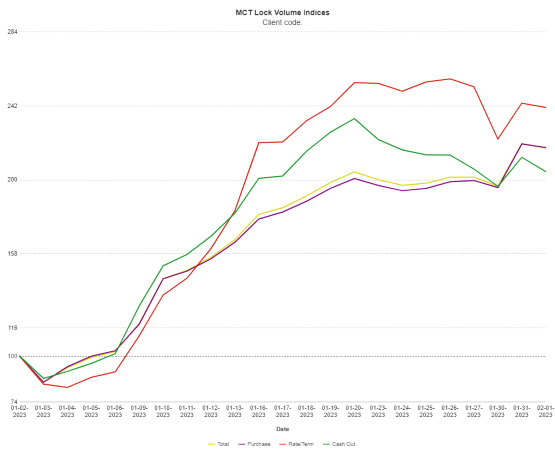

MCT: Rate Lock Volume Jumps 109% In January

Volume increased across the board, lead by rate/term refis rising 124%.

- Purchase lock activity increased 110% in January from December.

- Total lock activity remains 54% below the level at the same point last year.

The volume of mortgage rate locks soared in January from a month earlier, according to a new report.

Overall, rate lock activity increased 109% in January from December, according to the MCTlive! Lock Volume Indices report from Mortgage Capital Trading Inc. (MCT).

Rate lock volume increased across the board for the month, led by rate/term refinance volume rising 124% in January from a month earlier, Cash-out refinance volume rose 93% month over month, the report said.

Purchase lock activity, meanwhile, was up nearly 110% from December, MCT said.

“Though December lock activity is traditionally low, with many people focused on the holidays during the final week of the month, the lock figures for January clearly show some positive rate elasticity,” the report states. “As the [Federal Reserve] reaches its terminal federal funds rate for this cycle, we should see downward pressure on mortgage rates, which will only help increase origination activity.”

Despite the significant jump in January, total lock activity remains down 54% from the same point last year, MCT said, attributing it primarily to the drop in refinance demand as purchase lock activity sits 36% lower than at the same point last year.

Rate and term refinance volume is down 84% from a year ago, while cash-out refinance volume is down 86% over that same period.

Purchase locks accounted for 88% of total lock volume In January, while cash-out refinances comprised 8% and rate/term refinances made up just 4% of total locks.

Founded in 2001, MCT is based in San Diego and produces its MCTlive! Lock Volume Indices, which provides a look at a balanced cross-section of several hundred lenders among retail, correspondent, wholesale and consumer direct channels.