May Rate Locks See Modest Rise

Black Knight says locks remain suppressed by high rates, lack of inventory.

Sometimes an improvement in the housing market is just a quirk of the calendar.

That’s the suggestion from Black Knight Inc., which on Monday released its latest Originations Market Monitor report, reviewing mortgage origination data through the end of May.

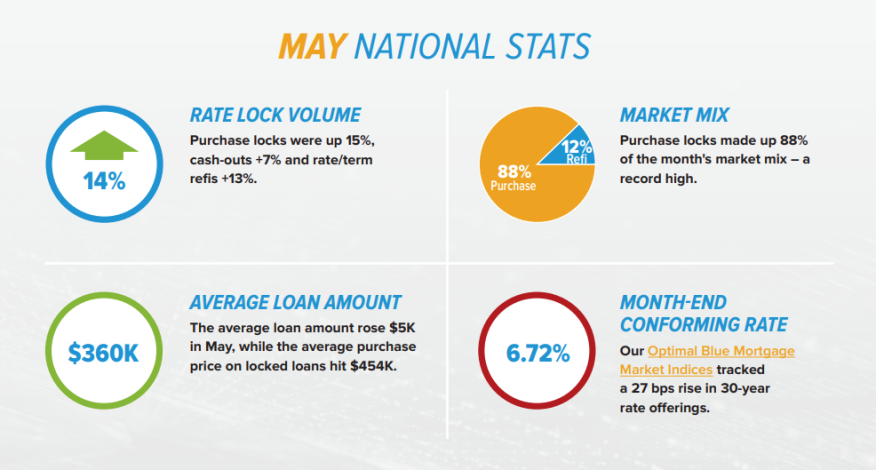

The month’s pipeline data showed rate locks increased 14% overall on a month-to-month basis, with purchase locks up almost 15%, cash-out refinances rising 7%, and rate/term refinance locks climbing 13%.

While those numbers appear to show a significant increase, the real estate data company cautioned that the bulk of the increase can be attributed to May having two more business days than April.

Adjusting for that, daily volume was up a more modest 4% month over month, Black Knight said.

The company did note that purchase locks accounted for 88% of overall rate locks in May, the highest share on record. Despite that, purchase lock counts were down 37% year over year and are down 29% compared with pre-pandemic levels in 2019, it said..

“While May was an improvement over April, mortgage lending remains constrained, to say the least,” said Andy Walden, vice president of enterprise research and strategy at Black Knight. “Indeed, while rate locks on purchase loans rose from April, they also dipped to their lowest level yet relative to 2018-19 averages, as rates rose late in the month. Mind you, purchase loans have been making up the lion’s share of origination activity for much of the last year, making this a likely harbinger of both slowing home sales as well as purchase mortgage origination volumes on the horizon.”

Walden noted that the current market represents “the most purchase-dominant market we’ve seen in decades” And that’s despite the many headwinds, “and we all know them well by now: rates, affordability, prices and inventory.”

He continued, “Nearly nine out of every 10 mortgages originated today is a purchase loan. At the same time, the level of economic uncertainty in the market has resulted in historically wide spreads between 10-year Treasury yields and 30-year mortgage rates, and that uncertainty seems to be trickling down to tightening credit standards across the board.”

He added that “uncertainty breeds a fear of risk, and that is likely driving the rises we’ve seen in down payments and credit scores among recent originations. The credit box is certainly tightening, but it’s far from the only challenge facing prospective homebuyers.”

Other Key Highlights:

- The Optimal Blue Mortgage Market Indices showed 30-year conforming rates rose 27 basis points in May to 6.72% after holding between 6.38% and 6.5% for the first half of the month.

- Despite jumbo rates remaining elevated, nonconforming locks (including jumbo and expanded guidelines) gained share relative to all other products in May.

- The average purchase price rose for the sixth consecutive month to hit $454,000, while the average loan amount rose to $360,000.

- Credit scores of conforming, FHA and VA borrowers rose again in May — indicative of tightening credit standards in an uncertain economic environment — with purchase lock credit scores nearing record highs.

- The adjustable-rate mortgage (ARM) share of May’s lock activity climbed to 8.41% as more borrowers sought relief from rising fixed rates late in the month.

- The 10-year Treasury yield rose 20 basis points in May to 3.64%, as the spread with mortgage rates continued to grow, briefly touching a six-year high on May 30 before ending the month at 3.08%.