations was the most common answer among Asian/Pacific Islander respondents (43.8%) and white respondents (39.6%).

Black millennials are half as likely to own homes as white millennials, according to a separate Redfin analysis, though the racial homeownership gap exists across every generation due to decades of racist policies and discrimination.

Generational Divide

When it came to age groups, skipping vacations was the top choice for baby boomers (42.8%), Gen Xers (36.8%) and millennials (31.3%) who struggle to afford housing. But for Gen Zers, the most common sacrifices were working extra hours, selling belongings and skipping meals, all of which clocked in at roughly 27%.

Baby boomers were most likely to say they easily afford housing payments (61.9%), followed by Gen Xers (48.7%), millennials (40.2%) and Gen Zers (26.9%).

Nearly one of every seven millennials (13.5%) who struggle to afford their housing payments have dipped into retirement savings to cover their monthly costs.